Question: Part A L&T Company applies the Direct Write Off Method in accounting for uncollectible accounts. On February 12, 2021 the company determines that it cannot

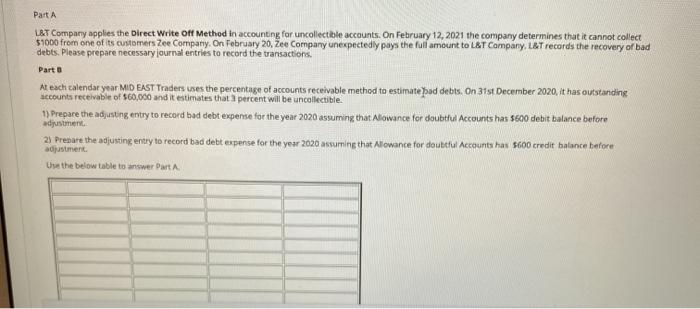

Part A L&T Company applies the Direct Write Off Method in accounting for uncollectible accounts. On February 12, 2021 the company determines that it cannot collect 51000 from one of its customers Zee Company on February 20, Zee Company unexpectedly pays the full amount to LAT Company, L&T records the recovery of bad debts. Please prepare necessary journal entries to record the transactions. Part 0 At each calendar year MID EAST Traders uses the percentage of accounts receivable method to estimate sud debts. On 31st December 2020, it has outstanding accounts receivable of $60,000 and it estimates that percent will be uncollectible. 3. Prepare the adjusting entry to record bad debt expense for the year 2020 assuming that Alowance for doubtful Accounts has $600 debit balance before adjustment 2) Prepare the adjusting entry to record bad debt expense for the year 2020 asumine that Allowance for dovettul Accounts has 500 credite balance before adjustment Use the below table to answer Part A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts