Question: Part 3: Sample Test Problems 1) Sun & Sand Sports Company has accounts payable of $1,221,669, cash of $677,423, inventory of $2,312,478, accounts receivable of

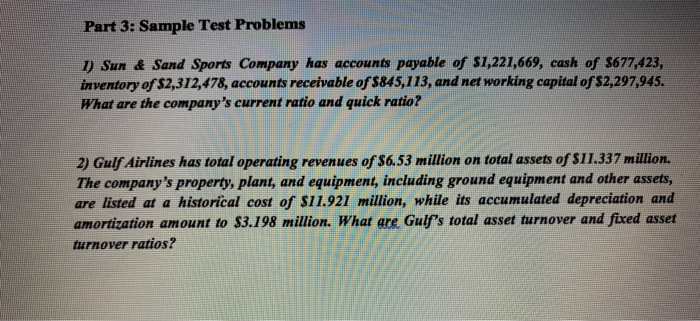

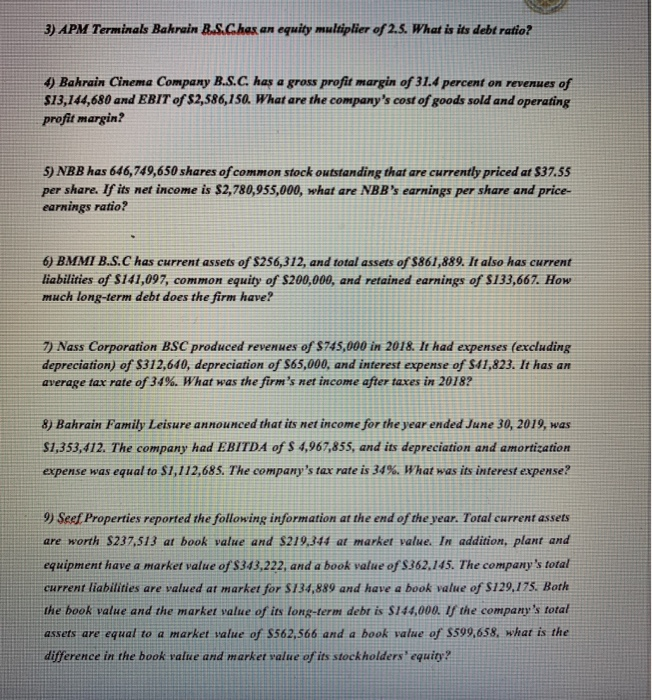

Part 3: Sample Test Problems 1) Sun & Sand Sports Company has accounts payable of $1,221,669, cash of $677,423, inventory of $2,312,478, accounts receivable of $845,713, and networking capital of $2,297,945. What are the company's current ratio and quick ratio? 2) Gulf Airlines has total operating revenues of $6.53 million on total assets of $11.337 million. The company's property, plant, and equipment, including ground equipment and other assets, are listed at a historical cost of $11.921 million, while its accumulated depreciation and amortization amount to $3.198 million. What are Gulf's total asset turnover and fixed asset turnover ratios? 3) APM Terminals Bahrain B.S.Chas an equity multiplier of 2.5. What is its debt ratio? 4) Bahrain Cinema Company B.S.C has a gross profit margin of 31.4 percent on revenues of $13,144,680 and EBIT of $2,586,150. What are the company's cost of goods sold and operating profit margin? 5) NBB has 646,749,650 shares of common stock outstanding that are currently priced at $37.55 per share. If its net income is $2,780,955,000, what are NBB's earnings per share and price- earnings ratio? 6) BMMI B.S.C has current assets of $256,312, and total assets of $861,889. It also has current liabilities of $141,097, common equity of $200,000, and retained earnings of $133,667. How much long-term debt does the firm have? 7) Nass Corporation BSC produced revenues of $745,000 in 2018. It had expenses (excluding depreciation) of $312,610, depreciation of $65,000, and interest expense of $11,823. It has an average tax rate of 34%. What was the firm's net income after taxes in 2018? 8) Bahrain Family Leisure announced that its net income for the year ended June 30, 2019, was $1,353,412. The company had EBITDA of $ 4,967,855, and its depreciation and amortization expense was equal to S7,112,685. The company's tax rate is 34%. What was its interest expense? 9) Seef Properties reported the following information at the end of the year. Total current assets are worth $237.513 at book value and $219,344 at market value. In addition, plant and equipment have a market value of $343,222, and a book value of $362.145. The company's total current liabilities are valued at market for $734,889 and have a book value of $129,175. Both the book value and the market value of its long-term debris $144,000. If the company's total assets are equal to a market value of $562,566 and a book value of $599,658. what is the difference in the book value and market value of its stockholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts