Question: part 2-4 #1 is set up to complete. Check figures are: For #2 there will be a debit to goodwill of $25,000, For #3 there

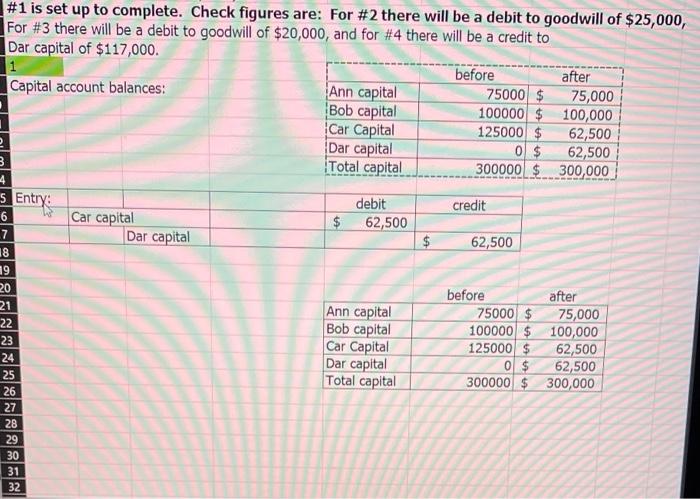

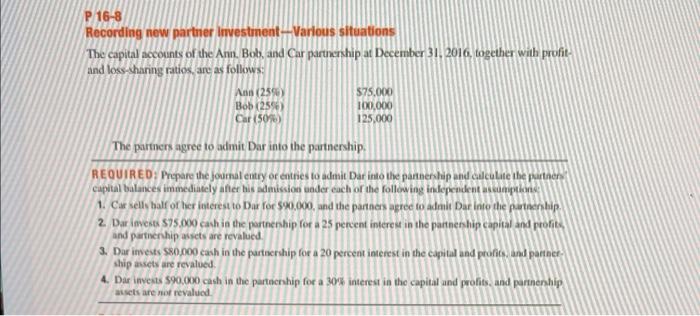

#1 is set up to complete. Check figures are: For #2 there will be a debit to goodwill of $25,000, For #3 there will be a debit to goodwill of $20,000, and for #4 there will be a credit to Dar capital of $117,000. 1 before after Capital account balances: Ann capital 75000 $ 75,000 Bob capital 100000 $100,000 Car Capital 125000 $ 62,500 Dar capital 0 $ 62,500 Total capital 300000 $ 300,000 4 5 Entry debit credit 6 Car capital $ 62,500 7 Dar capital 62,500 3 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 Ann capital Bob capital Car Capital Dar capital Total capital before after 75000 $ 75,000 100000 $ 100,000 125000 $ 62,500 0 $ 62,500 300000 $ 300,000 P 16-8 Recording new partner Investment -- Various situations The capital accounts of the Ann. Bob, and Car partnership at December 31, 2016, together with profit and loss sharing ratios, are as follows: A (2590) 575.000 Bob (256) 100,000 Car (50%) 125,000 The partners agree to admit Dar into the partnership REQUIRED: Prepare the journal entry or entries to admit Dar into the partnership and calculate the partner capital balances immediately after his admission oder each of the following independent cumption 1. Cat sells balfor her interest to bar for $20.000, and the partners agree to admit Dar into the partnehip 2. Dar invest $75.000 cash in the partnership for a 25 percent interest in the partnership capital and profit and partnership assets are revalued. 3. Dar invests $80.000 cash in the partnership for a 20 percent interest in the capital and profits and partner ship assets are revalued 4. Dar invests $90.000 cash in the partnership for a 30% interest in the capital and profits and partnership austs are not revalued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts