Question: Part 2 . The client also owns a bond portfolio with ( $ 1 ) million invested in zero coupon Treasury bonds

Part

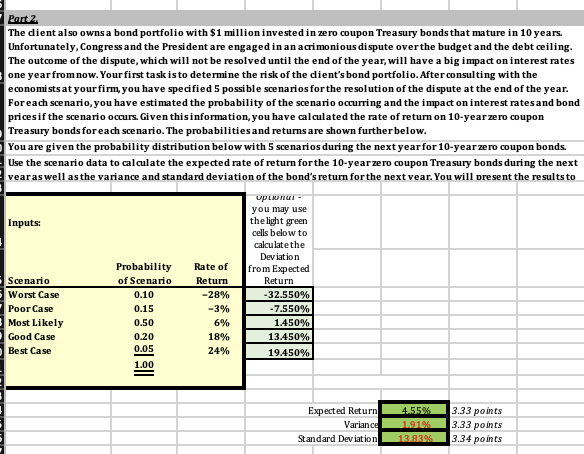

The client also owns a bond portfolio with $ million invested in zero coupon Treasury bonds that mature in years. Unfortunately, Congress and the President are engaged in an acrimonious dispute over the budget and the debt ceiling. The outcome of the dispute, which will not be resolved until the end of the year, will have a big impact on interest rates one yearfrom now. Yourfirst task is to determine the risk of the client's bond portfolio. After consulting with the economists at yourfirm, you have specified possible scenarios forthe resolution of the dispute at the end of the year. Foreach scenario, you have estimated the probability of the scenario occurring and the impact on interest rates and bond prices if the scenario occurs. Given this information, you have calculated the rate of return on mathbfyearzero coupon Treasury bonds for each scenario. The probabilities and returns are shown further below.

You are given the probability distribution below with scenarios during the next yearfor yearzero coupon bonds. Use the scenario data to calculate the expected rate of return for the mathbfyearzero coupon Treasury bonds during the next vearas well as the variance and standard deviation of the bond's return for the next vear. You will present the results to

Inputs:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock