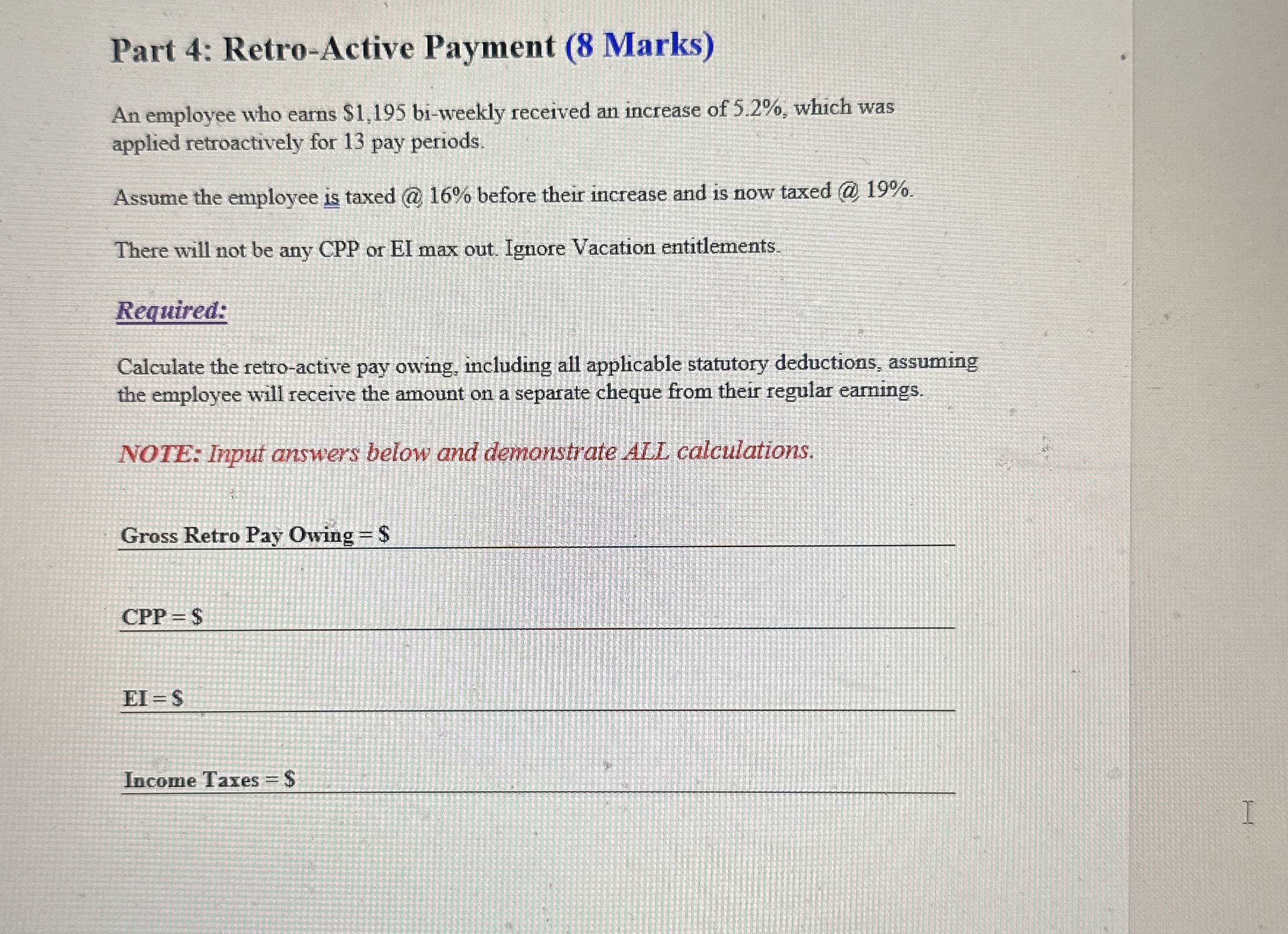

Question: Part 4 : Retro - Active Payment ( 8 Marks ) An employee who earns $ 1 , 1 9 5 bi - weekly received

Part : RetroActive Payment Marks

An employee who earns $ biweekly received an increase of which was applied retroactively for pay periods.

Assume the employee is taxed @ before their increase and is now taxed @

There will not be any CPP or EI max out. Ignore Vacation entitlements.

Required:

Calculate the retroactive pay owing, including all applicable statutory deductions, assuming the employee will receive the amount on a separate cheque from their regular earnings.

NOTE: Input answers below and demonstrate AII calculations.

Gross Retro Pay Owing $

$

Income Taxes $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock