Question: PART A - MULTIPLE CHOICE QUESTIONS (2 MARKS EACH) 1. A company buys a new machine costing 10,000. If the depreciation rate was determined to

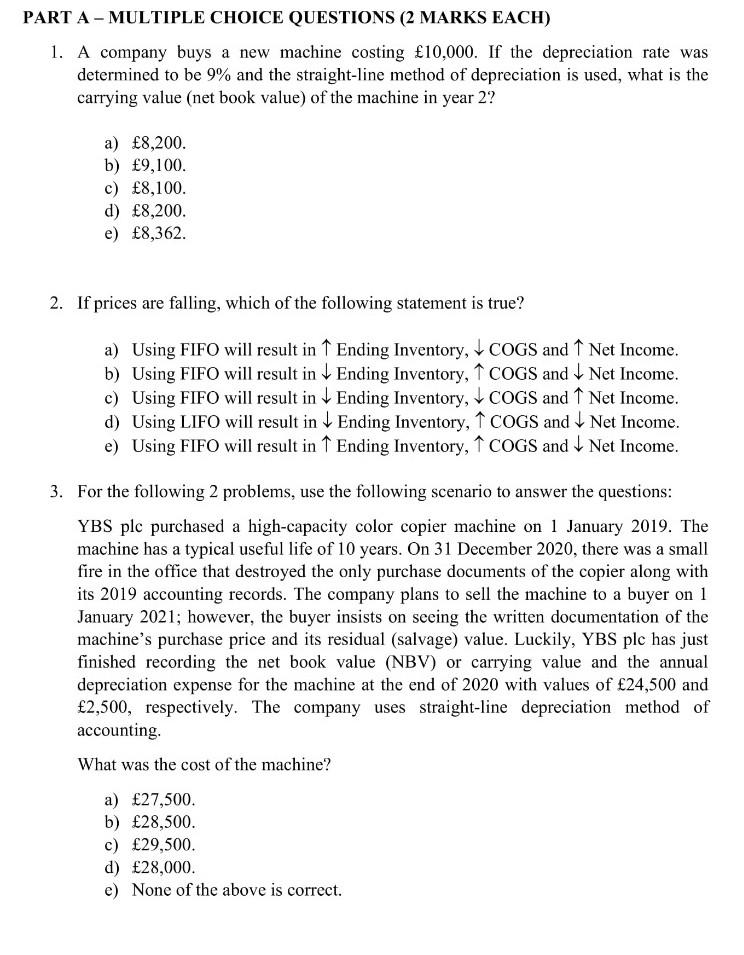

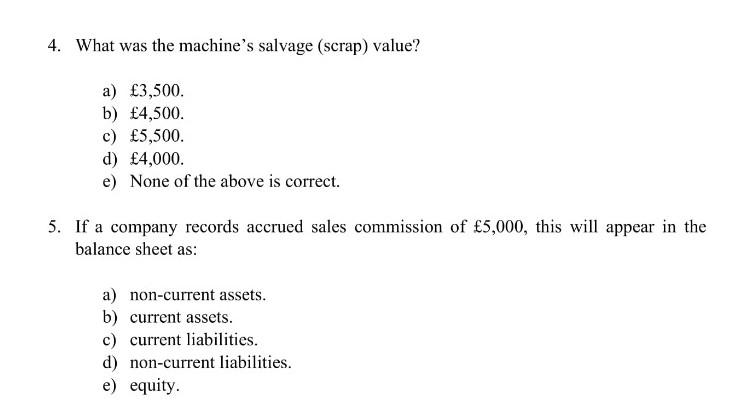

PART A - MULTIPLE CHOICE QUESTIONS (2 MARKS EACH) 1. A company buys a new machine costing 10,000. If the depreciation rate was determined to be 9% and the straight-line method of depreciation is used, what is the carrying value (net book value) of the machine in year 2? a) 8,200. b) 9,100. c) 8,100. d) 8,200. e) 8,362. 2. If prices are falling, which of the following statement is true? a) Using FIFO will result in 1 Ending Inventory, COGS and 1 Net Income. b) Using FIFO will result in Ending Inventory, 1 COGS and Net Income. c) Using FIFO will result in Ending Inventory, COGS and 1 Net Income. d) Using LIFO will result in Ending Inventory, 1 COGS and Net Income. e) Using FIFO will result in 1 Ending Inventory, 7 COGS and Net Income. 3. For the following 2 problems, use the following scenario to answer the questions: YBS plc purchased a high-capacity color copier machine on 1 January 2019. The machine has a typical useful life of 10 years. On 31 December 2020, there was a small fire in the office that destroyed the only purchase documents of the copier along with its 2019 accounting records. The company plans to sell the machine to a buyer on 1 January 2021; however, the buyer insists on seeing the written documentation of the machine's purchase price and its residual (salvage) value. Luckily, YBS plc has just finished recording the net book value (NBV) or carrying value and the annual depreciation expense for the machine at the end of 2020 with values of 24,500 and 2,500, respectively. The company uses straight-line depreciation method of accounting What was the cost of the machine? a) 27,500. b) 28,500. c) 29,500. d) 28,000. e) None of the above is correct. 4. What was the machine's salvage (scrap) value? a) 3,500. b) 4,500. c) 5,500 d) 4,000. e) None of the above is correct. 5. If a company records accrued sales commission of 5,000, this will appear in the balance sheet as: a) non-current assets. b) current assets. c) current liabilities. d) non-current liabilities. e) equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts