Question: PART A 15 Marks Utilize the 2022 financial statements for Inspiron Inc. provided on page 2 and assume that the company is currently operating below

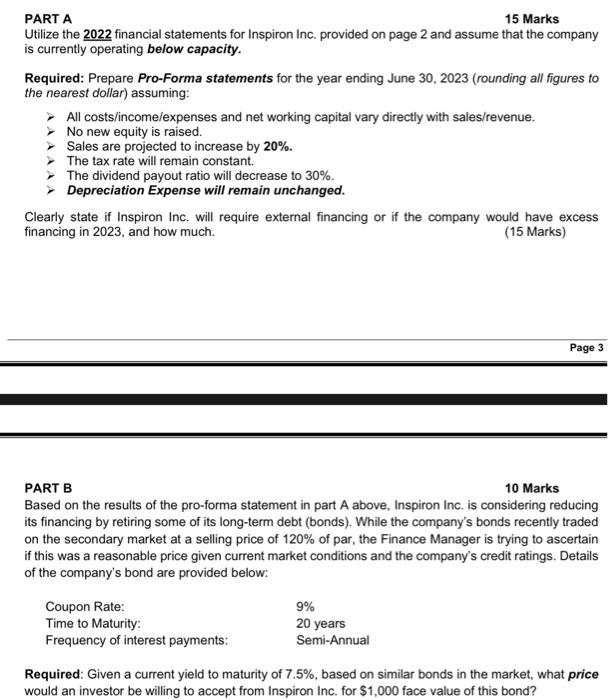

PART A 15 Marks Utilize the 2022 financial statements for Inspiron Inc. provided on page 2 and assume that the company is currently operating below capacity. Required: Prepare Pro-Forma statements for the year ending June 30, 2023 (rounding all figures to the nearest dollar) assuming: All costs/income/expenses and net working capital vary directly with sales/revenue. No new equity is raised. Sales are projected to increase by 20%. The tax rate will remain constant. The dividend payout ratio will decrease to 30%. Depreciation Expense will remain unchanged. Clearly state if Inspiron Inc. will require external financing or if the company would have excess financing in 2023, and how much. (15 Marks) PART B 10 Marks Based on the results of the pro-forma statement in part A above, Inspiron Inc. is considering reducing its financing by retiring some of its long-term debt (bonds). While the company's bonds recently traded on the secondary market at a selling price of 120% of par, the Finance Manager is trying to ascertain if this was a reasonable price given current market conditions and the company's credit ratings. Details of the company's bond are provided below: Required: Given a current yield to maturity of 7.5%, based on similar bonds in the market, what price would an investor be willing to accept from Inspiron Inc. for $1,000 face value of this bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts