Question: PART A 10 Marks As an alternative option to reducing its financing, Inspiron Inc. is considering buying back some of its common shares. The Finance

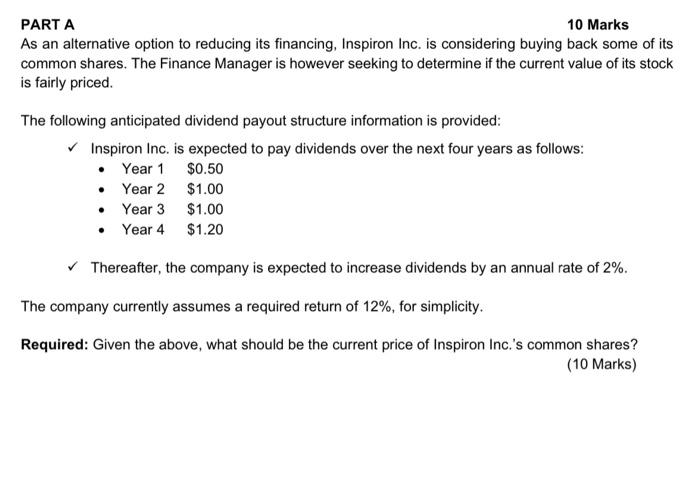

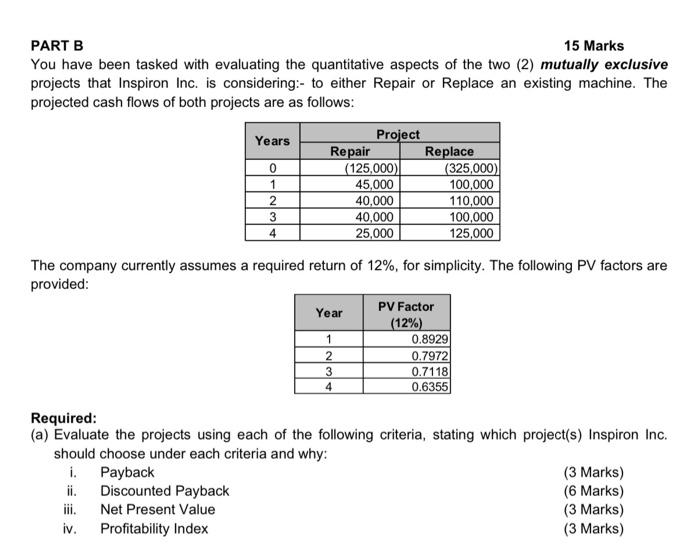

PART A 10 Marks As an alternative option to reducing its financing, Inspiron Inc. is considering buying back some of its common shares. The Finance Manager is however seeking to determine if the current value of its stock is fairly priced. The following anticipated dividend payout structure information is provided: Inspiron Inc. is expected to pay dividends over the next four years as follows: - Year 1$0.50 - Year 2$1.00 - Year 3$1.00 - Year 4$1.20 Thereafter, the company is expected to increase dividends by an annual rate of 2%. The company currently assumes a required return of 12%, for simplicity. Required: Given the above, what should be the current price of Inspiron Inc.'s common shares? (10 Marks) PART B 15 Marks You have been tasked with evaluating the quantitative aspects of the two (2) mutually exclusive projects that Inspiron Inc. is considering:- to either Repair or Replace an existing machine. The projected cash flows of both projects are as follows: The company currently assumes a required return of 12%, for simplicity. The following PV factors are provided: Required: (a) Evaluate the projects using each of the following criteria, stating which project(s) Inspiron Inc. should choose under each criteria and why: i. Payback (3 Marks) ii. Discounted Payback (6 Marks) iii. Net Present Value (3 Marks) iv. Profitability Index

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts