Question: Part 2. Practical Part It is March 2020, governments started to announce lockdowns in different areas of the world. As a financial analyst, you saw

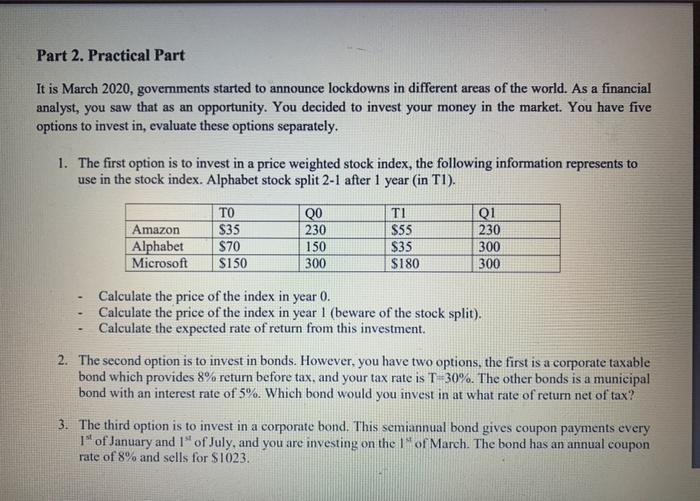

Part 2. Practical Part It is March 2020, governments started to announce lockdowns in different areas of the world. As a financial analyst, you saw that as an opportunity. You decided to invest your money in the market. You have five options to invest in, evaluate these options separately. 1. The first option is to invest in a price weighted stock index, the following information represents to use in the stock index. Alphabet stock split 2-1 after 1 year (in T1). Amazon Alphabet Microsoft TO $35 $70 S150 00 230 150 300 $55 $35 $180 Q1 230 300 300 Calculate the price of the index in year 0. Calculate the price of the index in year 1 (beware of the stock split). Calculate the expected rate of return from this investment. 2. The second option is to invest in bonds. However, you have two options, the first is a corporate taxable bond which provides 8% return before tax, and your tax rate is T 30%. The other bonds is a municipal bond with an interest rate of 5%. Which bond would you invest in at what rate of return net of tax? 3. The third option is to invest in a corporate bond. This semiannual bond gives coupon payments every 1" of January and I" of July, and you are investing on the 1" of March. The bond has an annual coupon rate of 8% and sells for $1023

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts