Question: Part 3. Data Questions (30 points in total) As an entry-level analyst in the finance industry, you are expected to be comfortable with some data

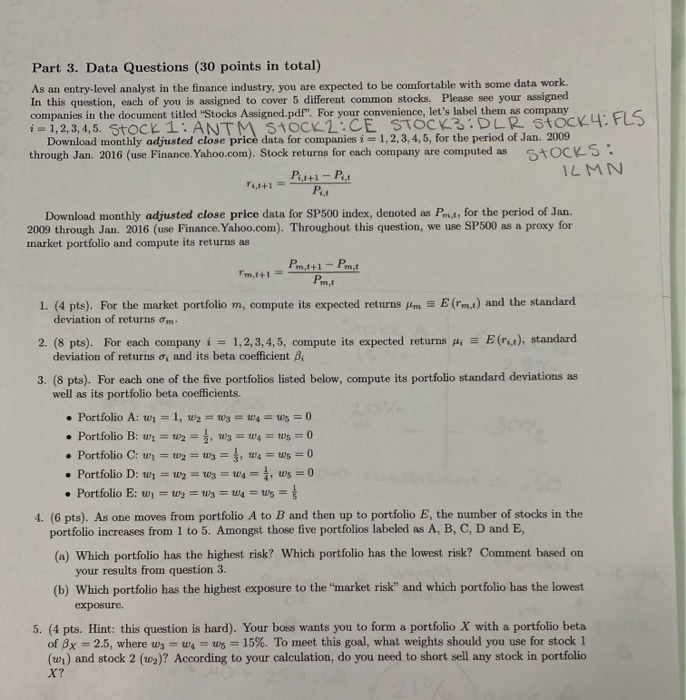

Part 3. Data Questions (30 points in total) As an entry-level analyst in the finance industry, you are expected to be comfortable with some data work. In this question, each of you is assigned to cover 5 different common stocks. Please see your assigned companies in the document titled "Stocks Assigned.pdf". For your convenience, let's label them as company i = 1,2,3,4,5. Stock 1: ANTM STOCK 2:CE STOCK3: DLR STOCK 4: FLS Download monthly adjusted close price data for companies i = 1,2,3,4,5, for the period of Jan. 2009 through Jan. 2016 (use Finance. Yahoo.com). Stock returns for each company are computed as STOCKS. ILMN + 4+1-P Download monthly adjusted close price data for SP 500 index, denoted as Pm,t, for the period of Jan. 2009 through Jan. 2016 (use Finance. Yahoo.com). Throughout this question, we use SP500 as a proxy for market portfolio and compute its returns as Top,141 - Poeti - Pmi 1. (4 pts). For the market portfolio m, compute its expected returns deviation of returns om Erm.t) and the standard 2. (8 pts). For each company i = 1,2,3,4,5, compute its expected returns i = E(r), standard deviation of returns , and its beta coefficient B 3. (8 pts). For each one of the five portfolios listed below, compute its portfolio standard deviations as well as its portfolio beta coefficients. Portfolio A: 1, 2= w w ws = 0 Portfolio B: W = 2 = W3 = w4=ts = 0 Portfolio C: w =w2 = x3 = $, W4 = ws=0 Portfolio D: w = w2 =W3 = w4= ws=0 Portfolio E: w =w2 = W3 = 4 W = $ 4. (6 pts). As one moves from portfolio A to B and then up to portfolio E, the number of stocks in the portfolio increases from 1 to 5. Amongst those five portfolios labeled as A, B, C, D and E, (a) Which portfolio has the highest risk? Which portfolio has the lowest risk? Comment based on your results from question 3. (b) Which portfolio has the highest exposure to the market risk" and which portfolio has the lowest exposure. 5. (4 pts. Hint: this question is hard). Your boss wants you to form a portfolio X with a portfolio beta of Bx = 2.5, where we w = us = 15%. To meet this goal, what weights should you use for stock 1 (w.) and stock 2 ()? According to your calculation, do you need to short sell any stock in portfolio X? Part 3. Data Questions (30 points in total) As an entry-level analyst in the finance industry, you are expected to be comfortable with some data work. In this question, each of you is assigned to cover 5 different common stocks. Please see your assigned companies in the document titled "Stocks Assigned.pdf". For your convenience, let's label them as company i = 1,2,3,4,5. Stock 1: ANTM STOCK 2:CE STOCK3: DLR STOCK 4: FLS Download monthly adjusted close price data for companies i = 1,2,3,4,5, for the period of Jan. 2009 through Jan. 2016 (use Finance. Yahoo.com). Stock returns for each company are computed as STOCKS. ILMN + 4+1-P Download monthly adjusted close price data for SP 500 index, denoted as Pm,t, for the period of Jan. 2009 through Jan. 2016 (use Finance. Yahoo.com). Throughout this question, we use SP500 as a proxy for market portfolio and compute its returns as Top,141 - Poeti - Pmi 1. (4 pts). For the market portfolio m, compute its expected returns deviation of returns om Erm.t) and the standard 2. (8 pts). For each company i = 1,2,3,4,5, compute its expected returns i = E(r), standard deviation of returns , and its beta coefficient B 3. (8 pts). For each one of the five portfolios listed below, compute its portfolio standard deviations as well as its portfolio beta coefficients. Portfolio A: 1, 2= w w ws = 0 Portfolio B: W = 2 = W3 = w4=ts = 0 Portfolio C: w =w2 = x3 = $, W4 = ws=0 Portfolio D: w = w2 =W3 = w4= ws=0 Portfolio E: w =w2 = W3 = 4 W = $ 4. (6 pts). As one moves from portfolio A to B and then up to portfolio E, the number of stocks in the portfolio increases from 1 to 5. Amongst those five portfolios labeled as A, B, C, D and E, (a) Which portfolio has the highest risk? Which portfolio has the lowest risk? Comment based on your results from question 3. (b) Which portfolio has the highest exposure to the market risk" and which portfolio has the lowest exposure. 5. (4 pts. Hint: this question is hard). Your boss wants you to form a portfolio X with a portfolio beta of Bx = 2.5, where we w = us = 15%. To meet this goal, what weights should you use for stock 1 (w.) and stock 2 ()? According to your calculation, do you need to short sell any stock in portfolio X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts