Question: Part A (2 marks ) The following section is taken from Lucas Ltd's statement of financial position at 31 December, 2021. Cash dividends declared for

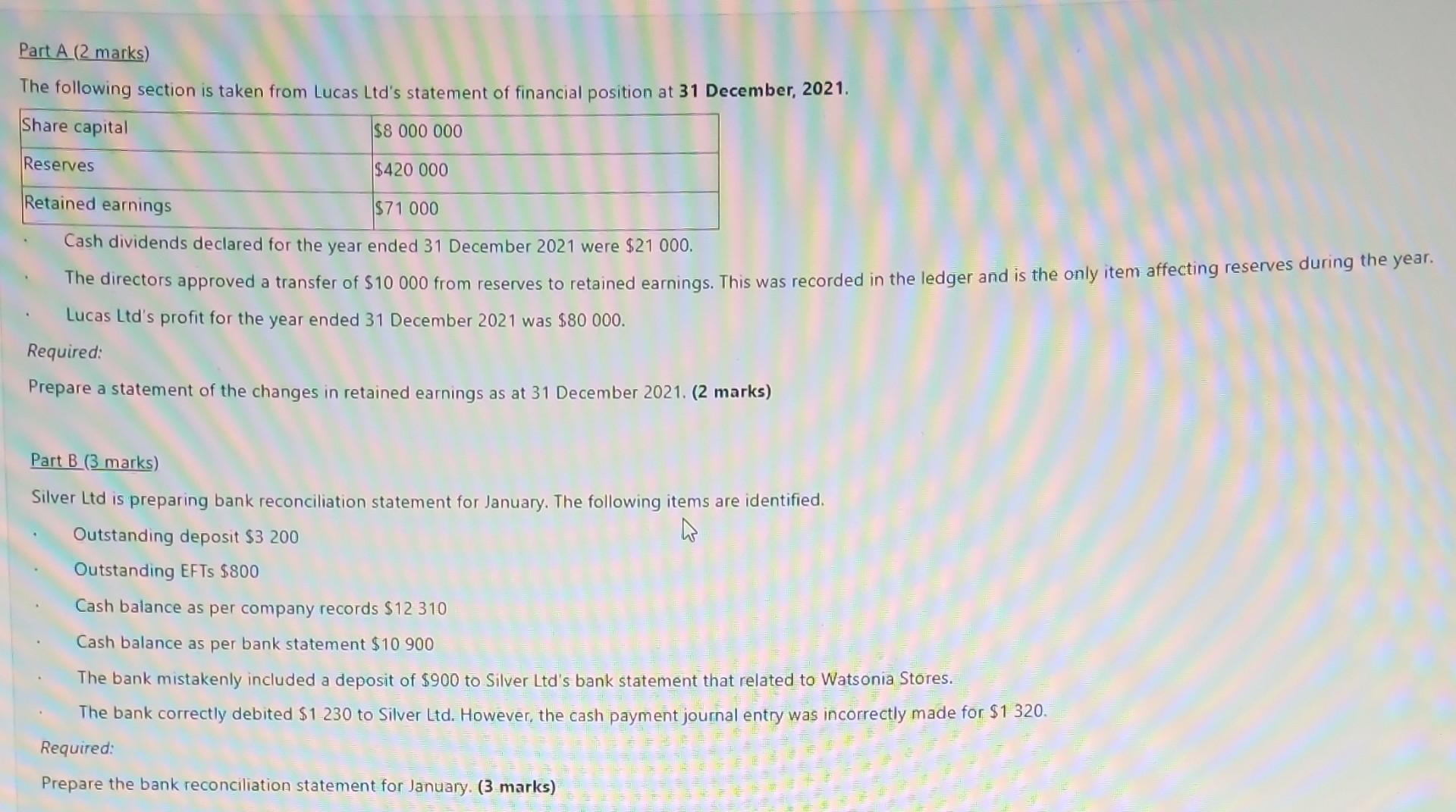

Part A (2 marks ) The following section is taken from Lucas Ltd's statement of financial position at 31 December, 2021. Cash dividends declared for the year ended 31 December 2021 were $21000. The directors approved a transfer of $10000 from reserves to retained earnings. This was recorded in the ledger and is the only item affecting reserves during the Lucas Ltd's profit for the year ended 31 December 2021 was $80000. Required: Prepare a statement of the changes in retained earnings as at 31 December 2021. (2 marks) Part B (3 marks ) Silver Ltd is preparing bank reconciliation statement for January. The following items are identified. Outstanding deposit $3200 Outstanding EFTs $800 Cash balance as per company records $12310 Cash balance as per bank statement $10900 The bank mistakenly included a deposit of $900 to Silver Ltd's bank statement that related to Watsonia Stores. The bank correctly debited $1230 to Silver Ltd. However, the cash payment journal entry was incorrectly made for $1320. Required: Prepare the bank reconciliation statement for January. ( 3 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts