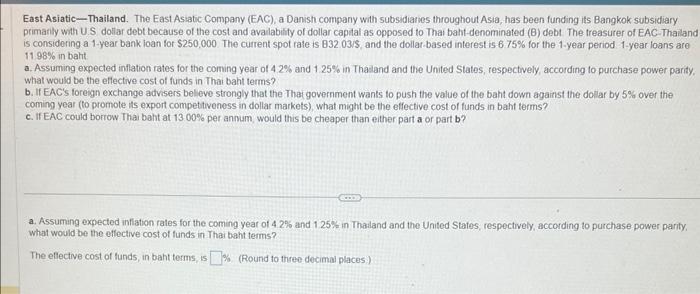

Question: part a, b, and c please. round to 4 decimal places thank you. East Asiatic-Thailand. The East Asiabic Company (EAC), a Danish company with subsidiaties

East Asiatic-Thailand. The East Asiabic Company (EAC), a Danish company with subsidiaties throughout Asia, has been funding its Bangkok subsidiary primarily with U.S dollar debt because of the cost and availability of dollar capial as opposed to Thai baht-denominated (B) debt. The treasurer of EAC-Thailand is considering a 1 year bank loan for $250,000. The current spot rate is 832.03/5, and the dollar-based interest is 675% for the 1-year period 1 -year loans are 11.98% in baht a. Assuming expected inflation rates for the coming year of 42% and 1.25% in Thaland and the United States, respectively, according to purchase power parity, what would be the eflective cost of funds in Thai baht terms? b. If EAC's foreign exchange advisers believe strongly that the Thar government wants to push the value of the baht down against the dollar by 5% over the coming year (to promote its export compettiveness in dollar markets), what might be the effective cost of funds in baht terms? c. If EAC could borrow Thai baht at 1300% per annum, would this be cheaper than ether part a or part b? a. Assuming expected inflation rates for the coming yeat of 42% and 1.25% in Thailand and the United States, respectively, according to purchase power parity. what would be the effective cost of funds in Thar baht terms? The eflective cost of tunds, in baht terms, is \% (Round to three decimai places:)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts