Question: PART 2 QUESTION 1 (35 MARKS) Mitcham Ltd. is a public corporation that is listed on the Toronto Stock Exchange. Mitcham Ltd.'s principal business includes

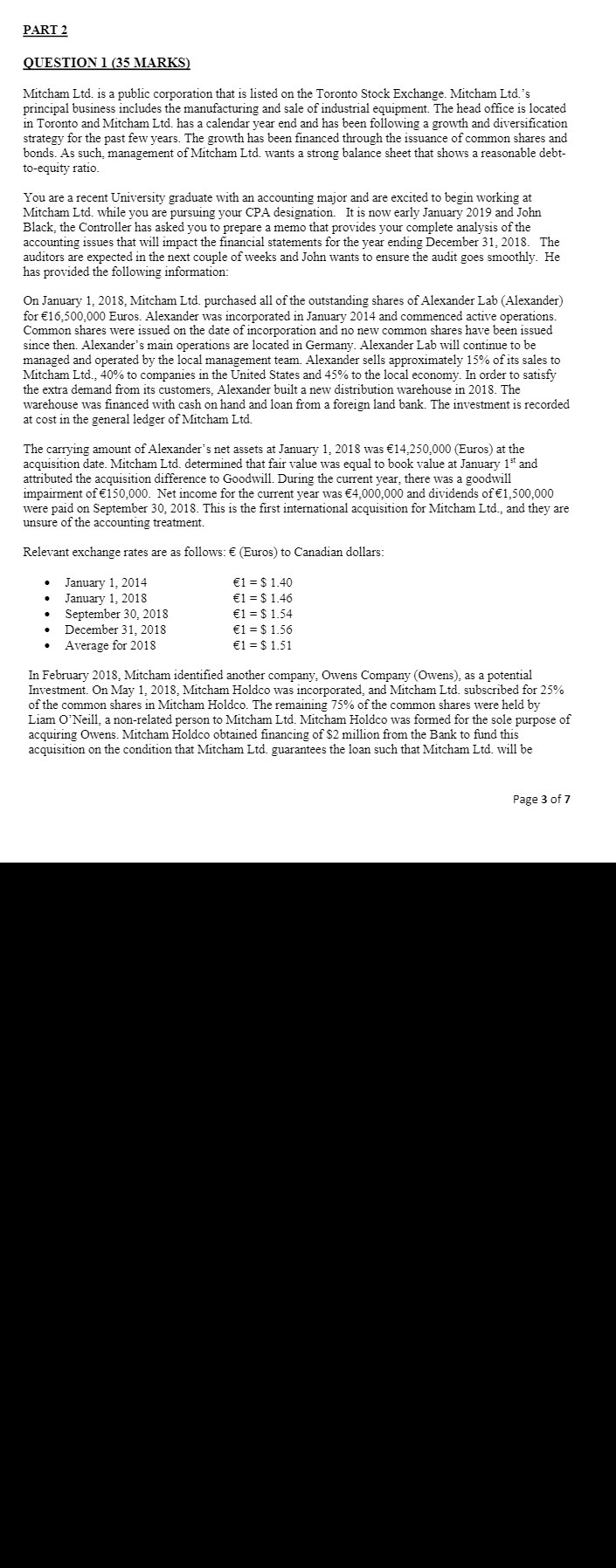

PART 2 QUESTION 1 (35 MARKS) Mitcham Ltd. is a public corporation that is listed on the Toronto Stock Exchange. Mitcham Ltd.'s principal business includes the manufacturing and sale of industrial equipment. The head office is located in Toronto and Mitcham Lid. has a calendar year end and has been following a growth and diversification strategy for the past few years. The growth has been financed through the issuance of common shares and bonds. As such, management of Mitcham Lid. wants a strong balance sheet that shows a reasonable debt- to-equity ratio You are a recent University graduate with an accounting major and are excited to begin working at Mitcham Ltd. while you are pursuing your CPA designation. It is now early January 2019 and John Black, the Controller has asked you to prepare a memo that provides your complete analysis of the accounting issues that will impact the financial statements for the year ending December 31, 2018. The auditors are expected in the next couple of weeks and John wants to ensure the audit goes smoothly. He has provided the following information: On January 1, 2018, Mitcham Lid. purchased all of the outstanding shares of Alexander Lab (Alexander) for E16,500,000 Euros. Alexander was incorporated in January 2014 and commenced active operations. Common shares were issued on the date of incorporation and no new common shares have been issued since then. Alexander's main operations are located in Germany. Alexander Lab will continue to be managed and operated by the local management team. Alexander sells approximately 15% of its sales to Mitcham Ltd., 40% to companies in the United States and 45% to the local economy. In order to satisfy the extra demand from its customers, Alexander built a new distribution warehouse in 2018. The warehouse was financed with cash on hand and loan from a foreign land bank. The investment is recorded at cost in the general ledger of Mitcham Lid. The carrying amount of Alexander's net assets at January 1, 2018 was E14,250,000 (Euros) at the acquisition date. Mitcham Ltd. determined that fair value was equal to book value at January 1 and attributed the acquisition difference to Goodwill. During the current year, there was a goodwill impairment of E150,000. Net income for the current year was $4,000,000 and dividends of E1,500,000 were paid on September 30, 2018. This is the first international acquisition for Mitcham Ltd., and they are unsure of the accounting treatment. Relevant exchange rates are as follows: E (Euros) to Canadian dollars: January 1, 2014 (1 = $ 1.40 January 1, 2018 E1 = $ 1.46 September 30, 2018 E1 = $ 1.54 . December 31, 2018 E1 = $ 1.56 Average for 2018 E1 = $ 1.51 In February 2018, Mitcham identified another company, Owens Company (Owens), as a potential Investment. On May 1, 2018, Mitcham Holdco was incorporated, and Mitcham Ltd. subscribed for 25% of the common shares in Mitcham Holdco. The remaining 75% of the common shares were held by Liam O'Neill, a non-related person to Mitcham Lid. Mitcham Holdco was formed for the sole purpose of acquiring Owens. Mitcham Holdco obtained financing of $2 million from the Bank to fund this acquisition on the condition that Mitcham Lid. guarantees the loan such that Mitcham Ltd. will be Page 3 of 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts