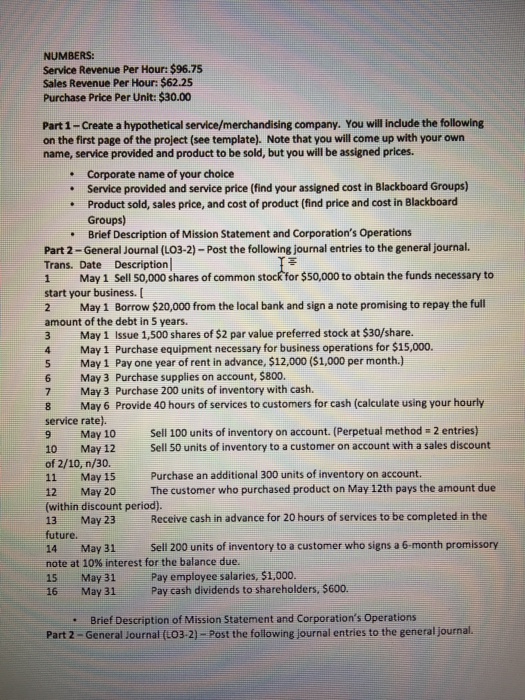

Question: Part 3 Part 3 -General Ledger (LO3-2)-Post the information from the journal entries into the general ledger. Part 4- Trial Balance (L03-2)-Prepare a trial balance

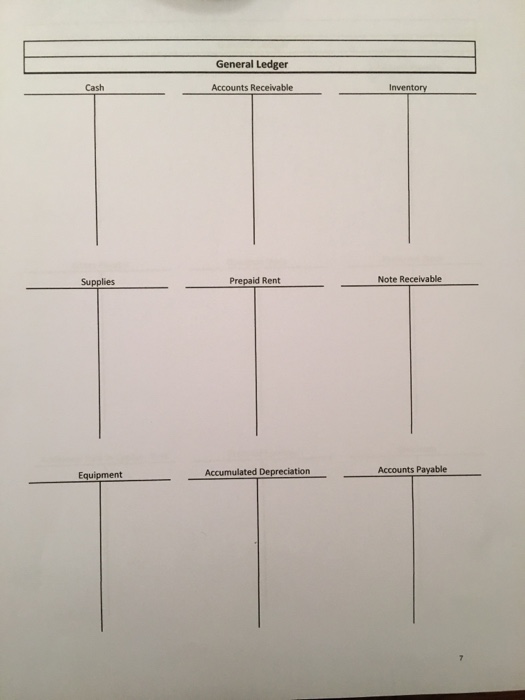

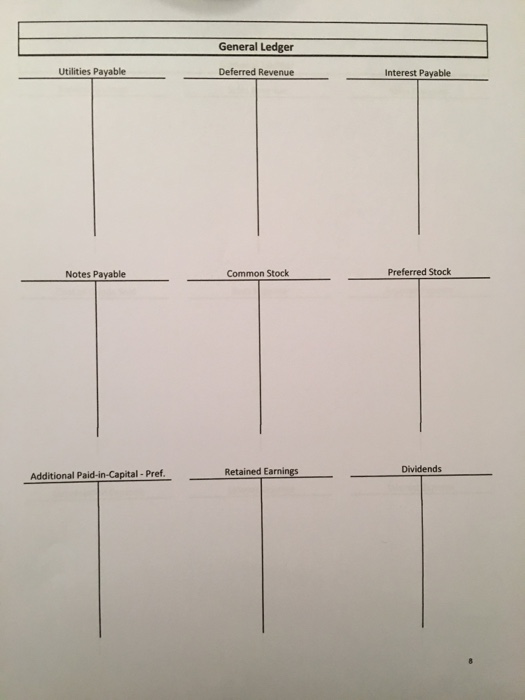

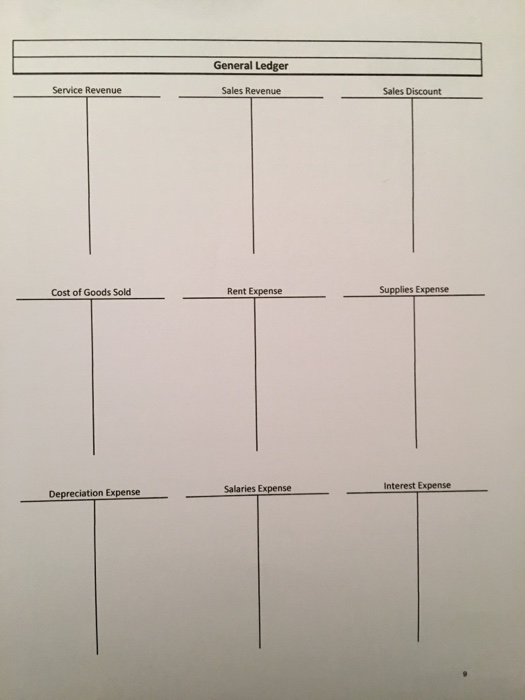

Part 3 -General Ledger (LO3-2)-Post the information from the journal entries into the general ledger. Part 4- Trial Balance (L03-2)-Prepare a trial balance from the information in the general ledger. Part 2 cont. -Adjusting journal Entries-(LO3-3)- Post the following adjusting entries to the general journal Adj-1 May 31 Record the portion of the Prepaid Rent used in May. Adj-2 May 31 The company has $300 of supplies left at month end. Adj-3 May 31 Record one month of depreciation on the equipment. The equipmernt has a useful life of 10 years and zero residual value. Adj-4 May 31 Provide 10 hours of services that were paid in advance on May 23rd. Adj-5 May 31 Record the receipt of a $300 utilities bill due on June 5th Adj-6 May 31 Record accrued interest on the $20,000-5 year note payable. The annual interest rate is 10%. Part 3 cont.- General Ledger Post the adjusting entries to the General Ledger. Part 5-Adjusted Trial Balance (LO3-3)-Post the ending balances from the General Ledger to the Adjusted Trial Balance. Debits should equal credits if you have done the prior steps correctly Part 6-Prepare the end of month Income Statement (LO3-4). Part 7-Prepare the end of month Retained Earnings Statement (LO3-4). Part 8-Prepare the end of month Balance Sheet (L03-4) Part 1 cont. -Add the following closing entries to the general journal (LO3-4): Close out revenues/income Close out expenses/losses Clo-2 May 31 Clo-3 May 31 Close out dividends Part 2 cont. Post the above closing entries to the general ledger (LO3.4). Part 9-Prepare a post -closing trial balance (LO3-4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts