Question: Part A 10 Marks Milles Fleurs is undergoing an analysis of one of the products it produces, the Ambard Plus. Each Ambard Plus is sold

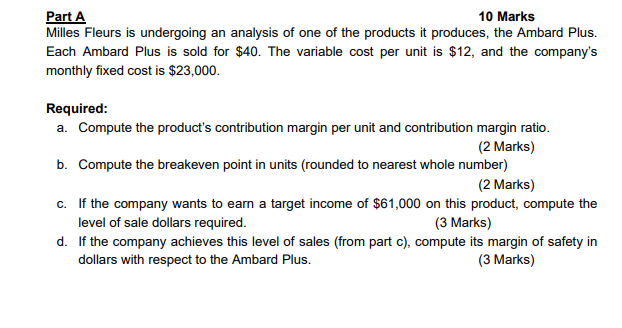

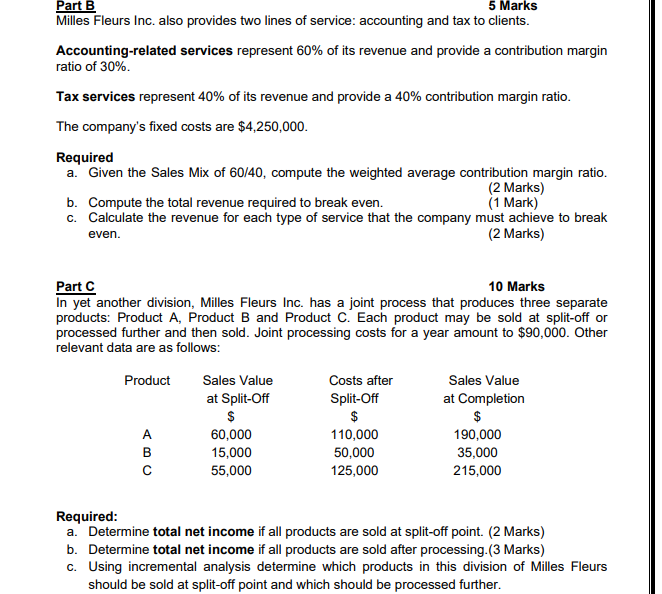

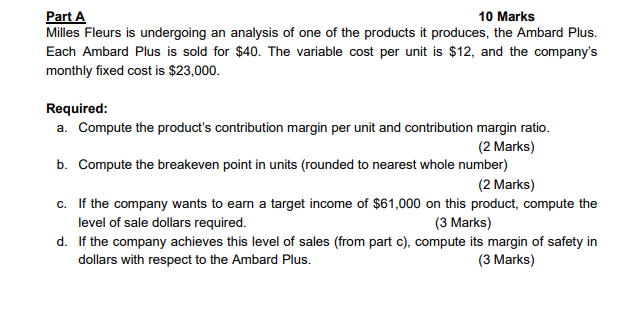

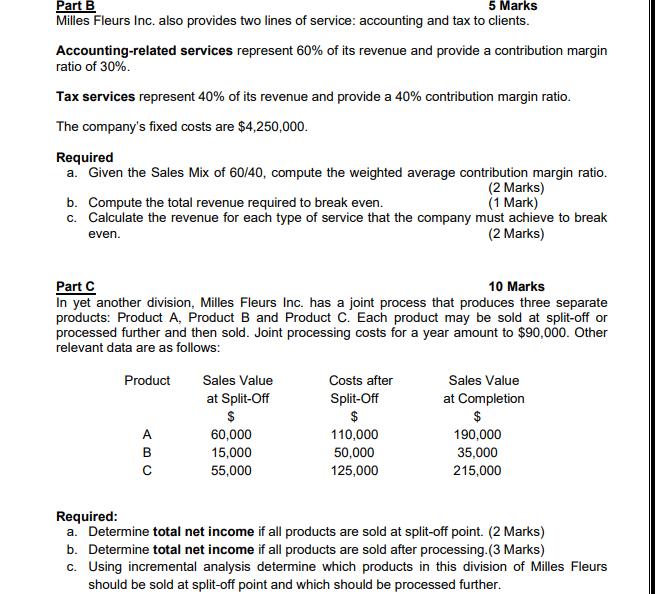

Part A 10 Marks Milles Fleurs is undergoing an analysis of one of the products it produces, the Ambard Plus. Each Ambard Plus is sold for $40. The variable cost per unit is $12, and the company's monthly fixed cost is $23,000. Required: a. Compute the product's contribution margin per unit and contribution margin ratio. (2 Marks) b. Compute the breakeven point in units (rounded to nearest whole number) (2 Marks) c. If the company wants to earn a target income of $61,000 on this product, compute the level of sale dollars required. (3 Marks) d. If the company achieves this level of sales (from part c), compute its margin of safety in dollars with respect to the Ambard Plus. (3 Marks)Part B 5 Marks Milles Fleurs Inc. also provides two lines of service: accounting and tax to clients. Accounting-related services represent 60% of its revenue and provide a contribution margin ratio of 30%. Tax services represent 40% of its revenue and provide a 40% contribution margin ratio. The company's fixed costs are $4,250,000. Required a. Given the Sales Mix of 60/40, compute the weighted average contribution margin ratio. (2 Marks) b. Compute the total revenue required to break even. (1 Mark) c. Calculate the revenue for each type of service that the company must achieve to break even. (2 Marks) Part C 10 Marks In yet another division, Milles Fleurs Inc. has a joint process that produces three separate products: Product A, Product B and Product C. Each product may be sold at split-off or processed further and then sold. Joint processing costs for a year amount to $90,000. Other relevant data are as follows: Product Sales Value Costs after Sales Value at Split-Off Split-Off at Completion $ $ A 60,000 110,000 190,000 B 15,000 50,000 35,000 O 55,000 125,000 215,000 Required: a. Determine total net income if all products are sold at split-off point. (2 Marks) b. Determine total net income if all products are sold after processing. (3 Marks) c. Using incremental analysis determine which products in this division of Milles Fleurs should be sold at split-off point and which should be processed further

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts