Question: PART A: Multiple-Choice Questions (14 marks) 1. SIMTech analysed the relationship between total factory overhead and changes in direct labour hours. It found the following:

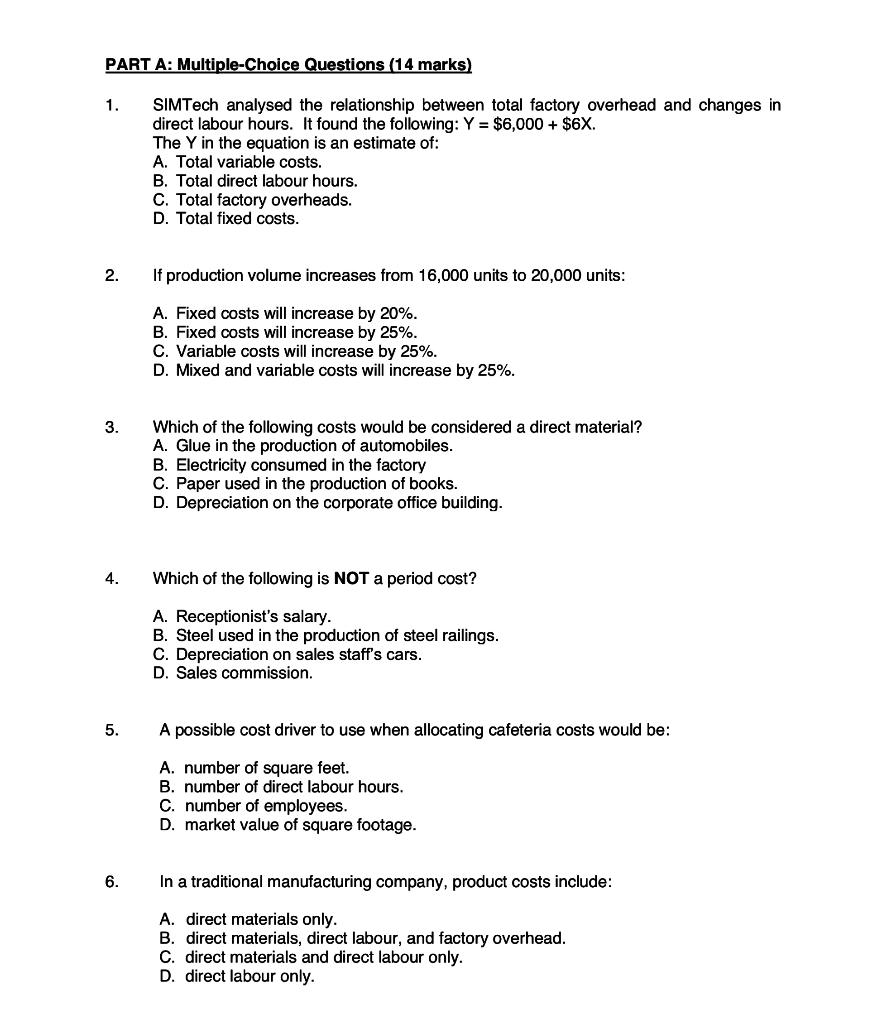

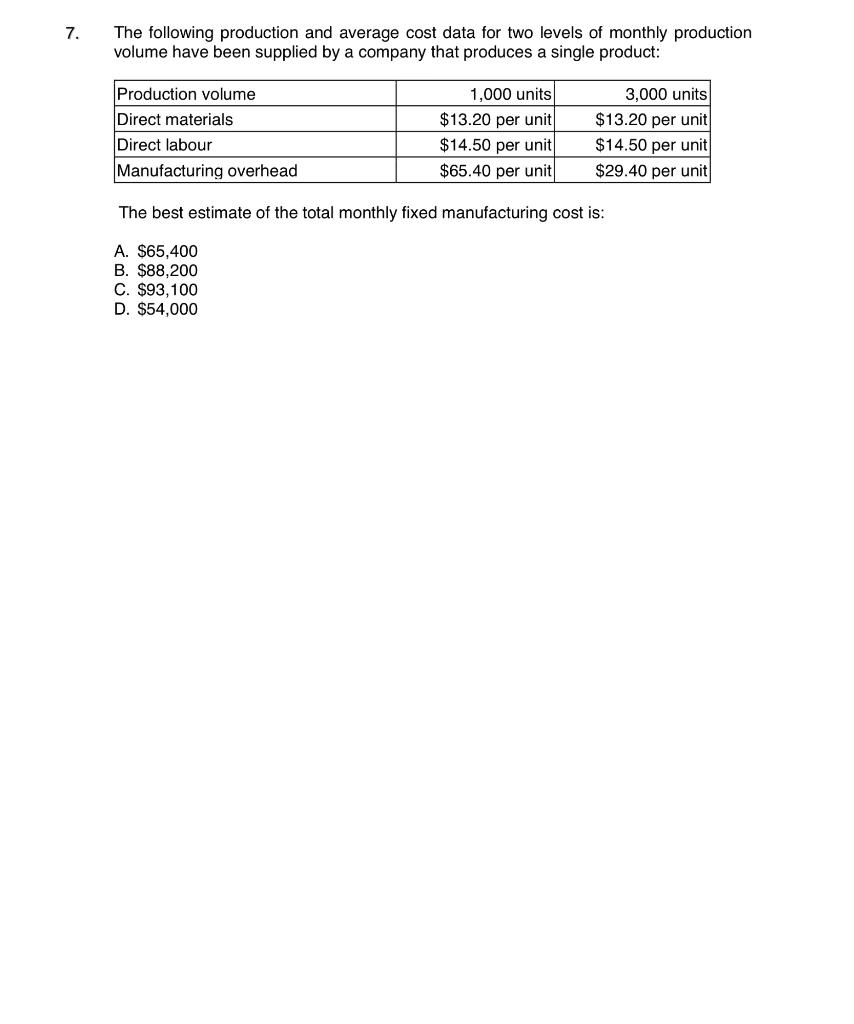

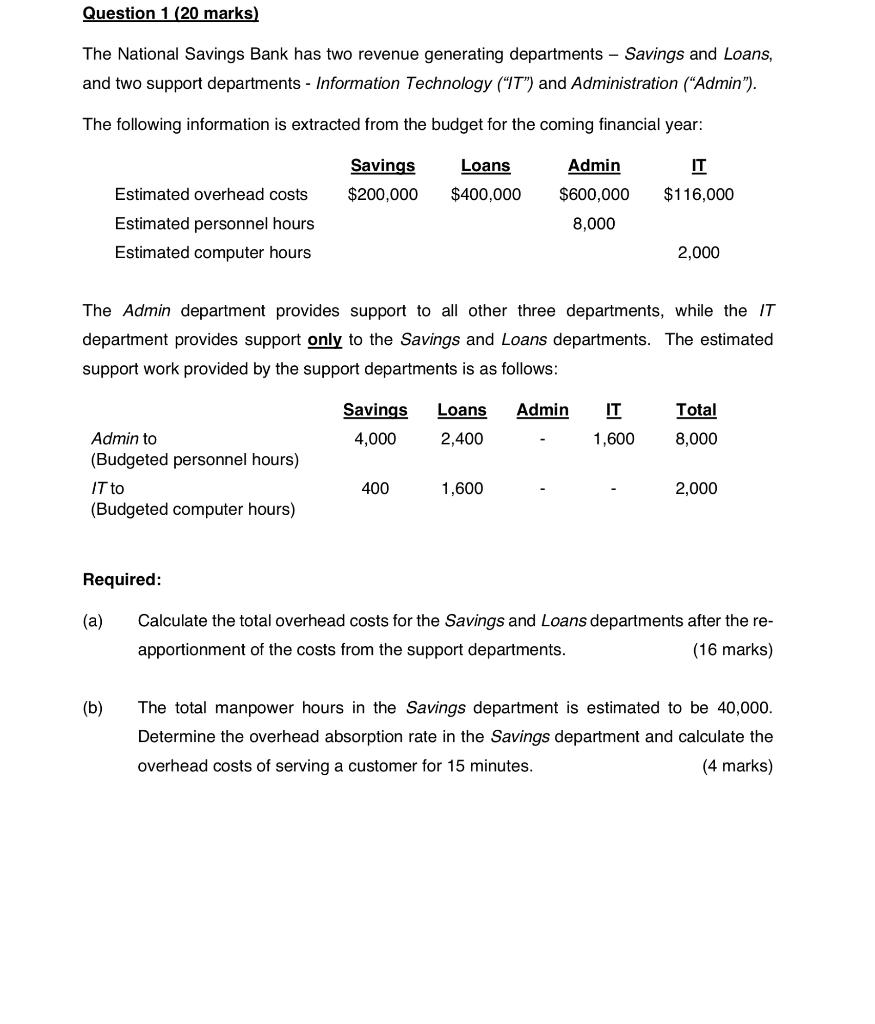

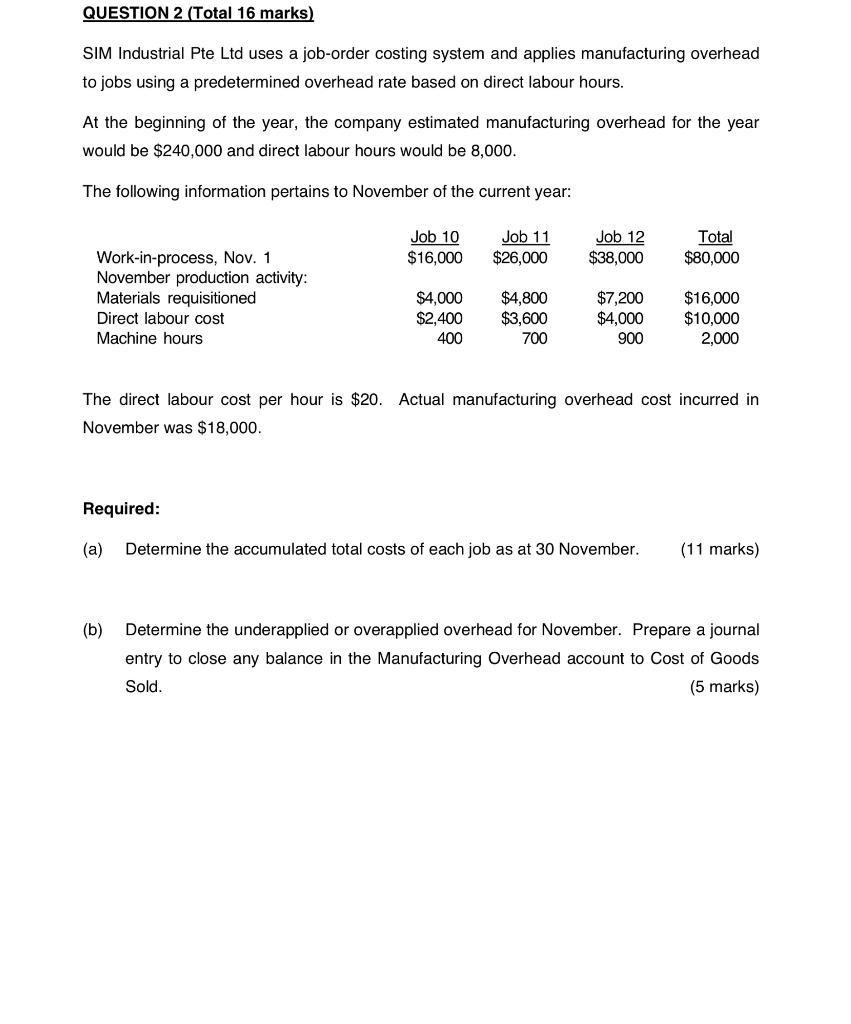

PART A: Multiple-Choice Questions (14 marks) 1. SIMTech analysed the relationship between total factory overhead and changes in direct labour hours. It found the following: Y = $6,000+ $6X. The Y in the equation is an estimate of: A. Total variable costs. B. Total direct labour hours. C. Total factory overheads. D. Total fixed costs. 2. If production volume increases from 16,000 units to 20,000 units: A. Fixed costs will increase by 20%. B. Fixed costs will increase by 25%. C. Variable costs will increase by 25%. D. Mixed and variable costs will increase by 25%. 3. Which of the following costs would be considered a direct material? A. Glue in the production of automobiles. B. Electricity consumed in the factory C. Paper used in the production of books. D. Depreciation on the corporate office building. 4. Which of the following is NOT a period cost? A. Receptionist's salary. B. Steel used in the production of steel railings. C. Depreciation on sales staff's cars. D. Sales commission. 5. A possible cost driver to use when allocating cafeteria costs would be: A. number of square feet. B. number of direct labour hours. C. number of employees. D. market value of square footage. 6. In a traditional manufacturing company, product costs include: A. direct materials only. B. direct materials, direct labour, and factory overhead. C. direct materials and direct labour only. D. direct labour only. 7. The following production and average cost data for two levels of monthly production volume have been supplied by a company that produces a single product: Production volume Direct materials Direct labour Manufacturing overhead 1,000 units $13.20 per unit $14.50 per unit $65.40 per unit 3,000 units $13.20 per unit $14.50 per unit $29.40 per unit The best estimate of the total monthly fixed manufacturing cost is: A. $65,400 B. $88,200 C. $93, 100 D. $54,000 Question 1 (20 marks) The National Savings Bank has two revenue generating departments - Savings and Loans, and two support departments - Information Technology ("IT") and Administration ("Admin"). The following information is extracted from the budget for the coming financial year: Savings Admin IT Loans $400,000 Estimated overhead costs $200,000 $600,000 $116,000 8,000 Estimated personnel hours Estimated computer hours 2,000 The Admin department provides support to all other three departments, while the IT department provides support only to the Savings and Loans departments. The estimated support work provided by the support departments is as follows: Savings Loans Admin IT Total 4,000 2,400 1,600 8,000 Admin to (Budgeted personnel hours) IT to (Budgeted computer hours) 400 1,600 2,000 Required: (a) Calculate the total overhead costs for the Savings and Loans departments after the re- apportionment of the costs from the support departments. (16 marks) (b) The total manpower hours in the Savings department is estimated to be 40,000. Determine the overhead absorption rate in the Savings department and calculate the overhead costs of serving a customer for 15 minutes. (4 marks) QUESTION 2 (Total 16 marks) SIM Industrial Pte Ltd uses a job-order costing system and applies manufacturing overhead to jobs using a predetermined overhead rate based on direct labour hours. At the beginning of the year, the company estimated manufacturing overhead for the year would be $240,000 and direct labour hours would be 8,000. The following information pertains to November of the current year: Total Job 10 $ 16,000 Job 11 $26,000 Job 12 $38,000 $80,000 Work-in-process, Nov. 1 November production activity: Materials requisitioned Direct labour cost Machine hours $4,000 $2,400 400 $4,800 $3,600 700 $7,200 $4,000 900 $16,000 $10,000 2.000 The direct labour cost per hour is $20. Actual manufacturing overhead cost incurred in November was $18,000. Required: (a) Determine the accumulated total costs of each job as at 30 November. (11 marks) (b) Determine the underapplied or overapplied overhead for November. Prepare a journal entry to close any balance in the Manufacturing Overhead account to Cost of Goods Sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts