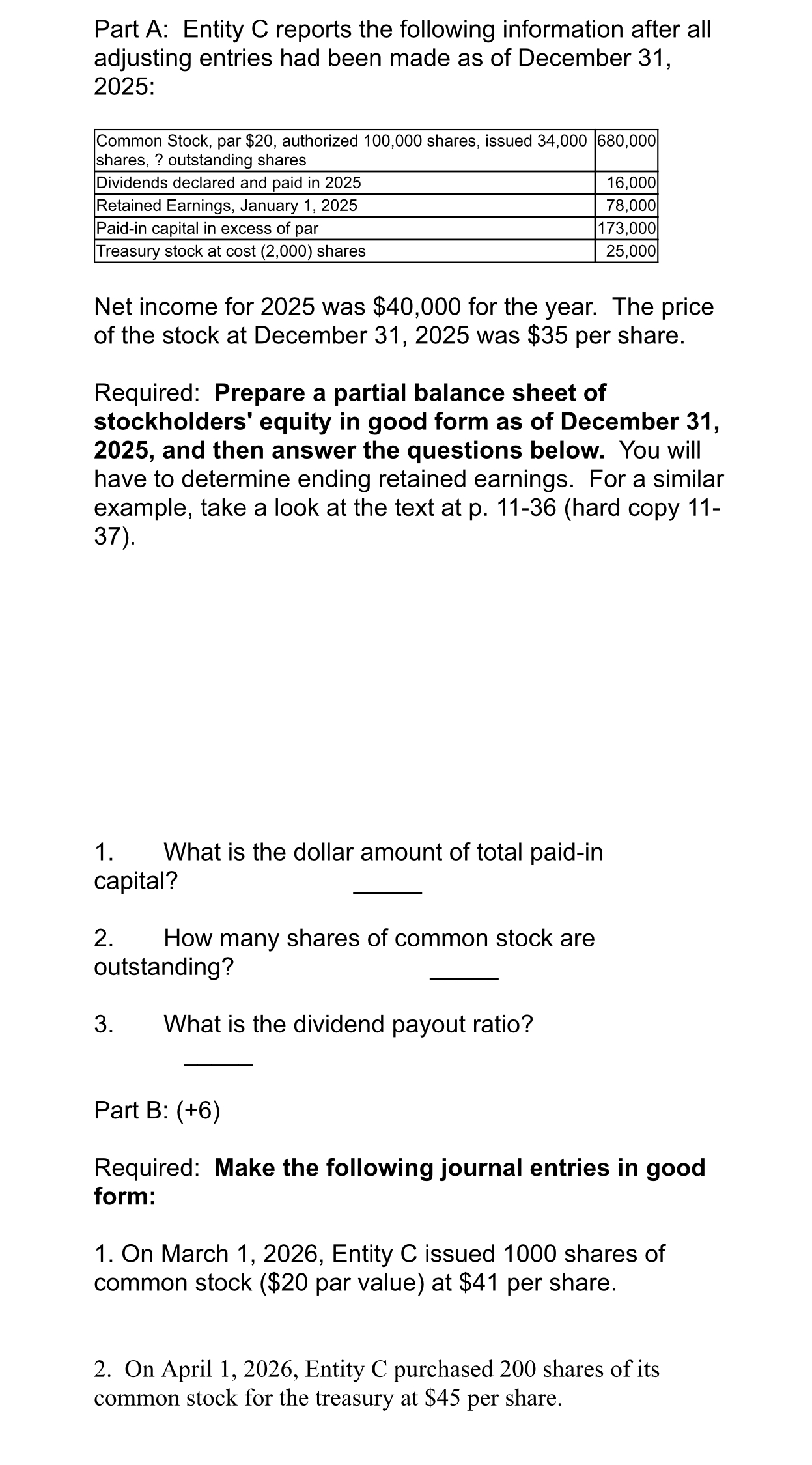

Question: Part A: Entity C reports the following information after all adjusting entries had been made as of December 3 1 , 2 0 2 5

Part A: Entity C reports the following information after all adjusting entries had been made as of December :

tabletableCommon Stock, par $ authorized shares, issued shares outstanding sharesDividends declared and paid in Retained Earnings, January Paidin capital in excess of par,Treasury stock at cost shares,

Net income for was $ for the year. The price of the stock at December was $ per share.

Required: Prepare a partial balance sheet of stockholders' equity in good form as of December and then answer the questions below. You will have to determine ending retained earnings. For a similar example, take a look at the text at phard copy

What is the dollar amount of total paidin capital?

How many shares of common stock are outstanding?

What is the dividend payout ratio?

Part B:

Required: Make the following journal entries in good form:

On March Entity C issued shares of common stock $ par value at $ per share.

On April Entity C purchased shares of its common stock for the treasury at $ per share.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock