Question: Part 3: Negative amortization fixed rate mortgage (CPM) 1. Create a monthly amortization schedule for a negatively amortized $250K,5yr,4.75% fixed rate mortgage. The monthly payments

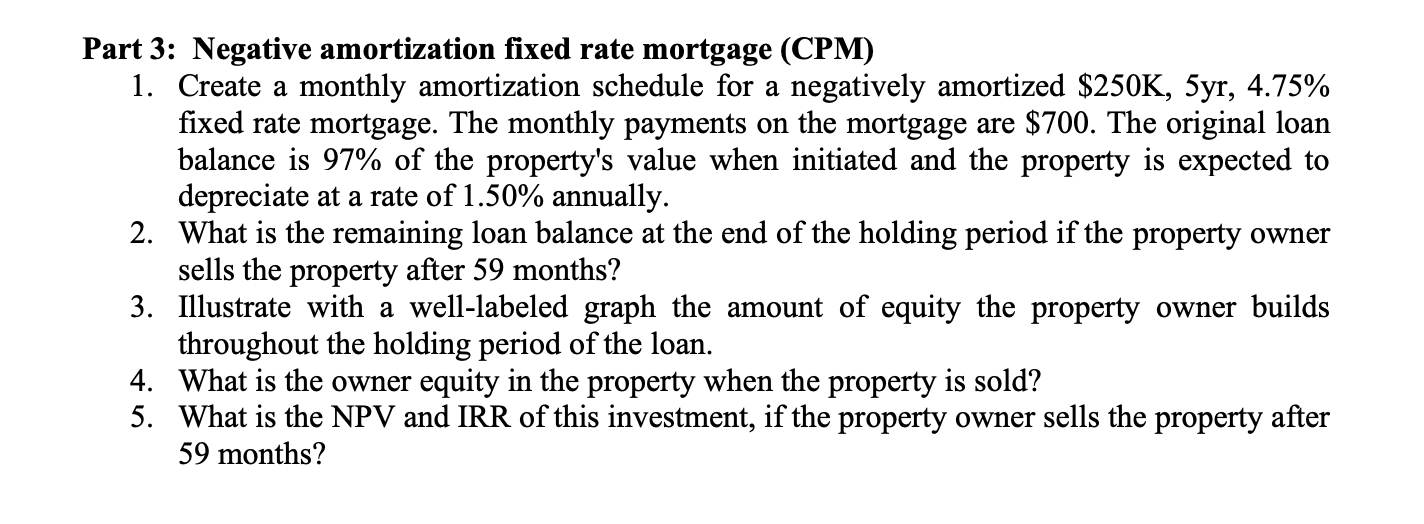

Part 3: Negative amortization fixed rate mortgage (CPM) 1. Create a monthly amortization schedule for a negatively amortized $250K,5yr,4.75% fixed rate mortgage. The monthly payments on the mortgage are $700. The original loan balance is 97% of the property's value when initiated and the property is expected to depreciate at a rate of 1.50% annually. 2. What is the remaining loan balance at the end of the holding period if the property owner sells the property after 59 months? 3. Illustrate with a well-labeled graph the amount of equity the property owner builds throughout the holding period of the loan. 4. What is the owner equity in the property when the property is sold? 5. What is the NPV and IRR of this investment, if the property owner sells the property after 59 months? Part 3: Negative amortization fixed rate mortgage (CPM) 1. Create a monthly amortization schedule for a negatively amortized $250K,5yr,4.75% fixed rate mortgage. The monthly payments on the mortgage are $700. The original loan balance is 97% of the property's value when initiated and the property is expected to depreciate at a rate of 1.50% annually. 2. What is the remaining loan balance at the end of the holding period if the property owner sells the property after 59 months? 3. Illustrate with a well-labeled graph the amount of equity the property owner builds throughout the holding period of the loan. 4. What is the owner equity in the property when the property is sold? 5. What is the NPV and IRR of this investment, if the property owner sells the property after 59 months

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts