Question: Part a (4 marks) 2 marks for the cash flow diagram, as follows. Give a mark for indicating the diagram is drawn from Clarrie's perspective.

Part a (4 marks)

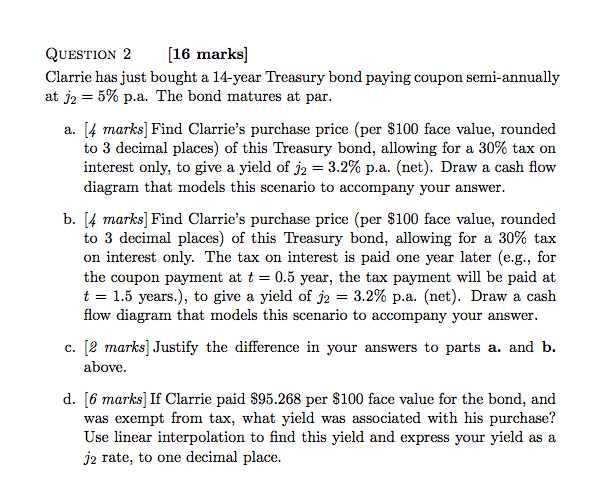

2 marks for the cash flow diagram, as follows.

- Give a mark for indicating the diagram is drawn from Clarrie's perspective.

- Give a mark for indicating a negative cash flow of P (or equivalent) at t=0 years.

- Give a mark for indicating positive cash flows of coupon of 2.5 each half-year over the 14 years.

- Give a mark for indicating negative cash flows of tax of 0.75 each half-year over the 14 years.

2 marks for Clarrie's purchase price, as follows.

- Give 1 marks for using the correct methodology to calculate the purchase price (reducing appropriately for errors and omissions).

- Give a mark for correctly calculating the price.

Part b (4 marks)

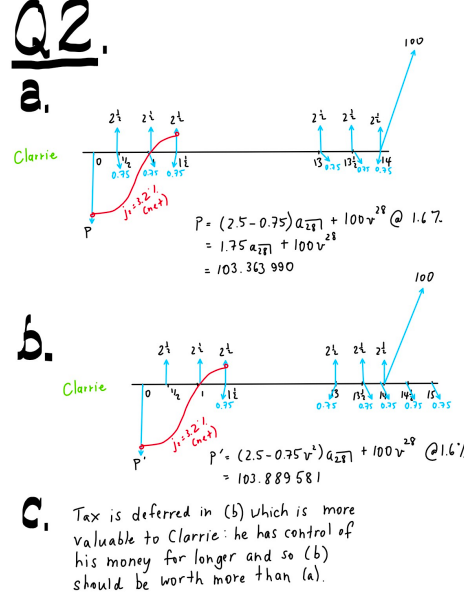

2 marks for the cash flow diagram, as follows.

- Give a mark for indicating the diagram is drawn from Clarrie's perspective.

- Give a mark for indicating a negative cash flow of P (or equivalent) at t=0 years.

- Give a mark for indicating positive cash flows of coupon of 2.5 each half-year over the 14 years.

- Give a mark for indicating negative cash flows of tax of 0.75 each half-year over the 14 years, but starting at t=1.5 (not 0.5, as above).

2 marks for Clarrie's purchase price, as follows.

- Give 1 marks for using the correct methodology to calculate the purchase price (reducing appropriately for errors and omissions).

- Give a mark for correctly calculating the price.

Part c (2 marks)

Give, either

- 2 marks for saying higher price in b accompanied by solid reasoning, OR

- 1 marks for saying higher price in b accompanied by weak reasoning, OR

- 1 mark for saying higher price in b accompanied by no reasoning, OR

- mark for not saying higher or lower price but accompanied by solid reasoning, OR

- zero, otherwise.

For this task I need to award marks for the working out. Answers for the question ae given. I desperately need help

QUESTION 2 [16 marks] Clarrie has just bought a 14-year Treasury bond paying coupon semi-annually at j2 = 5% p.a. The bond matures at par. a. [4 marks] Find Clarrie's purchase price (per $100 face value, rounded to 3 decimal places) of this Treasury bond, allowing for a 30% tax on interest only, to give a yield of j2 = 3.2% p.a. (net). Draw a cash flow diagram that models this scenario to accompany your answer. b. [4 marks] Find Clarrie's purchase price (per $100 face value, rounded to 3 decimal places) of this Treasury bond, allowing for a 30% tax on interest only. The tax on interest is paid one year later (e.g., for the coupon payment at t = 0.5 year, the tax payment will be paid at t = 1.5 years.), to give a yield of j2 = 3.2% p.a. (net). Draw a cash flow diagram that models this scenario to accompany your answer. c. [2 marks] Justify the difference in your answers to parts a. and b. above. d. [6 marks] If Clarrie paid $95.268 per $100 face value for the bond, and was exempt from tax, what yield was associated with his purchase? Use linear interpolation to find this yield express your yield as a j2 rate, to one decimal place. Q2. G a. Clarrie b. 0 21 21 21 3 0.75 0.75 0.75 j:32% (net) 0 21 21 21 I VIE 0.75 2 2 2 13% 13 14 0.35 075 0,75 28 P. (2.5-0.75) a1 + 100~ @ 1.67. = 1.75 a1 + 10028 = 103.363 990 100 24 24 24 13 134 . 1411 15 0.75 0.75 0.75 0.75 0.75 28 P'. (2.5-0.75 v) a51 + 100v @1.6% = 103.889 581 Clarrie C Tax is deferred in (b) which is more valuable to Clarrie: he has control of his money for longer and so (b) I should be worth more than (a). j:32'/ (net) 100 QUESTION 2 [16 marks] Clarrie has just bought a 14-year Treasury bond paying coupon semi-annually at j2 = 5% p.a. The bond matures at par. a. [4 marks] Find Clarrie's purchase price (per $100 face value, rounded to 3 decimal places) of this Treasury bond, allowing for a 30% tax on interest only, to give a yield of j2 = 3.2% p.a. (net). Draw a cash flow diagram that models this scenario to accompany your answer. b. [4 marks] Find Clarrie's purchase price (per $100 face value, rounded to 3 decimal places) of this Treasury bond, allowing for a 30% tax on interest only. The tax on interest is paid one year later (e.g., for the coupon payment at t = 0.5 year, the tax payment will be paid at t = 1.5 years.), to give a yield of j2 = 3.2% p.a. (net). Draw a cash flow diagram that models this scenario to accompany your answer. c. [2 marks] Justify the difference in your answers to parts a. and b. above. d. [6 marks] If Clarrie paid $95.268 per $100 face value for the bond, and was exempt from tax, what yield was associated with his purchase? Use linear interpolation to find this yield express your yield as a j2 rate, to one decimal place. Q2. G a. Clarrie b. 0 21 21 21 3 0.75 0.75 0.75 j:32% (net) 0 21 21 21 I VIE 0.75 2 2 2 13% 13 14 0.35 075 0,75 28 P. (2.5-0.75) a1 + 100~ @ 1.67. = 1.75 a1 + 10028 = 103.363 990 100 24 24 24 13 134 . 1411 15 0.75 0.75 0.75 0.75 0.75 28 P'. (2.5-0.75 v) a51 + 100v @1.6% = 103.889 581 Clarrie C Tax is deferred in (b) which is more valuable to Clarrie: he has control of his money for longer and so (b) I should be worth more than (a). j:32'/ (net) 100

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts