Question: Part A. Marshall Fields Company has a beginning inventory in year one of $1,400,000 and an ending inventory of $1,694,000. The price level has

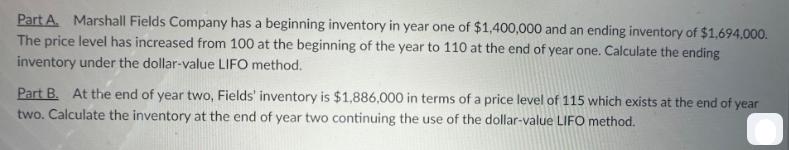

Part A. Marshall Fields Company has a beginning inventory in year one of $1,400,000 and an ending inventory of $1,694,000. The price level has increased from 100 at the beginning of the year to 110 at the end of year one. Calculate the ending inventory under the dollar-value LIFO method. Part B. At the end of year two, Fields' inventory is $1,886,000 in terms of a price level of 115 which exists at the end of year two. Calculate the inventory at the end of year two continuing the use of the dollar-value LIFO method.

Step by Step Solution

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Part A To calculate the ending inventory under the dollarvalue LIFO method well need to use the pric... View full answer

Get step-by-step solutions from verified subject matter experts