Question: part a and b are added please help on part c The company estimates that it could process the low-grade lumber further at a cost

part a and b are added please help on part c

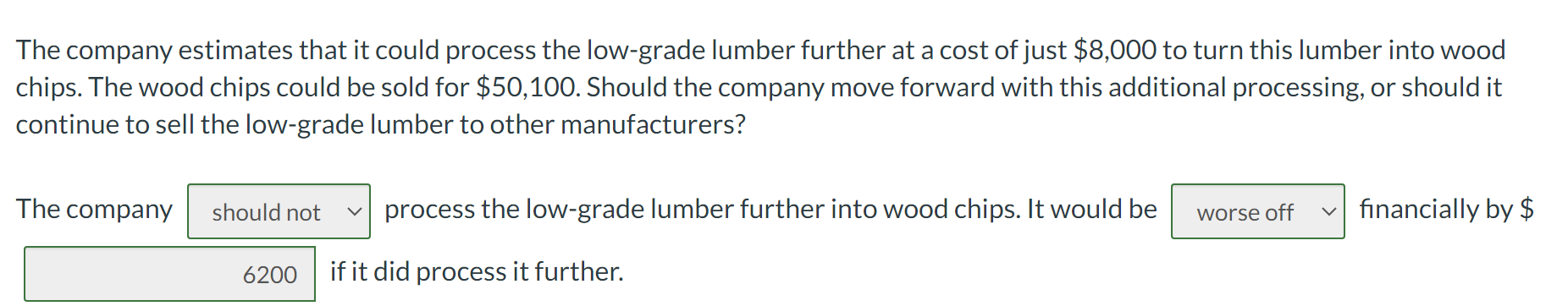

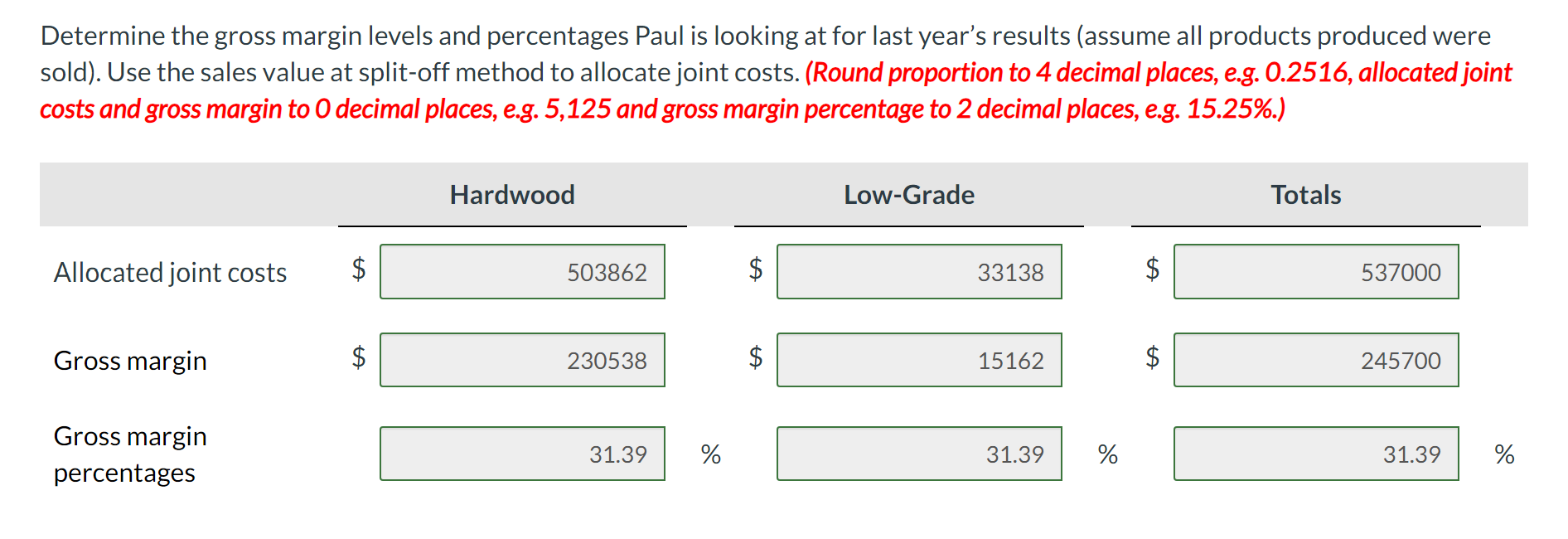

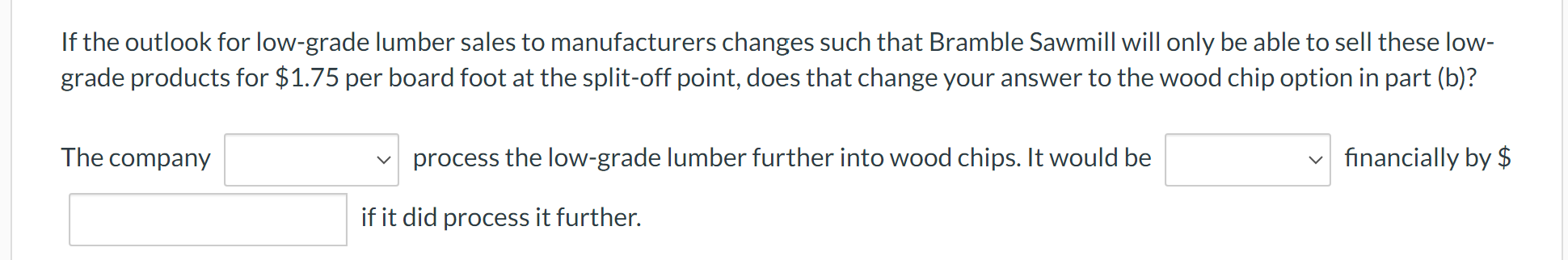

The company estimates that it could process the low-grade lumber further at a cost of just $8,000 to turn this lumber into wood chips. The wood chips could be sold for $50,100. Should the company move forward with this additional processing, or should it continue to sell the low-grade lumber to other manufacturers? The company process the low-grade lumber further into wood chips. It would be financially by $ if it did process it further. Determine the gross margin levels and percentages Paul is looking at for last year's results (assume all products produced were sold). Use the sales value at split-off method to allocate joint costs. (Round proportion to 4 decimal places, e.g. 0.2516, allocated joint costs and gross margin to 0 decimal places, e.g. 5,125 and gross margin percentage to 2 decimal places, e.g. 15.25\%.) If the outlook for low-grade lumber sales to manufacturers changes such that Bramble Sawmill will only be able to sell these lowgrade products for $1.75 per board foot at the split-off point, does that change your answer to the wood chip option in part (b)? The company process the low-grade lumber further into wood chips. It would be financially by $ if it did process it further. The company estimates that it could process the low-grade lumber further at a cost of just $8,000 to turn this lumber into wood chips. The wood chips could be sold for $50,100. Should the company move forward with this additional processing, or should it continue to sell the low-grade lumber to other manufacturers? The company process the low-grade lumber further into wood chips. It would be financially by $ if it did process it further. Determine the gross margin levels and percentages Paul is looking at for last year's results (assume all products produced were sold). Use the sales value at split-off method to allocate joint costs. (Round proportion to 4 decimal places, e.g. 0.2516, allocated joint costs and gross margin to 0 decimal places, e.g. 5,125 and gross margin percentage to 2 decimal places, e.g. 15.25\%.) If the outlook for low-grade lumber sales to manufacturers changes such that Bramble Sawmill will only be able to sell these lowgrade products for $1.75 per board foot at the split-off point, does that change your answer to the wood chip option in part (b)? The company process the low-grade lumber further into wood chips. It would be financially by $ if it did process it further

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts