Question: part A is SOLVED already, need your help with part B, and C. thank you in advance! Concord is a licensed dentist. During the first

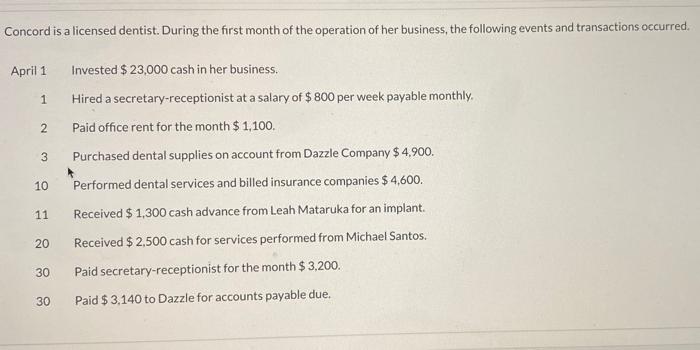

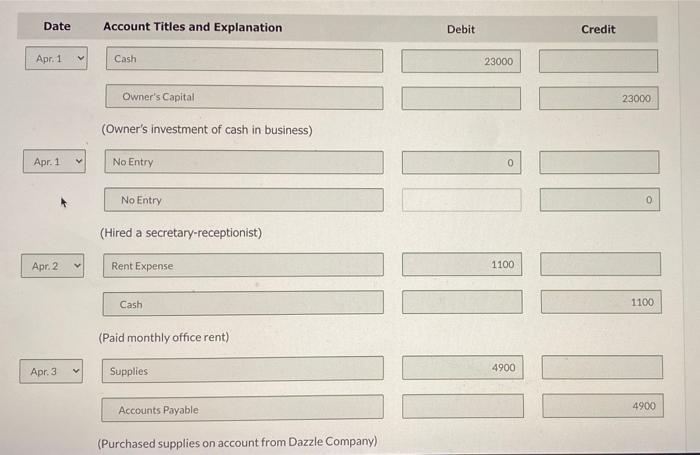

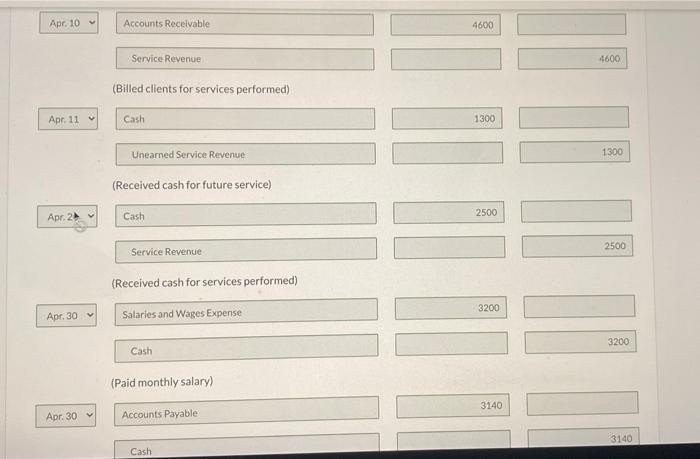

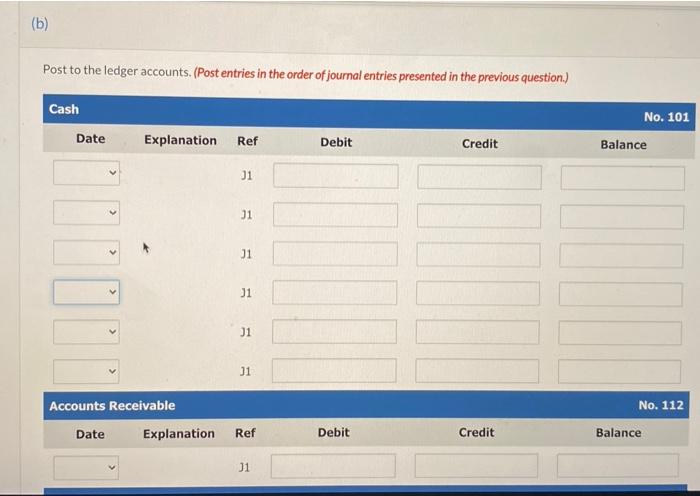

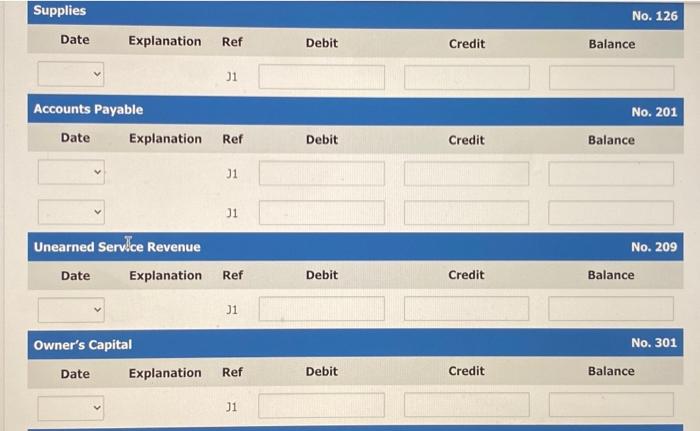

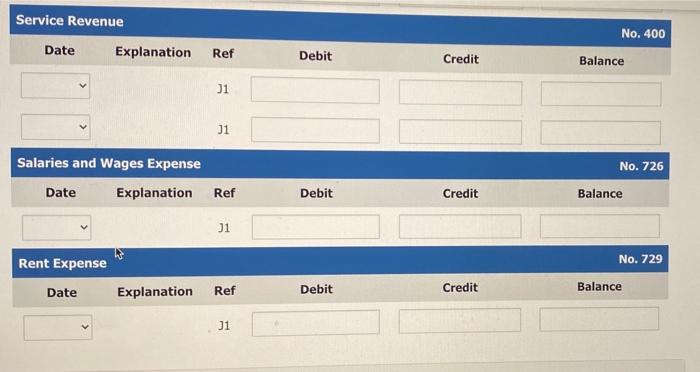

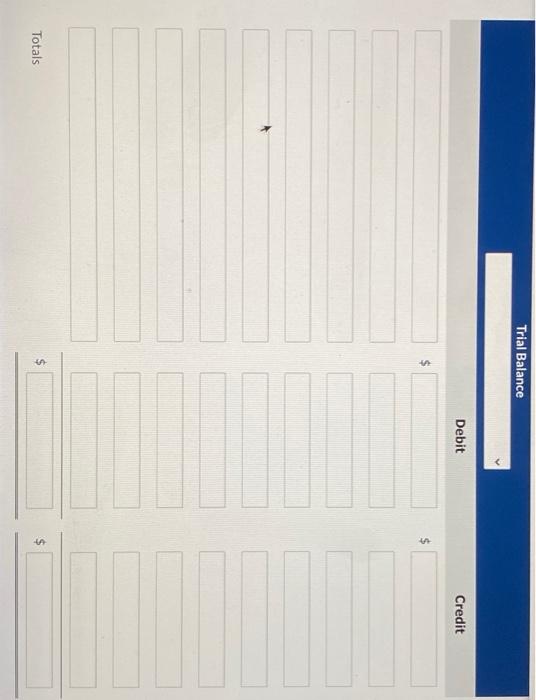

Concord is a licensed dentist. During the first month of the operation of her business, the following events and transactions occurred. April 1 1 2 3 Invested $ 23,000 cash in her business. Hired a secretary-receptionist at a salary of $ 800 per week payable monthly Paid office rent for the month $ 1,100. Purchased dental supplies on account from Dazzle Company $4.900. Performed dental services and billed insurance companies $4,600. Received $ 1,300 cash advance from Leah Mataruka for an implant. Received $ 2,500 cash for services performed from Michael Santos. 10 11 20 30 Paid secretary-receptionist for the month $3,200. 30 Paid $3,140 to Dazzle for accounts payable due. Date Account Titles and Explanation Debit Credit Apr. 1 Cash 23000 Owner's Capital 23000 (Owner's investment of cash in business) Apr. 1 No Entry 0 No Entry 0 (Hired a secretary-receptionist) Apr. 2 Rent Expense 1100 Cash 1100 (Paid monthly office rent) Apr. 3 Supplies 4900 Accounts Payable 4900 (Purchased supplies on account from Dazzle Company) Apr. 10 Accounts Receivable 4600 Service Revenue 4600 (Billed clients for services performed) Apr. 11 Cash 1300 Unearned Service Revenue 1300 (Received cash for future service) Apr. 2 Cash 2500 2500 Service Revenue (Received cash for services performed) 3200 Apr 30 Salaries and Wages Expense 3200 Cash (Paid monthly salary) 3140 Apr. 30 Accounts Payable 3140 Cash (b) Post to the ledger accounts. (Post entries in the order of journal entries presented in the previous question.) Cash No. 101 Date Explanation Ref Debit Credit Balance J1 J1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts