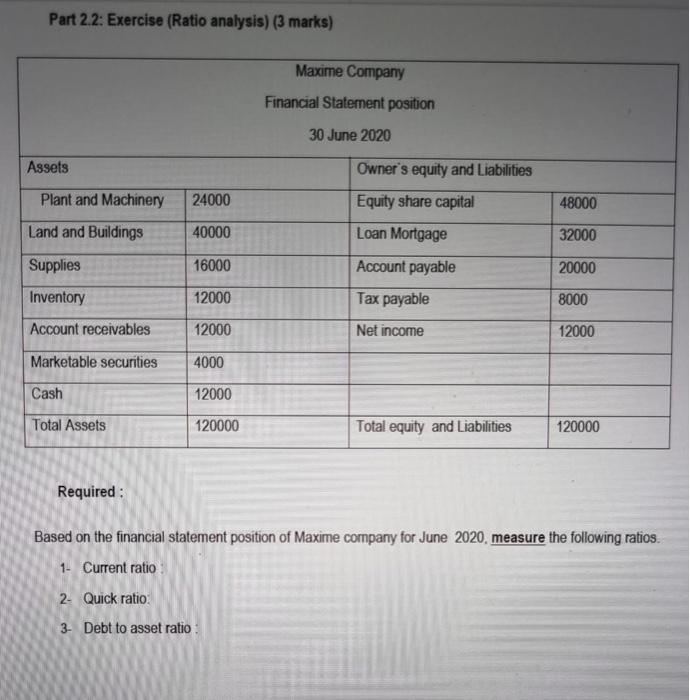

Question: Part 2.2: Exercise (Ratio analysis) (3 marks) Required : Based on the financial statement position of Maxime company for June 2020, measure the following ratios.

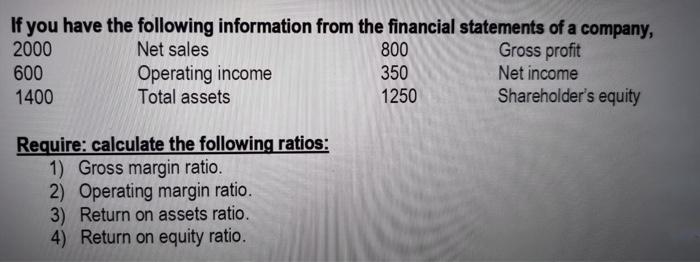

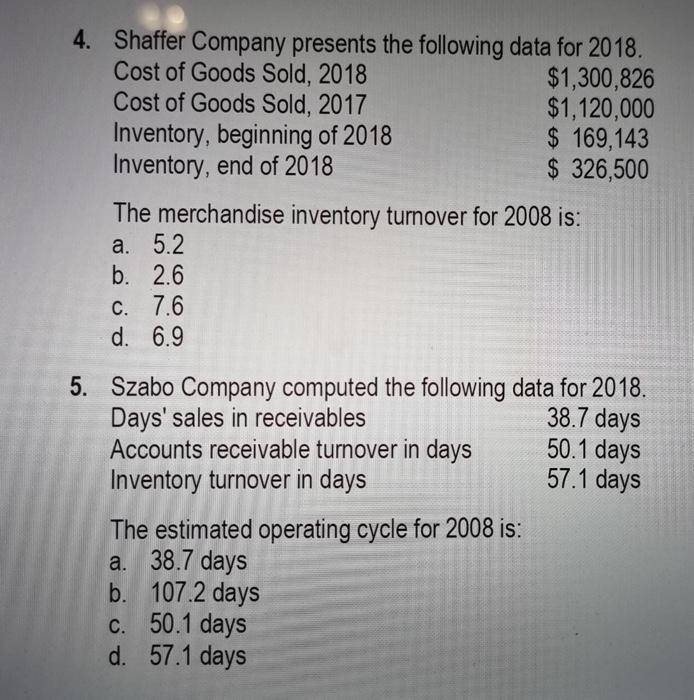

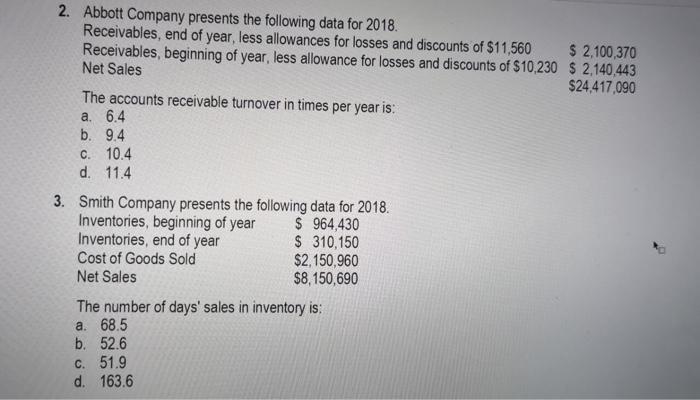

Part 2.2: Exercise (Ratio analysis) (3 marks) Required : Based on the financial statement position of Maxime company for June 2020, measure the following ratios. 1- Current ratio : 2- Quick ratio: 3- Debt to asset ratio: If you have the following information from the financial statements of a company, Require: calculate the following ratios: 1) Gross margin ratio. 2) Operating margin ratio. 3) Return on assets ratio. 4) Return on equity ratio. The merchandise inventory turnover for 2008 is: a. 5.2 b. 2.6 c. 7.6 d. 6.9 5. Szabo Company computed the following data for 2018. Days' sales in receivables 38.7 days Accounts receivable turnover in days 50.1 days Inventory turnover in days The estimated operating cycle for 2008 is: a. 38.7 days b. 107.2 days c. 50.1 days d. 57.1 days 2. Abbott Company presents the following data for 2018. Receivables, end of year, less allowances for losses and discounts of $11,560$2,100,370 Receivables, beginning of year, less allowance for losses and discounts of $10,230$2,140,443 Net Sales The accounts receivable turnover in times per year is: a. 6.4 b. 9.4 c. 10.4 d. 11.4 3. Smith Company presents the following data for 2018 . The number of days' sales in inventory is: a. 68.5 b. 52.6 c. 51.9 d. 163.6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts