Question: Part 8 Tactical Financing Decisions INTERMEDIATE PROBLEMS 3-5 (18-3) Stock Issues Benjamin Garcia's start-up business is succeeding, but he needs $200,000 in additional funding to

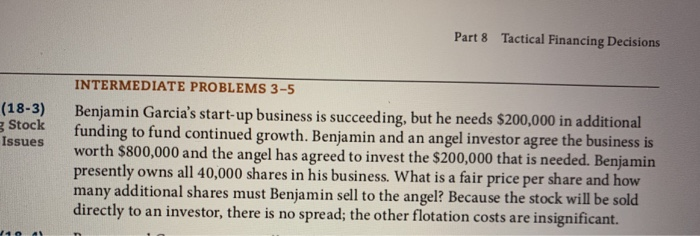

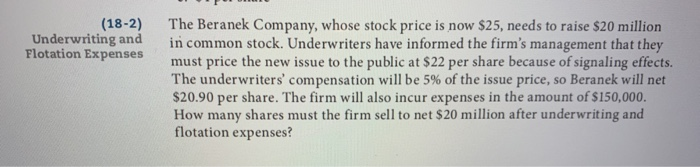

Part 8 Tactical Financing Decisions INTERMEDIATE PROBLEMS 3-5 (18-3) Stock Issues Benjamin Garcia's start-up business is succeeding, but he needs $200,000 in additional funding to fund continued growth. Benjamin and an angel investor agree the business is worth $800,000 and the angel has agreed to invest the $200,000 that is needed. Benjamin presently owns all 40,000 shares in his business. What is a fair price per share and how many additional shares must Benjamin sell to the angel? Because the stock will be sold directly to an investor, there is no spread; the other flotation costs are insignificant. (18-2) Underwriting and Flotation Expenses The Beranek Company, whose stock price is now $25, needs to raise $20 million in common stock. Underwriters have informed the firm's management that they must price the new issue to the public at $22 per share because of signaling effects. The underwriters' compensation will be 5% of the issue price, so Beranek will net $20.90 per share. The firm will also incur expenses in the amount of $150,000. How many shares must the firm sell to net $20 million after underwriting and flotation expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts