Question: Part 2: Ralph's Manufacturing is considering developing a new product. The research and development costs would be spread out as follows: One year from today

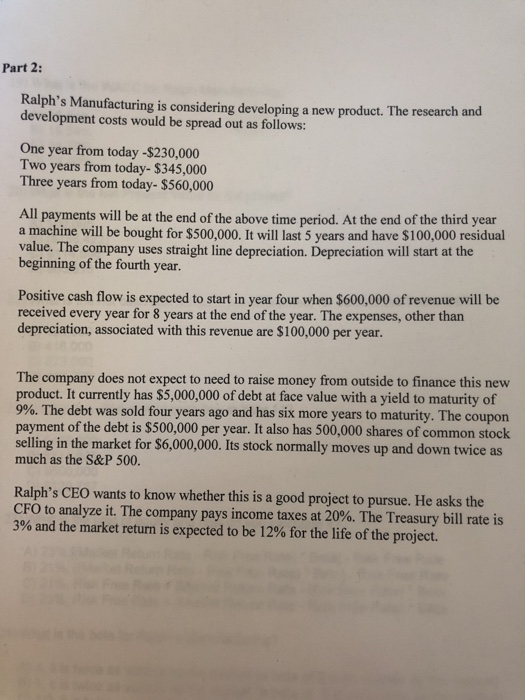

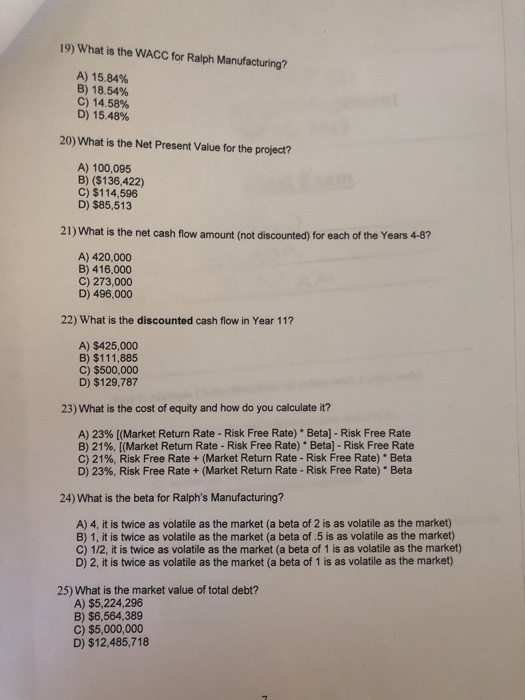

Part 2: Ralph's Manufacturing is considering developing a new product. The research and development costs would be spread out as follows: One year from today -$230,000 Two years from today- $345,000 Three years from today- $560,000 All payments will be at the end of the above time period. At the end of the third year a machine will be bought for $500,000. It will last 5 years and have $100,000 residual value. The company uses straight line depreciation. Depreciation will start at the beginning of the fourth year. Positive cash flow is expected to start in year four when $600,000 of revenue will be received every year for 8 years at the end of the year. The expenses, other than depreciation, associated with this revenue are $100,000 per year. The company does not expect to need to raise money from outside to finance this new product. It currently has $5,000,000 of debt at face value with a yield to maturity of 9%. The debt was sold four years ago and has six more years to maturity. The coupon payment of the debt is $500,000 per year. It also has 500,000 shares of common stock selling in the market for $6,000,000. Its stock normally much as the S&P 500. up and down twice as moves Ralph's CEO wants to know whether this is a good project to pursue. He asks the CFO to analyze it. The company pays income taxes at 20%. The Treasury bill rate is 3% and the market return is expected to be 12% for the life of the project. 19) What is the WACC for Ralph Manufacturing? A) 15.84% B) 18.54% C) 14.58% D) 15.48% 20) What is the Net Present Value for the project? A) 100,095 B) ($136,422) C) $114,596 D) $85,513 21) What is the net cash flow amount (not discounted) for each of the Years 4-8? A) 420,000 B) 416,000 C) 273,000 D) 496,000 22) What is the discounted cash flow in Year 11? A) $425,000 B) $111,885 C) $500,000 D) $129,787 23) What is the cost of equity and how do you calculate it? A) 23% [ (Market Return Rate - Risk Free Rate) Beta] - Risk Free Rate B) 21%, [ (Market Return Rate - Risk Free Rate) Beta] - Risk Free Rate C) 21%, Risk Free Rate + D) 23%, Risk Free Rate + (Market Return Rate Risk Free Rate) Beta (Market Return Rate- Risk Free Rate) Beta 24)What is the beta for Ralph's Manufacturing? A) 4, it is twice as volatile as the market (a beta of 2 is as volatile as the market) B) 1, it is twice as volatile as the market (a beta of .5 is as volatile as the market) C) 1/2, it is twice as volatile as the market (a beta of 1 is as volatile as the market) D) 2, it is twice as volatile as the market (a beta of 1 is as volatile as the market) 25) What is the market value of total debt? A) $5,224,296 B) $6,564,389 C) $5,000,000 D) $12,485,718

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts