Question: Part 3 Using the Score Financial Projections Template (See Below) analyze the pictures in their entirety for any aspects that may not be obvious to

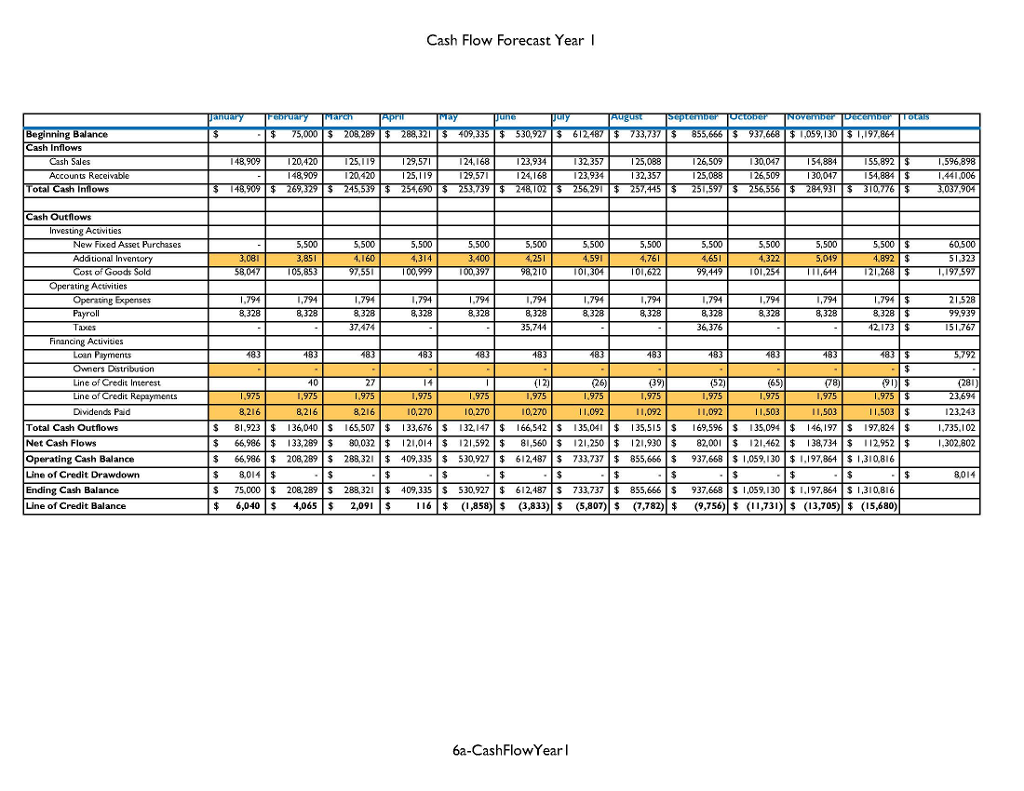

Part 3 Using the Score Financial Projections Template (See Below) analyze the pictures in their entirety for any aspects that may not be obvious to the common financial statement user. Explain each of these areas of possible confusion.Also,Please provide assumptions regarding financial statement content monthly for the first year. The spreadsheet did not show up on word like I wanted it to. If the person looking at this would like a copy of the excel spreadsheet I would be happy to send it to them.

Part 3 Using the Score Financial Projections Template (See Below) analyze the pictures in their entirety for any aspects that may not be obvious to the common financial statement user. Explain each of these areas of possible confusion.Also,Please provide assumptions regarding financial statement content monthly for the first year. The spreadsheet did not show up on word like I wanted it to. If the person looking at this would like a copy of the excel spreadsheet I would be happy to send it to them.

| Cash Flow Forecast Year 1 | |||||||||||||

| Prepared By: | Company Name: | ||||||||||||

| Owner | Company 1 | ||||||||||||

| Month 1 | Month 2 | Month 3 | Month 4 | Month 5 | Month 6 | Month 7 | Month 8 | Month 9 | Month 10 | Month 11 | Month 12 | Totals | |

| Beginning Balance | $ - | $ 75,000 | $ 208,289 | $ 288,321 | $ 409,335 | $ 530,927 | $ 612,487 | $ 733,737 | $ 855,666 | $ 937,668 | $1,059,130 | $1,197,864 | |

| Cash Inflows | |||||||||||||

| Cash Sales | 148,909 | 120,420 | 125,119 | 129,571 | 124,168 | 123,934 | 132,357 | 125,088 | 126,509 | 130,047 | 154,884 | 155,892 | $ 1,596,898 |

| Accounts Receivable | - | 148,909 | 120,420 | 125,119 | 129,571 | 124,168 | 123,934 | 132,357 | 125,088 | 126,509 | 130,047 | 154,884 | $ 1,441,006 |

| Total Cash Inflows | $ 148,909 | $ 269,329 | $ 245,539 | $ 254,690 | $ 253,739 | $ 248,102 | $ 256,291 | $ 257,445 | $ 251,597 | $ 256,556 | $ 284,931 | $ 310,776 | $ 3,037,904 |

| Cash Outflows | |||||||||||||

| Investing Activities | |||||||||||||

| New Fixed Asset Purchases | - | 5,500 | 5,500 | 5,500 | 5,500 | 5,500 | 5,500 | 5,500 | 5,500 | 5,500 | 5,500 | 5,500 | $ 60,500 |

| Additional Inventory | 3,081 | 3,851 | 4,160 | 4,314 | 3,400 | 4,251 | 4,591 | 4,761 | 4,651 | 4,322 | 5,049 | 4,892 | $ 51,323 |

| Cost of Goods Sold | 58,047 | 105,853 | 97,551 | 100,999 | 100,397 | 98,210 | 101,304 | 101,622 | 99,449 | 101,254 | 111,644 | 121,268 | $ 1,197,597 |

| Operating Activities | |||||||||||||

| Operating Expenses | 1,794 | 1,794 | 1,794 | 1,794 | 1,794 | 1,794 | 1,794 | 1,794 | 1,794 | 1,794 | 1,794 | 1,794 | $ 21,528 |

| Payroll | 8,328 | 8,328 | 8,328 | 8,328 | 8,328 | 8,328 | 8,328 | 8,328 | 8,328 | 8,328 | 8,328 | 8,328 | $ 99,939 |

| Taxes | - | - | 37,474 | - | - | 35,744 | - | - | 36,376 | - | - | 42,173 | $ 151,767 |

| Financing Activities | |||||||||||||

| Loan Payments | 483 | 483 | 483 | 483 | 483 | 483 | 483 | 483 | 483 | 483 | 483 | 483 | $ 5,792 |

| Owners Distribution | - | - | - | - | - | - | - | - | - | - | - | - | $ - |

| Line of Credit Interest | 40 | 27 | 14 | 1 | (12) | (26) | (39) | (52) | (65) | (78) | (91) | $ (281) | |

| Line of Credit Repayments | 1,975 | 1,975 | 1,975 | 1,975 | 1,975 | 1,975 | 1,975 | 1,975 | 1,975 | 1,975 | 1,975 | 1,975 | $ 23,694 |

| Dividends Paid | 8,216 | 8,216 | 8,216 | 10,270 | 10,270 | 10,270 | 11,092 | 11,092 | 11,092 | 11,503 | 11,503 | 11,503 | $ 123,243 |

| Total Cash Outflows | $ 81,923 | $ 136,040 | $ 165,507 | $ 133,676 | $ 132,147 | $ 166,542 | $ 135,041 | $ 135,515 | $ 169,596 | $ 135,094 | $ 146,197 | $ 197,824 | $ 1,735,102 |

| Net Cash Flows | $ 66,986 | $ 133,289 | $ 80,032 | $ 121,014 | $ 121,592 | $ 81,560 | $ 121,250 | $ 121,930 | $ 82,001 | $ 121,462 | $ 138,734 | $ 112,952 | $ 1,302,802 |

| Operating Cash Balance | $ 66,986 | $ 208,289 | $ 288,321 | $ 409,335 | $ 530,927 | $ 612,487 | $ 733,737 | $ 855,666 | $ 937,668 | $1,059,130 | $1,197,864 | $1,310,816 | |

| Line of Credit Drawdown | $ 8,014 | $ - | $ - | $ - | $ - | $ - | $ - | $ - | $ - | $ - | $ - | $ - | $ 8,014 |

| Ending Cash Balance | $ 75,000 | $ 208,289 | $ 288,321 | $ 409,335 | $ 530,927 | $ 612,487 | $ 733,737 | $ 855,666 | $ 937,668 | $1,059,130 | $1,197,864 | $1,310,816 | |

| Line of Credit Balance | $ 6,040 | $ 4,065 | $ 2,091 | $ 116 | $ (1,858) | $ (3,833) | $ (5,807) | $ (7,782) | $ (9,756) | $ (11,731) | $ (13,705) | $ (15,680) | |

Cash Flow Forecast Year I Cash inflows Additional Inventory 51323 LTM ITM 179 ITM 171 179 21 S28 8328 8328 IS TYS39 Loan Pymen 153 153 153 Owners Distribution Line Credit Repaymen 23694 8216 82 161 82161 10270 10.270 10270 II.092 IIS03 II SO3 03 Dividends Paid 23.243 Net Cash Flo 288,321 409,335 Operating Cash S S S S S S Line of Credit Drawdown Ending Cash Balance Line of Credit Balance 6,040 4,065 S 2.091 S II6 853) 3,83)S (5307 S (7782 (756 IIT3DS (13705) (15080) 6a-Cash Flow Year Cash Flow Forecast Year I Cash inflows Additional Inventory 51323 LTM ITM 179 ITM 171 179 21 S28 8328 8328 IS TYS39 Loan Pymen 153 153 153 Owners Distribution Line Credit Repaymen 23694 8216 82 161 82161 10270 10.270 10270 II.092 IIS03 II SO3 03 Dividends Paid 23.243 Net Cash Flo 288,321 409,335 Operating Cash S S S S S S Line of Credit Drawdown Ending Cash Balance Line of Credit Balance 6,040 4,065 S 2.091 S II6 853) 3,83)S (5307 S (7782 (756 IIT3DS (13705) (15080) 6a-Cash Flow Year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts