Question: Part A. Consider the following statement by a project analyst: I analyzed my project using scenarios for the base case, best case, and worst case.

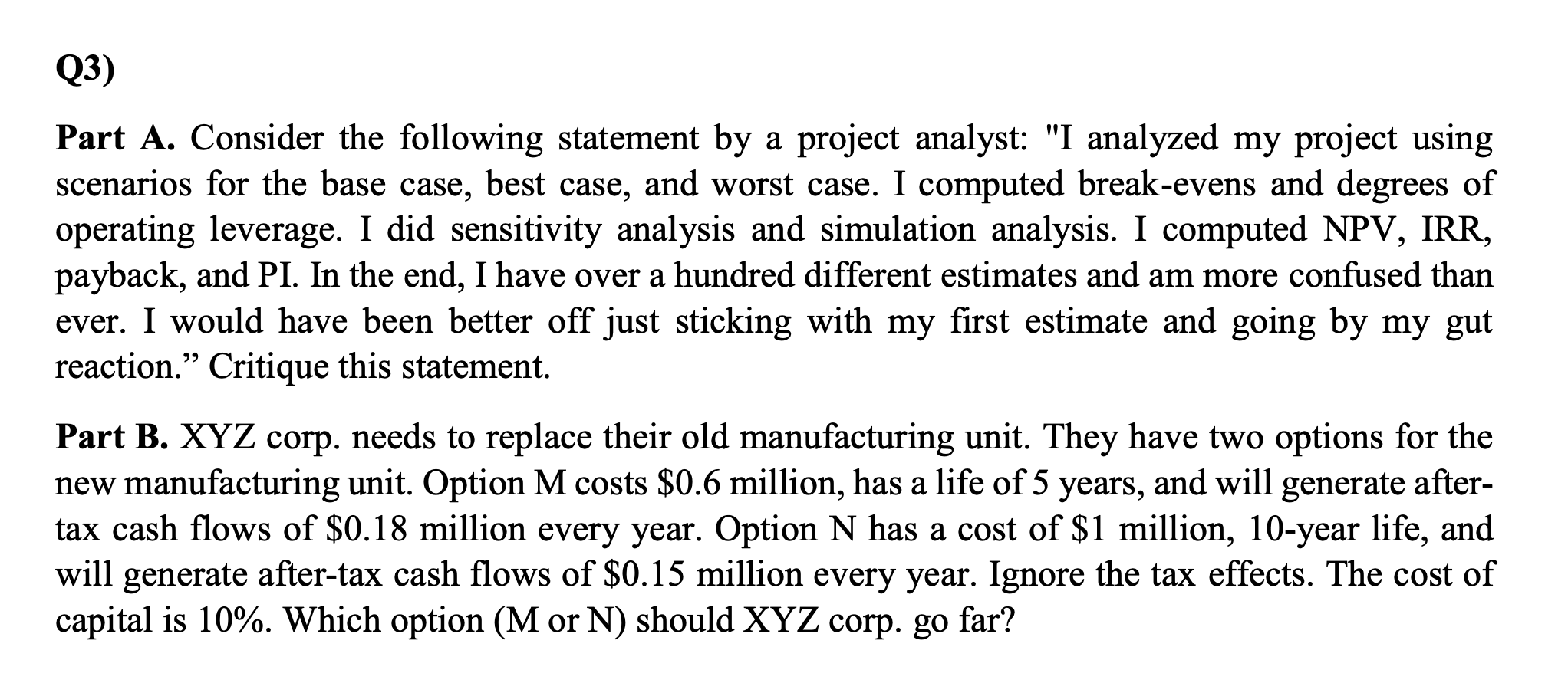

Part A. Consider the following statement by a project analyst: "I analyzed my project using scenarios for the base case, best case, and worst case. I computed break-evens and degrees of operating leverage. I did sensitivity analysis and simulation analysis. I computed NPV, IRR, payback, and PI. In the end, I have over a hundred different estimates and am more confused than ever. I would have been better off just sticking with my first estimate and going by my gut reaction." Critique this statement. Part B. XYZ corp. needs to replace their old manufacturing unit. They have two options for the new manufacturing unit. Option M costs $0.6 million, has a life of 5 years, and will generate aftertax cash flows of $0.18 million every year. Option N has a cost of $1 million, 10-year life, and will generate after-tax cash flows of $0.15 million every year. Ignore the tax effects. The cost of capital is 10%. Which option (M or N ) should XYZ corp. go far

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts