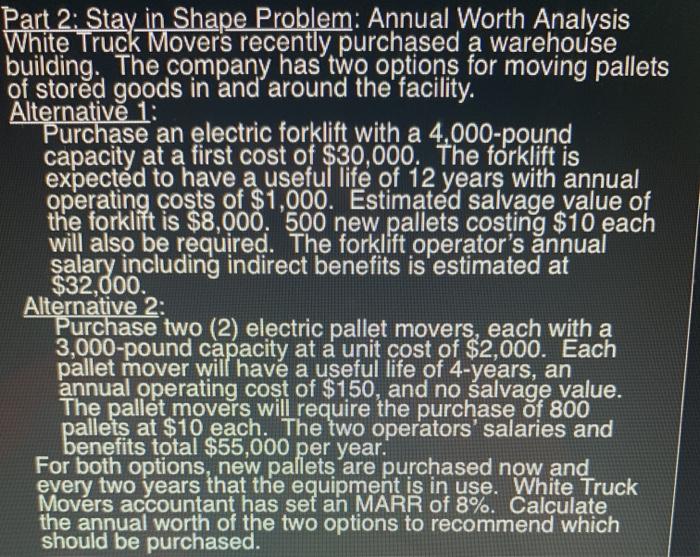

Question: Part 2: Stay in Shape Problem: Annual Worth Analysis White Truck Movers recently purchased a warehouse building. The company has two options for moving pallets

Part 2: Stay in Shape Problem: Annual Worth Analysis White Truck Movers recently purchased a warehouse building. The company has two options for moving pallets of stored goods in and around the facility. Alternativ 1: Purchase an electric forklift with a 4,000-pound capacity at a first cost of $30,000. The forklift is expected to have a useful life of 12 years with annual operating costs of $1,000. Estimated salvage value of the forklift is $8,000. 500 new pallets costing $10 each will also be required. The forklift operator's nnual salary including indirect benefits is estimated at $32,000. Alternative 2: Purchase two (2) electric pallet movers, each with a 3,000-pound capacity at a unit cost of $2,000. Each pallet mover will have a useful life of 4-years, an annual operating cost of $150, and no salvage value. The pallet movers will require the purchase of 800 pallets at $10 each. The two operators' salaries and benefits total $55,000 per year. For both options, new pallets are purchased now and every two years that the equipment is in use. White Truck Movers accountant has set an MARR of 8%. Calculate the annual worth of the two options to recommend which should be purchased

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts