Question: part a: journalize the transactions and the closing entry for net income (c) Prepare a stockholders' equity section at December 31, 2022. (Enter the account

part a: journalize the transactions and the closing entry for net income

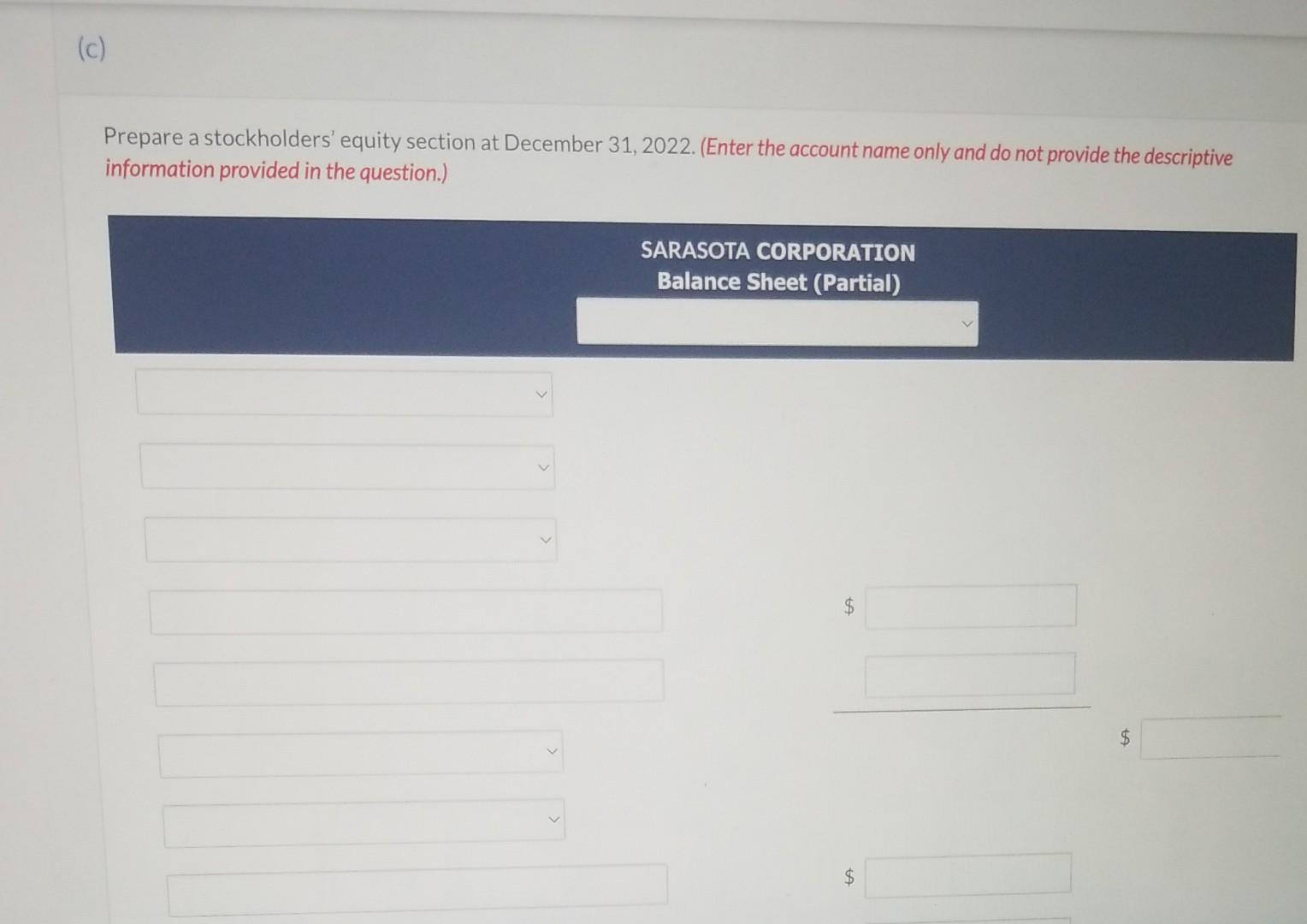

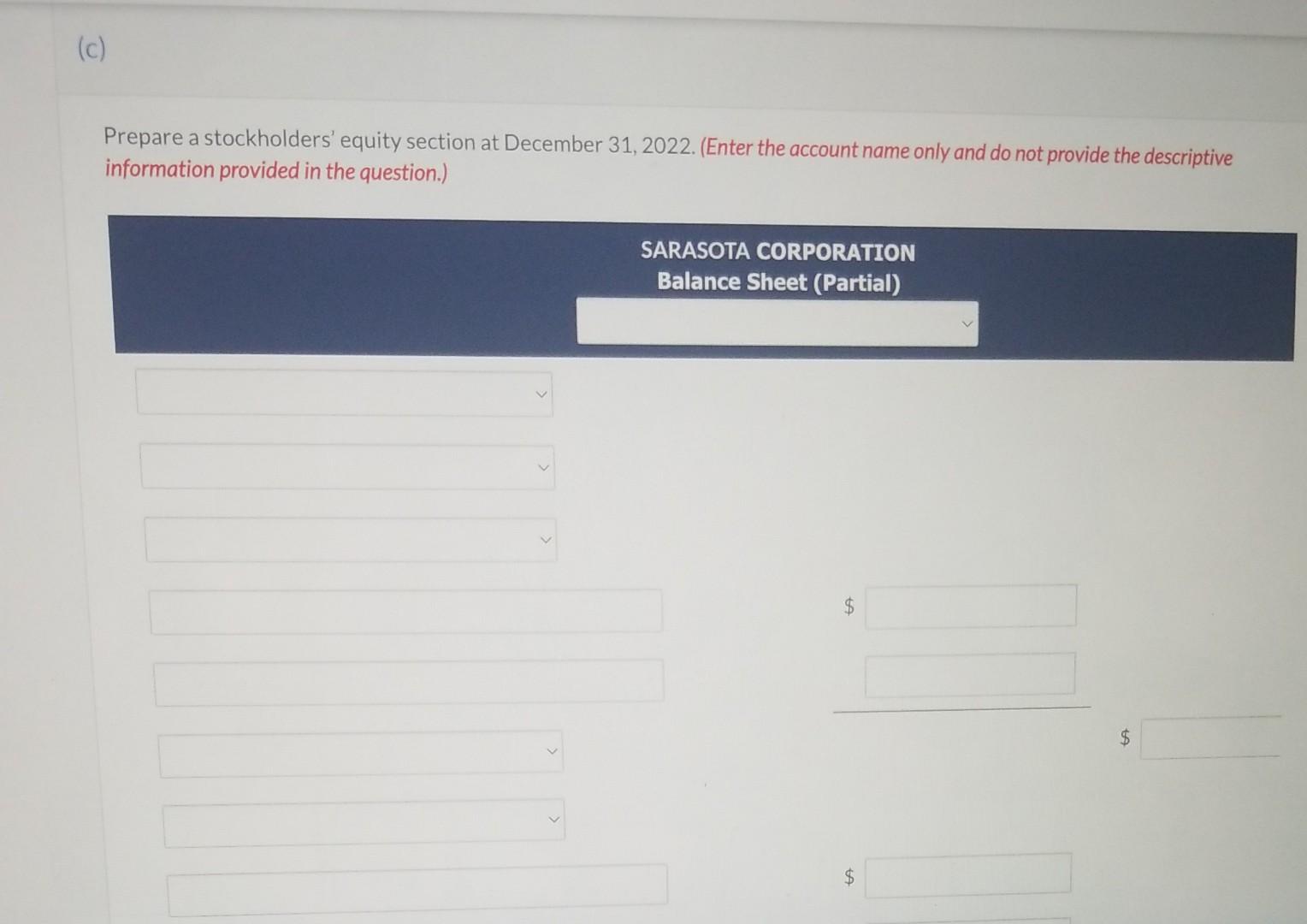

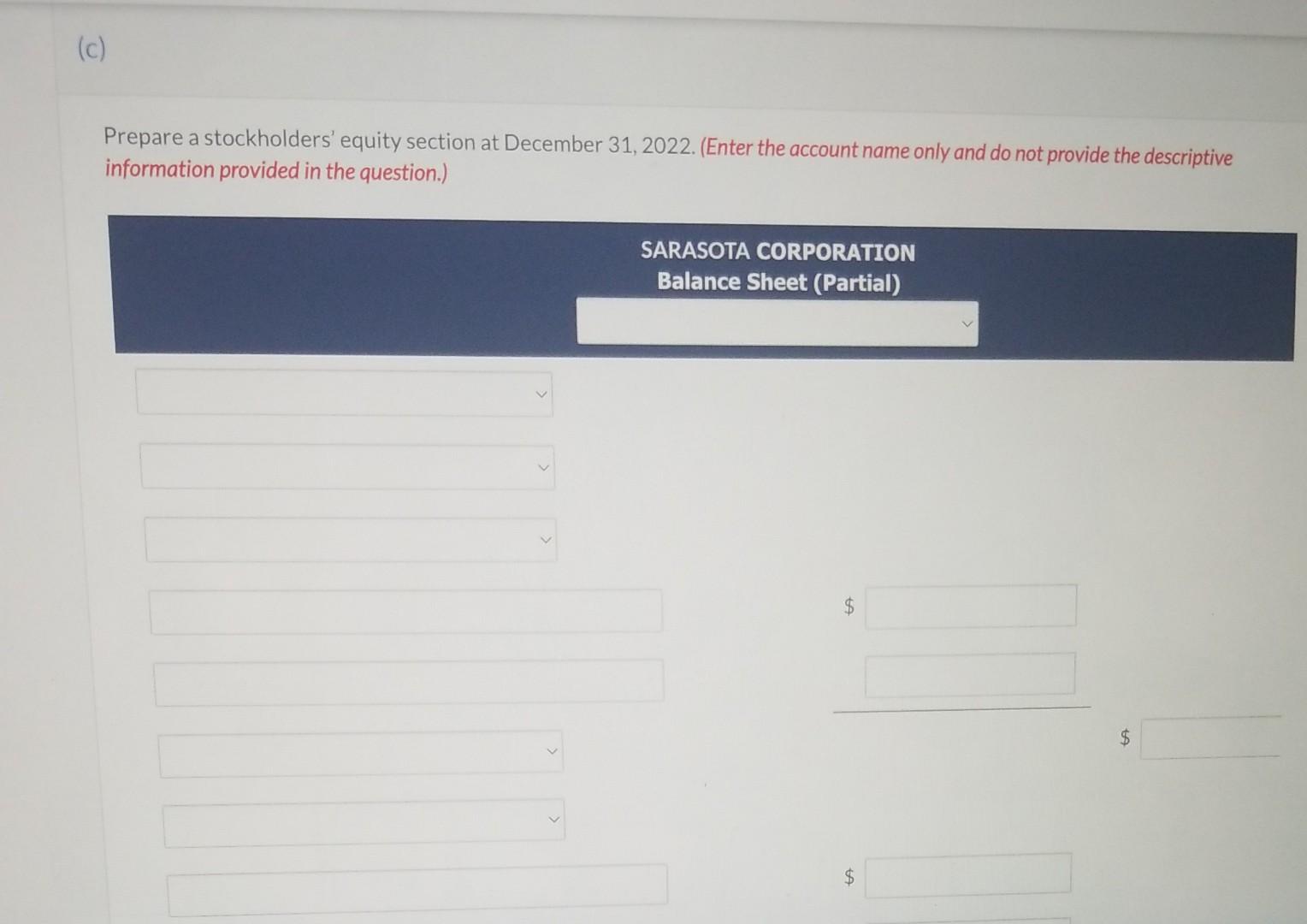

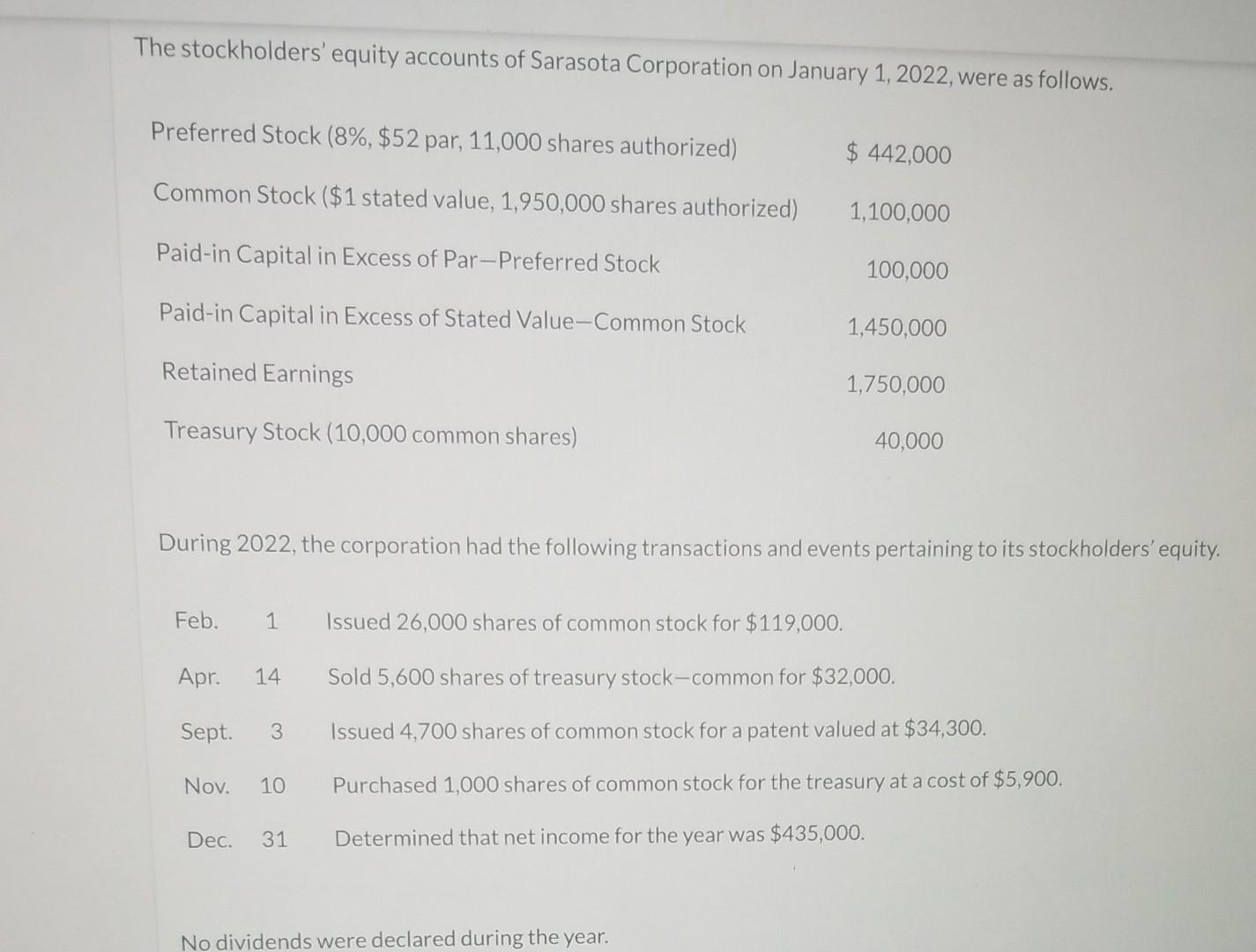

(c) Prepare a stockholders' equity section at December 31, 2022. (Enter the account name only and do not provide the descriptive information provided in the question.) SARASOTA CORPORATION Balance Sheet (Partial) $ LA $ (c) Prepare a stockholders' equity section at December 31, 2022. (Enter the account name only and do not provide the descriptive information provided in the question.) SARASOTA CORPORATION Balance Sheet (Partial) $ LA $ (c) Prepare a stockholders' equity section at December 31, 2022. (Enter the account name only and do not provide the descriptive information provided in the question.) SARASOTA CORPORATION Balance Sheet (Partial) $ LA $ The stockholders' equity accounts of Sarasota Corporation on January 1, 2022, were as follows. Preferred Stock (8%, $52 par, 11,000 shares authorized) $442,000 Common Stock ($1 stated value, 1,950,000 shares authorized) 1,100,000 Paid-in Capital in Excess of Par-Preferred Stock 100,000 Paid-in Capital in Excess of Stated Value-Common Stock 1,450,000 Retained Earnings 1,750,000 Treasury Stock (10,000 common shares) 40,000 During 2022, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Issued 26,000 shares of common stock for $119,000. Apr. 14 Sold 5,600 shares of treasury stock-common for $32,000. Sept. 3 Issued 4,700 shares of common stock for a patent valued at $34,300. Nov. 10 Purchased 1,000 shares of common stock for the treasury at a cost of $5,900. Dec. 31 Determined that net income for the year was $435,000. No dividends were declared during the year. (c) Prepare a stockholders' equity section at December 31, 2022. (Enter the account name only and do not provide the descriptive information provided in the question.) SARASOTA CORPORATION Balance Sheet (Partial) $ LA $ (c) Prepare a stockholders' equity section at December 31, 2022. (Enter the account name only and do not provide the descriptive information provided in the question.) SARASOTA CORPORATION Balance Sheet (Partial) $ LA $ (c) Prepare a stockholders' equity section at December 31, 2022. (Enter the account name only and do not provide the descriptive information provided in the question.) SARASOTA CORPORATION Balance Sheet (Partial) $ LA $ The stockholders' equity accounts of Sarasota Corporation on January 1, 2022, were as follows. Preferred Stock (8%, $52 par, 11,000 shares authorized) $442,000 Common Stock ($1 stated value, 1,950,000 shares authorized) 1,100,000 Paid-in Capital in Excess of Par-Preferred Stock 100,000 Paid-in Capital in Excess of Stated Value-Common Stock 1,450,000 Retained Earnings 1,750,000 Treasury Stock (10,000 common shares) 40,000 During 2022, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Issued 26,000 shares of common stock for $119,000. Apr. 14 Sold 5,600 shares of treasury stock-common for $32,000. Sept. 3 Issued 4,700 shares of common stock for a patent valued at $34,300. Nov. 10 Purchased 1,000 shares of common stock for the treasury at a cost of $5,900. Dec. 31 Determined that net income for the year was $435,000. No dividends were declared during the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts