Question: PART 2. Problems (50 points). Problem 1 (25 points). Brahms Manufacturing Company is a defense contractor that uses a job costing system for accumulating its

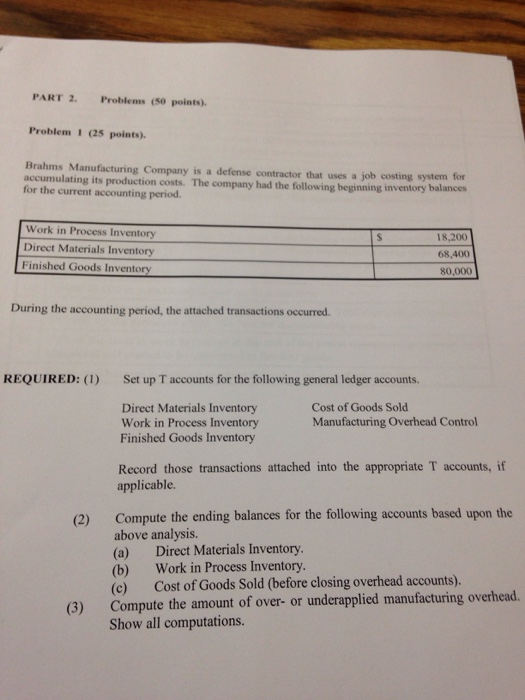

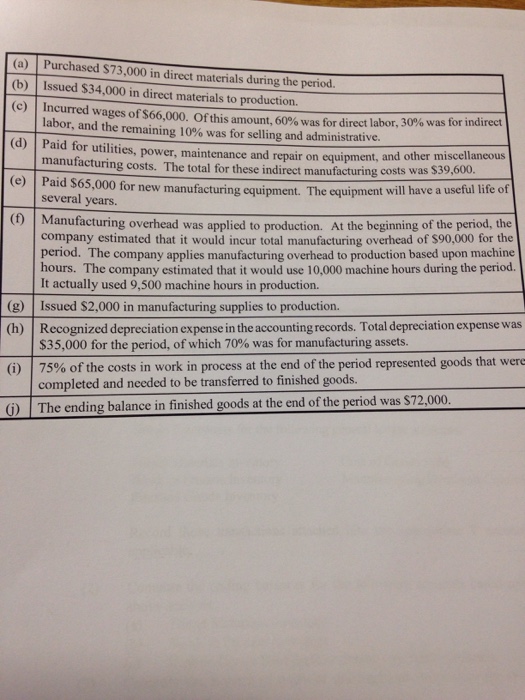

PART 2. Problems (50 points). Problem 1 (25 points). Brahms Manufacturing Company is a defense contractor that uses a job costing system for accumulating its production costs. The company had the following beginning inventory for the current accounting period. balances Work in Process Inventory Direct Materials Inventory Finished Goods Inventory 18,200 68,400 80,000 During the accounting period, the attached transactions occurred. REQUIRED: (I) Set up T accounts for the following general ledger accounts. Direct Materials Inventory Work in Process Inventory Finished Goods Inventory Cost of Goods Sold Manufacturing Overhead Contro Record those transactions attached into the appropriate T accounts, if applicable. (2) Compute the ending balamces for the follwing accounts based upon the Compute the ending balances for the following accounts based upon the above analysis. (a) Direct Materials Inventory (b) Work in Process Inventory (c) Cost of Goods Sold (before closing overhead accounts). Compute the amount of over- or underapplied manufacturing overhead. Show all computations. (2) (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts