Question: Part A covers Consolidations concepts. Part B covers practical demonstration of annual report on corporate combinations. Through this assignment, students will gain practical skills in

Part A covers Consolidations concepts. Part B covers practical demonstration of annual report on corporate combinations. Through this assignment, students will gain practical skills in preparing consolidated financial statement & explore consolidated reporting by analysing financial statements of Lion & Pioneer and Westpac Banking group.

Part A:

Lion Ltd owns per cent of the shares of Pioneer Ltd acquired on July for $ million when the shareholders funds of Pioneer Ltd were:

$

Share capital

Retained earnings

All assets of Pioneer Ltd are fairly stated at acquisition date. The directors believe that there has been an impairment loss on the goodwill of $ for the year ended June

During the financial year, Pioneer Ltd sells inventory to Lion Ltd at a sale price of $ The inventory cost Pioneer Ltd $ to produce. At June half of the inventory is still on hand with Lion Ltd The tax rate is per cent.

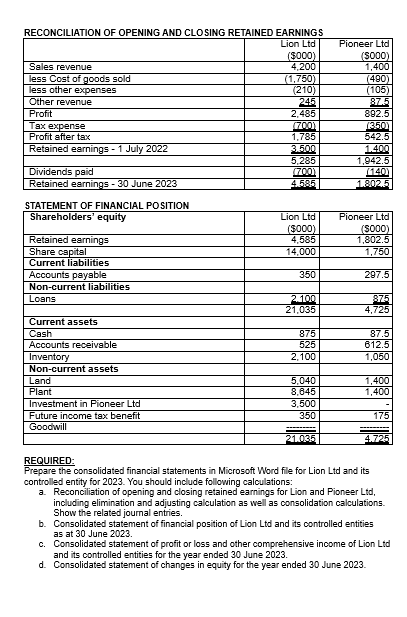

The financial statements of Lion Ltd and Pioneer Ltd at June are as follows:RECONCILIATION OF OPENING AND CLOSING RETAINED EARNINGS

STATEMENT OF FINANCIAL POSITION

REQUIRED:

Prepare the consolidated financial statements in Microsoft Word file for Lion Ltd and its

controlled entity for You should include following calculations:

a Reconciliation of opening and closing retained earnings for Lion and Pioneer Ltd

including elimination and adjusting calculation as well as consolidation calculations.

Show the related journal entries.

b Consolidated statement of financial position of Lion Ltd and its controlled entities

as at June

c Consolidated statement of profit or loss and other comprehensive income of Lion Ltd

and its controlled entities for the year ended June

d Consolidated statement of changes in equity for the year ended June

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock