Question: Part 2. Short-answer Questions (5 Points Each) Instruction: Answer each of the following questions briefly, specifically, and accurately. 1. Discuss the difference between systematic risk

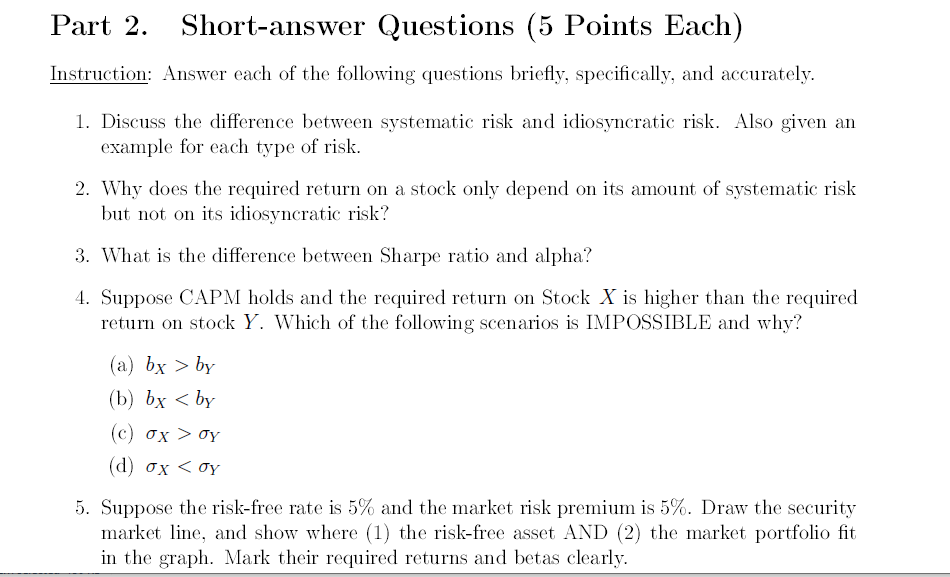

Part 2. Short-answer Questions (5 Points Each) Instruction: Answer each of the following questions briefly, specifically, and accurately. 1. Discuss the difference between systematic risk and idiosyncratic risk. Also given an example for each type of risk. 2. Why does the required return on a stock only depend on its amount of systematic risk but not on its idiosyncratic risk? 3. What is the difference between Sharpe ratio and alpha? 4. Suppose CAPM holds and the required return on Stock X is higher than the required return on stock Y. Which of the following scenarios is IMPOSSIBLE and why? (a) by > by (b) by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts