Question: PART 4 INTEGRATIVE PROBLEM: LONG-TERM ASSET AND LIABILITY MANAGEMENT JB Hi-Fi is an Australian company that is considering a joint venture with a Chinese company

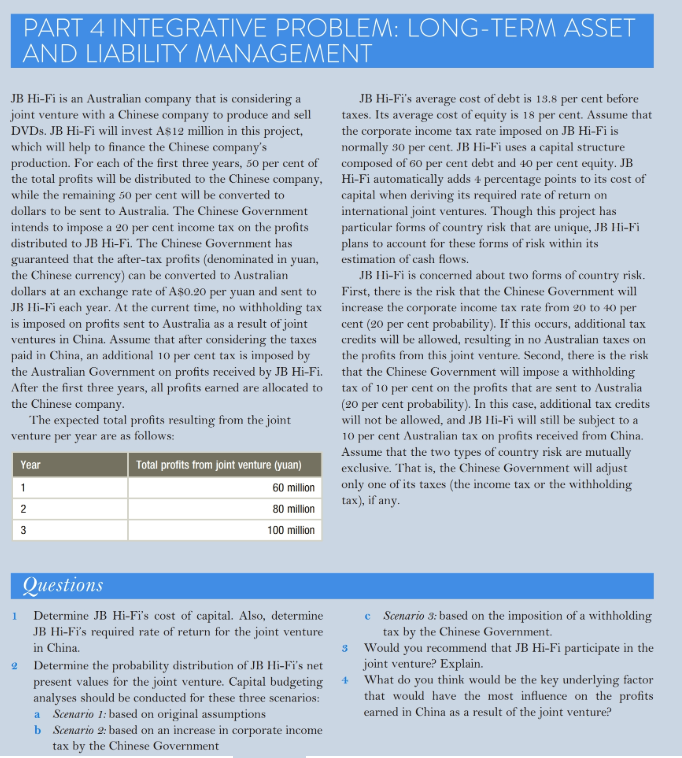

PART 4 INTEGRATIVE PROBLEM: LONG-TERM ASSET AND LIABILITY MANAGEMENT JB Hi-Fi is an Australian company that is considering a joint venture with a Chinese company to produce and sel taxe. Its average cost of equity is 18 per cent. Assume that DVDs. JB Hi-Fi will invest A$12 million in this project, which will help to finance the Chinese company's production. For each of the first three years, 50 per cent of composed of 6o per cent debt and 40 per cent equity. JB the total profits will be distributed to the Chinese company, Hi-Fi automatically adds 4 percentage points to its cost of while the remaining 50 per cent will be converted to dollars to be sent to Australia. The Chinese Government intends to impose a 20 per cent income tax on the profits particular forms of country risk that are unique, JB IHi-Fi distributed to JB Hi-Fi. The Chinese Government has guaranteed that the after-tax profits (denominated in yuan, estimation of cash flows. the Chinese currency) can be converted to Australian dollars at an exchange rate of As0.20 per yuan and sent to First, there is the risk that the Chinese Government will JB Hi-Fi each year. At the current time, no withholding tax increase the corporate income tax rate is imposed on profits sent to Australia as a result of joint cent (20 per cent probability). If this occurs, additional tax ventures in China. Assume that after considering the taxes credits will be allowed, resulting in no Australian taxes on paid in China, an additional 10 per cent tax is imposed by te profits from this joint venture. Second, there is the risk the Australian Government on profits received by JB Hi-Fi. that the Chinese Government will impose a withholding After the first three years, all profits earned are allocated to tax of 10 per cent on the profits that are sent to Australia the Chinese company JB Hi-Fi's average cost of debt is 13.8 per cent before the corporate income tax rate imposed on JB Hi-Fi is normally S0 per cent. JB Hi-Fi uses a capital structure capital when deriving its required rate of return on international joint ventures. Though this project h plans to account for these forms of risk within its JB Ili-Fi is concerned about two forms of country risk. from 20 to 40 per (20 per cent probability). In this case, additional tax credits The expected total profits resulting from the joint venture per year are as follows: will not be allowed, and JB Hi-Fi will still be subject to a 10 per cent Australian tax on profits received from China. Assume that the two types of country risk are mutually exclusive. That is, the Chinese Government will adjust Year Total profits from joint venture (yuan) 60 miononly one of its taxes (the income tax or the withholding 80 million 100 million tax), if an Questions 1 Determine JB Hi-Fis cost of capital. Also, determine Scenario 3: based on the imposition of a withholding c JB Hi-Fi's required rate of return for the joint venture in China. Determine the probability distribution of JB Hi-Fi's net present values for the joint venture. Capital budgeting tax by the Chinese Government. Would you recommend that JB Hi-Fi participate in the joint venture? Explain. s 2 What do you think would be the key underlying factor analyses should be conducted for these three scenarios: a Scenario 1: based on original assumptions b Scenario 2: based on an increase in corporate income that would have the most influence on the profits earned in China as a result of the joint venture tax by the Chinese Government PART 4 INTEGRATIVE PROBLEM: LONG-TERM ASSET AND LIABILITY MANAGEMENT JB Hi-Fi is an Australian company that is considering a joint venture with a Chinese company to produce and sel taxe. Its average cost of equity is 18 per cent. Assume that DVDs. JB Hi-Fi will invest A$12 million in this project, which will help to finance the Chinese company's production. For each of the first three years, 50 per cent of composed of 6o per cent debt and 40 per cent equity. JB the total profits will be distributed to the Chinese company, Hi-Fi automatically adds 4 percentage points to its cost of while the remaining 50 per cent will be converted to dollars to be sent to Australia. The Chinese Government intends to impose a 20 per cent income tax on the profits particular forms of country risk that are unique, JB IHi-Fi distributed to JB Hi-Fi. The Chinese Government has guaranteed that the after-tax profits (denominated in yuan, estimation of cash flows. the Chinese currency) can be converted to Australian dollars at an exchange rate of As0.20 per yuan and sent to First, there is the risk that the Chinese Government will JB Hi-Fi each year. At the current time, no withholding tax increase the corporate income tax rate is imposed on profits sent to Australia as a result of joint cent (20 per cent probability). If this occurs, additional tax ventures in China. Assume that after considering the taxes credits will be allowed, resulting in no Australian taxes on paid in China, an additional 10 per cent tax is imposed by te profits from this joint venture. Second, there is the risk the Australian Government on profits received by JB Hi-Fi. that the Chinese Government will impose a withholding After the first three years, all profits earned are allocated to tax of 10 per cent on the profits that are sent to Australia the Chinese company JB Hi-Fi's average cost of debt is 13.8 per cent before the corporate income tax rate imposed on JB Hi-Fi is normally S0 per cent. JB Hi-Fi uses a capital structure capital when deriving its required rate of return on international joint ventures. Though this project h plans to account for these forms of risk within its JB Ili-Fi is concerned about two forms of country risk. from 20 to 40 per (20 per cent probability). In this case, additional tax credits The expected total profits resulting from the joint venture per year are as follows: will not be allowed, and JB Hi-Fi will still be subject to a 10 per cent Australian tax on profits received from China. Assume that the two types of country risk are mutually exclusive. That is, the Chinese Government will adjust Year Total profits from joint venture (yuan) 60 miononly one of its taxes (the income tax or the withholding 80 million 100 million tax), if an Questions 1 Determine JB Hi-Fis cost of capital. Also, determine Scenario 3: based on the imposition of a withholding c JB Hi-Fi's required rate of return for the joint venture in China. Determine the probability distribution of JB Hi-Fi's net present values for the joint venture. Capital budgeting tax by the Chinese Government. Would you recommend that JB Hi-Fi participate in the joint venture? Explain. s 2 What do you think would be the key underlying factor analyses should be conducted for these three scenarios: a Scenario 1: based on original assumptions b Scenario 2: based on an increase in corporate income that would have the most influence on the profits earned in China as a result of the joint venture tax by the Chinese Government

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts