Question: Part A : Entity J sold $1,000,000, five year, 5% bonds on January 1, 2022 for $980,000. The bonds pay interest on December 31. The

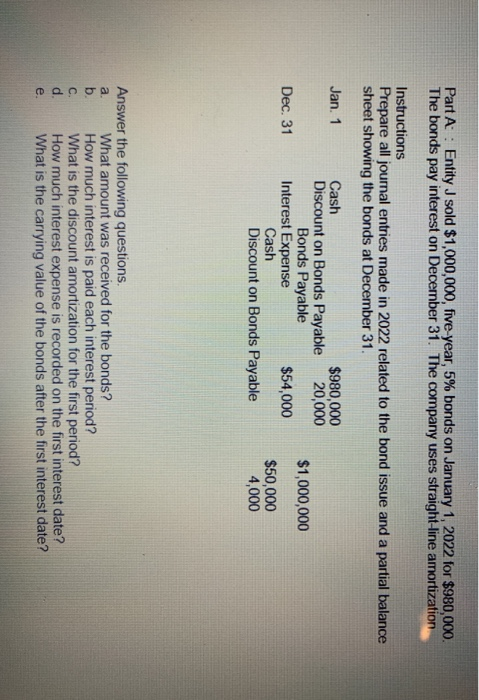

Part A : Entity J sold $1,000,000, five year, 5% bonds on January 1, 2022 for $980,000. The bonds pay interest on December 31. The company uses straight-line amortization Instructions Prepare all journal entries made in 2022 related to the bond issue and a partial balance sheet showing the bonds at December 31. Jan. 1 Cash $980,000 Discount on Bonds Payable 20,000 Bonds Payable Interest Expense $54,000 Cash Discount on Bonds Payable $1,000,000 Dec. 31 $50,000 4,000 Answer the following questions. What amount was received for the bonds? How much interest is paid each interest period? What is the discount amortization for the first period? How much interest expense is recorded on the first interest date? What is the carrying value of the bonds after the first interest date? DO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts