Question: Part 3: Module 7 &8: Management Issues for Non-Depository Institutions (See Chapter 11: Insurance Company Performance Analysis) The U.S. Property/Casualty Insurance Industry had the following

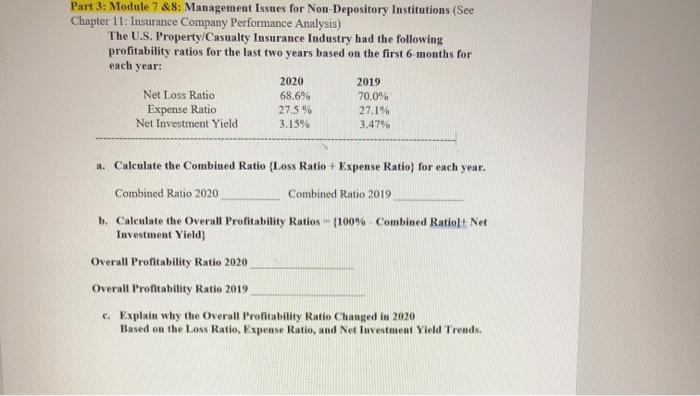

Part 3: Module 7 &8: Management Issues for Non-Depository Institutions (See Chapter 11: Insurance Company Performance Analysis) The U.S. Property/Casualty Insurance Industry had the following profitability ratios for the last two years based on the first 6 months for each year: 2020 2019 Net Loss Ratio 68.6% 70.0% Expense Ratio 27.5 % 27.1% Net Investment Yield 3.1996 3.47% a. Calculate the Combined Ratio (Loss Ratio + Expense Ratio) for each year. Combined Ratio 2020 Combined Ratio 2019 b. Calculate the Overall Profitability Ratios (100% Combined Ratiol+ Net Investment Yield) Overall Profitability Ratio 2020 Overall Profitability Ratio 2019 c. Explain why the Overall Profitability Ratio Changed in 2020 Based on the Loss Ratio, Expense Ratio, and Not Investment Yield Trends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts