Question: Part 5 Viper Squad is a U. S. based international conglomerate comprised of a number of geographically differentiated investment centers. Keel Bill is the manager

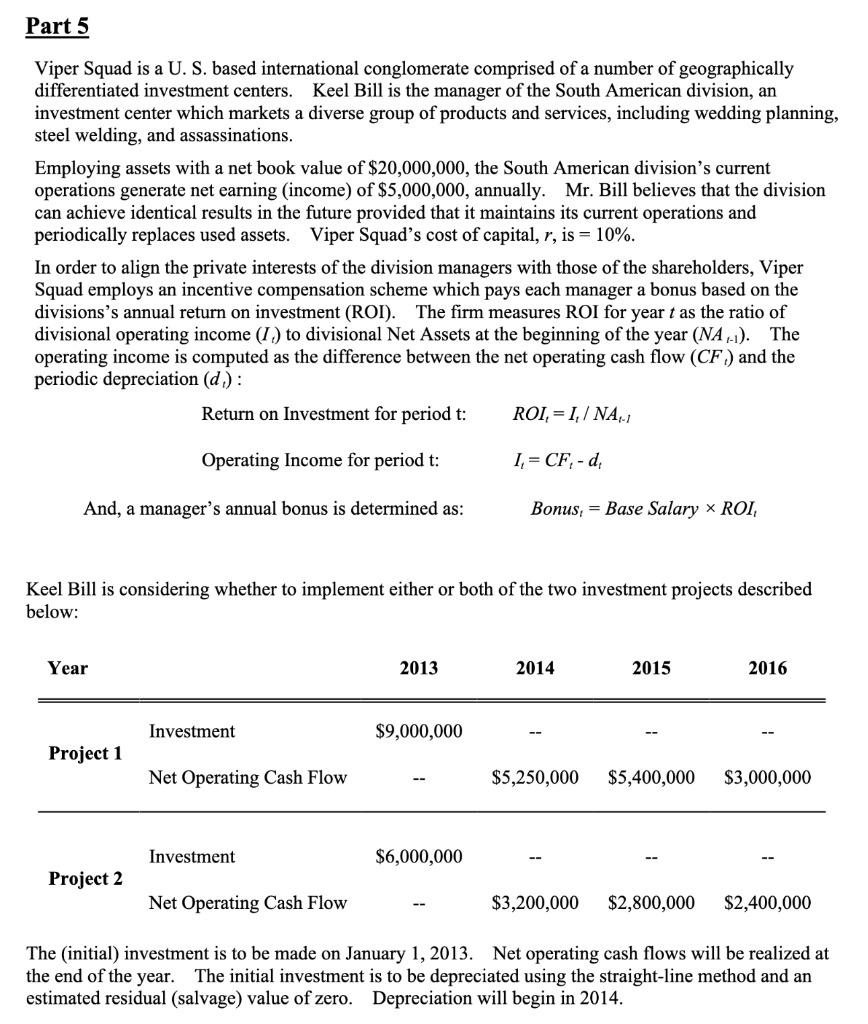

Part 5 Viper Squad is a U. S. based international conglomerate comprised of a number of geographically differentiated investment centers. Keel Bill is the manager of the South American division, an investment center which markets a diverse group of products and services, including wedding planning, steel welding, and assassinations. Employing assets with a net book value of $20,000,000, the South American division's current operations generate net earning (income) of $5,000,000, annually. Mr. Bill believes that the division can achieve identical results in the future provided that it maintains its current operations and periodically replaces used assets. Viper Squad's cost of capital, r, is = 10%. In order to align the private interests of the division managers with those of the shareholders, Viper Squad employs an incentive compensation scheme which pays each manager a bonus based on the divisions's annual return on investment (ROI). The firm measures ROI for year t as the ratio of divisional operating income (I.) to divisional Net Assets at the beginning of the year (NA ,-1). The operating income is computed as the difference between the net operating cash flow (CF) and the periodic depreciation (d): Return on Investment for period t: ROI, = 1,/ NA1 Operating Income for period t: 1,= CF,-d And, a manager's annual bonus is determined as: Bonus, = Base Salary * ROI, Keel Bill is considering whether to implement either or both of the two investment projects described below: Year 2013 2014 2015 2016 Investment $9,000,000 Project 1 Net Operating Cash Flow $5,250,000 $5,400,000 $3,000,000 Investment $6,000,000 Project 2 Net Operating Cash Flow $3,200,000 $2,800,000 $2,400,000 The initial) investment is to be made on January 1, 2013. Net operating cash flows will be realized at the end of the year. The initial investment is to be depreciated using the straight-line method and an estimated residual (salvage) value of zero. Depreciation will begin in 2014. 1. (3 points) What is the Net Present Value of the cash flows for each project? NPV of the net cash flows for Project 1 $ NPV of the net cash flows for Project 2 2. (4 points) What is the net present value of the Operating Income for each project? NPV of the Operating Income for Project 1 NPV of the Operating Income for Project 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts