Question: part A is already solved just need Part B The S&P 500 Index is currently at 1,200. You manage a $24 million indexed equity portfolio.

part A is already solved just need Part B

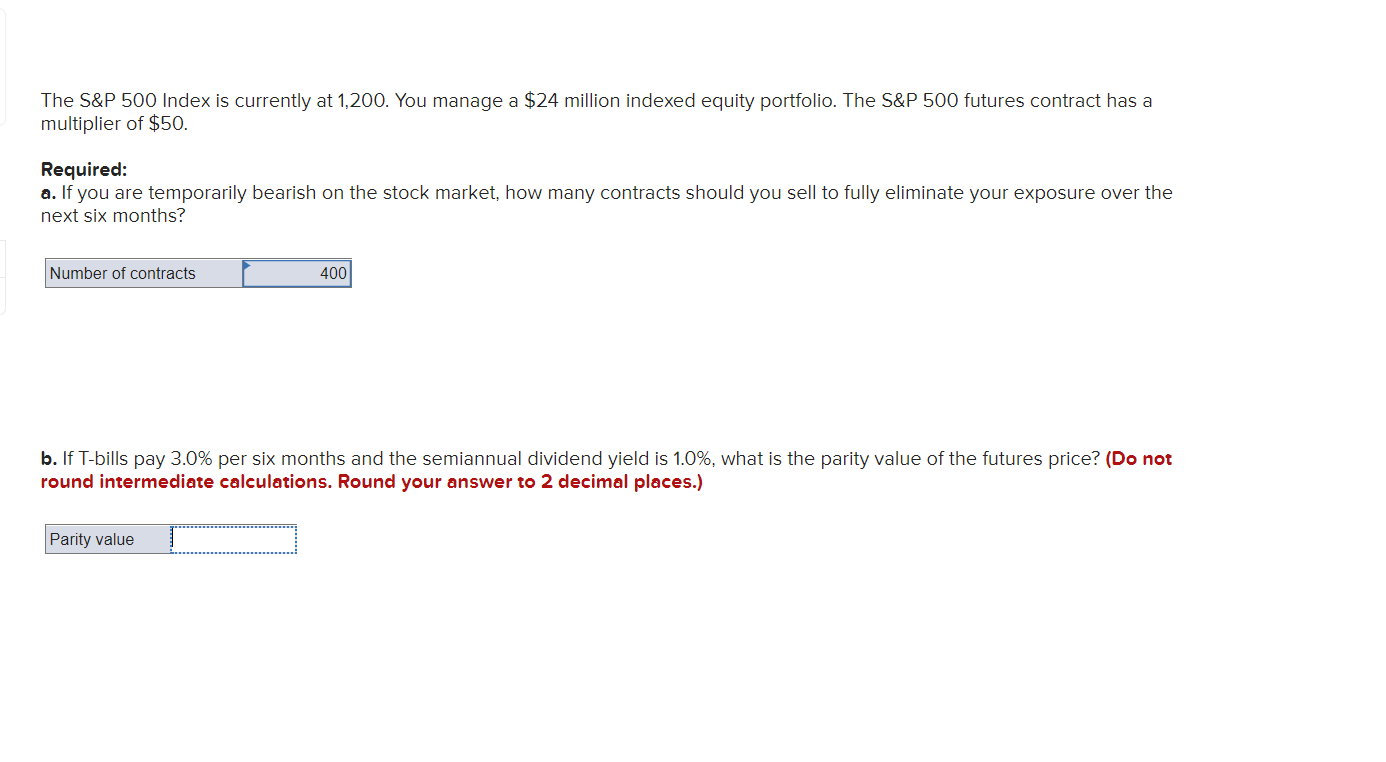

The S\&P 500 Index is currently at 1,200. You manage a $24 million indexed equity portfolio. The S\&P 500 futures contract has a multiplier of $50. Required: a. If you are temporarily bearish on the stock market, how many contracts should you sell to fully eliminate your exposure over the next six months? b. If T-bills pay 3.0% per six months and the semiannual dividend yield is 1.0%, what is the parity value of the futures price? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts