Question: Part A openvellur secure https//www.mathxl.com/Student/PlayerTest aspx?TestResult 6238271798ireview ayes, Summer 2017: In termediate Accounting ting Lab. Review Test: Chapter 5 Post-Test Score: 0.5 of 1 pt

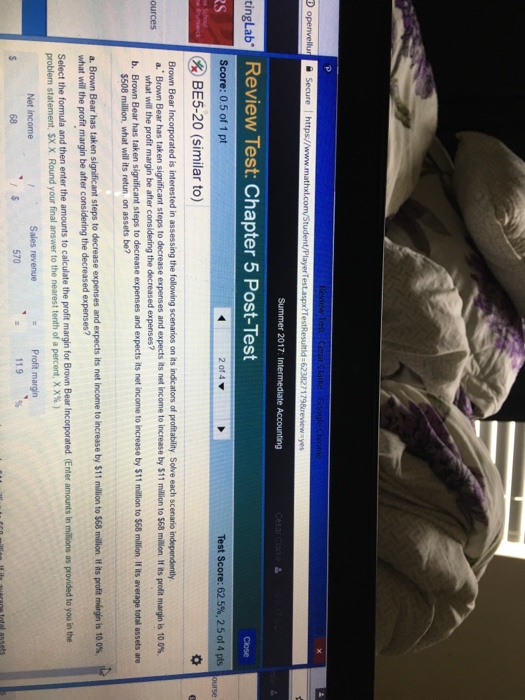

openvellur secure https//www.mathxl.com/Student/PlayerTest aspx?TestResult 6238271798ireview ayes, Summer 2017: In termediate Accounting ting Lab. Review Test: Chapter 5 Post-Test Score: 0.5 of 1 pt 2 of 4 Test Score: 62.5%, 2.5 of 4 pts BE5-20 (similar to) Brown Bear Incorporated is interested in assessing the following scenarios on its indicators of profitability. Solve each scenario independently a." Brown Bear has taken significant steps to decrease expenses and expects its net income to increase by $11 million to $68 milion If its profit margin is 10.0%, what will the profit margin be after considering the decreased expenses? b. Brown has taken significant steps to decrease expenses and expects its net income to increase by s11milion to S68 million lits average total assets are million, what its on a. Brown Bear has taken significant steps to decrease expenses and expects its net income to increase by $11 million to $68 million. If its profit mirgin is 10.0%, what will the profit margin be after considering the decreased expenses? Select the formula and then enter the amounts to calculate the profit margin for Brown Bear Incorporated (Enter amounts in milions as provided to you in the problem statement, SX x Round your final answer to the nearest tenth of a percent XX%) Profit margin Sales revenue 119

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts