Question: part a and b both are not complete. they are the questions being asked Grocery Chain Ltd. is a private company and operates several stores

part a and b both are not complete. they are the questions being asked

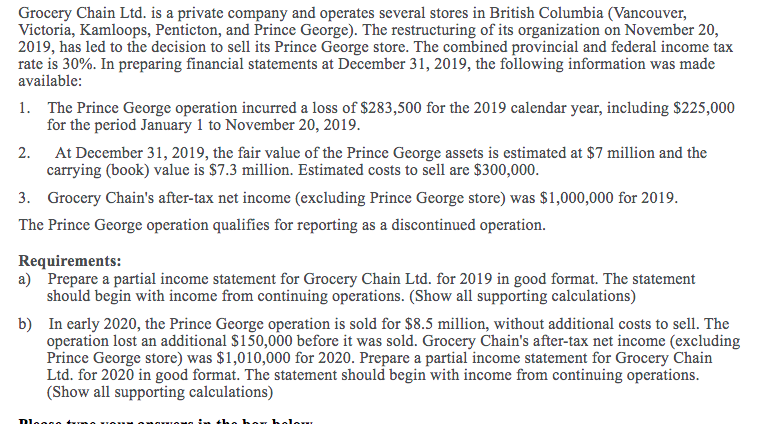

Grocery Chain Ltd. is a private company and operates several stores in British Columbia (Vancouver, Victoria, Kamloops, Penticton, and Prince George). The restructuring of its organization on November 20, 2019, has led to the decision to sell its Prince George store. The combined provincial and federal income tax rate is 30%. In preparing financial statements at December 31, 2019, the following information was made available: 1. The Prince George operation incurred a loss of $283,500 for the 2019 calendar year, including $225,000 for the period January 1 to November 20, 2019. 2. At December 31, 2019, the fair value of the Prince George assets is estimated at $7 million and the carrying (book) value is $7.3 million. Estimated costs to sell are $300,000. 3. Grocery Chain's after-tax net income (excluding Prince George store) was $1,000,000 for 2019. The Prince George operation qualifies for reporting as a discontinued operation. Requirements: a) Prepare a partial income statement for Grocery Chain Ltd. for 2019 in good format. The statement should begin with income from continuing operations. (Show all supporting calculations) b) In early 2020, the Prince George operation is sold for $8.5 million, without additional costs to sell. The operation lost an additional $150,000 before it was sold. Grocery Chain's after-tax net income (excluding Prince George store) was $1,010,000 for 2020. Prepare a partial income statement for Grocery Chain Ltd. for 2020 in good format. The statement should begin with income from continuing operations. (Show all supporting calculations) nlnn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts