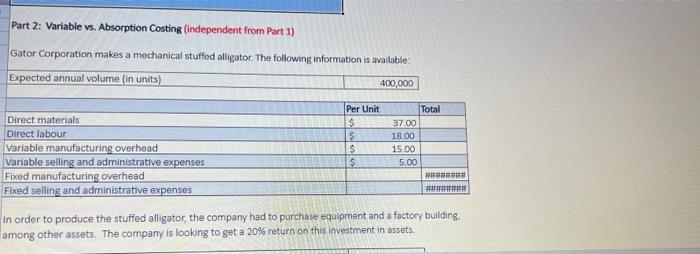

Question: Part 2: Variable vs. Absorption Costing (independent from Part 1) Gator Corporation makes a mechanical stuffed alligator. The following information is available: Expected annual volume

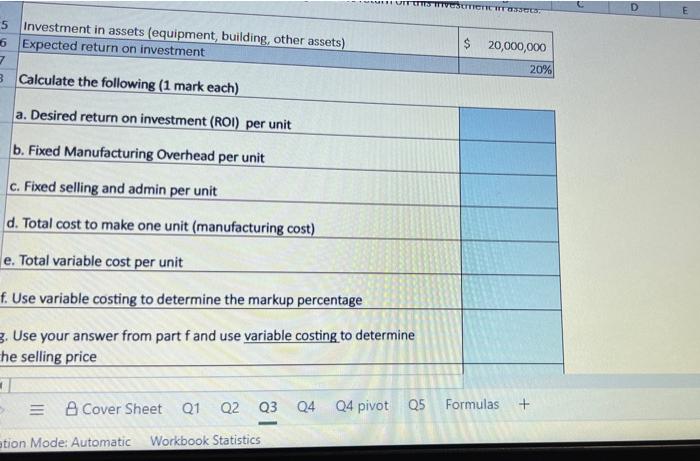

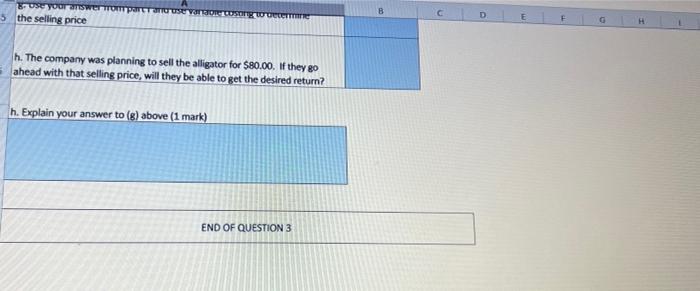

Part 2: Variable vs. Absorption Costing (independent from Part 1) Gator Corporation makes a mechanical stuffed alligator. The following information is available: Expected annual volume (in units) 400,000 Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative expenses Fixed manufacturing overhead Fixed selling and administrative expenses Per Unit $ $ $ $ Total 37.00 18.00 15.00 5.00 IOANN In order to produce the stuffed alligator, the company had to purchase equipment and a factory building, among other assets. The company is looking to get a 20% return on this investment in assets, UITOSTICTICOS E $ 20,000,000 5 Investment in assets (equipment, building, other assets) 6 Expected return on investment 7 3 Calculate the following (1 mark each) 20% a. Desired return on investment (ROI) per unit b. Fixed Manufacturing Overhead per unit c. Fixed selling and admin per unit d. Total cost to make one unit (manufacturing cost) e. Total variable cost per unit f. Use variable costing to determine the markup percentage 3. Use your answer from part fand use variable costing to determine he selling price 1 = A Cover Sheet Q1 Q2 Q3 Q4 04 pivot 05 Formulas + ation Mode: Automatic Workbook Statistics - Use your wompare 5 the selling price VORSORER W GETTI D H h. The company was planning to sell the alligator for $80.00. If they 80 ahead with that selling price, will they be able to get the desired return? h. Explain your answer to (8) above (1 mark) END OF QUESTION 3 Part 2: Variable vs. Absorption Costing (independent from Part 1) Gator Corporation makes a mechanical stuffed alligator. The following information is available: Expected annual volume (in units) 400,000 Direct materials Direct labour Variable manufacturing overhead Variable selling and administrative expenses Fixed manufacturing overhead Fixed selling and administrative expenses Per Unit $ $ $ $ Total 37.00 18.00 15.00 5.00 IOANN In order to produce the stuffed alligator, the company had to purchase equipment and a factory building, among other assets. The company is looking to get a 20% return on this investment in assets, UITOSTICTICOS E $ 20,000,000 5 Investment in assets (equipment, building, other assets) 6 Expected return on investment 7 3 Calculate the following (1 mark each) 20% a. Desired return on investment (ROI) per unit b. Fixed Manufacturing Overhead per unit c. Fixed selling and admin per unit d. Total cost to make one unit (manufacturing cost) e. Total variable cost per unit f. Use variable costing to determine the markup percentage 3. Use your answer from part fand use variable costing to determine he selling price 1 = A Cover Sheet Q1 Q2 Q3 Q4 04 pivot 05 Formulas + ation Mode: Automatic Workbook Statistics - Use your wompare 5 the selling price VORSORER W GETTI D H h. The company was planning to sell the alligator for $80.00. If they 80 ahead with that selling price, will they be able to get the desired return? h. Explain your answer to (8) above (1 mark) END OF QUESTION 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts