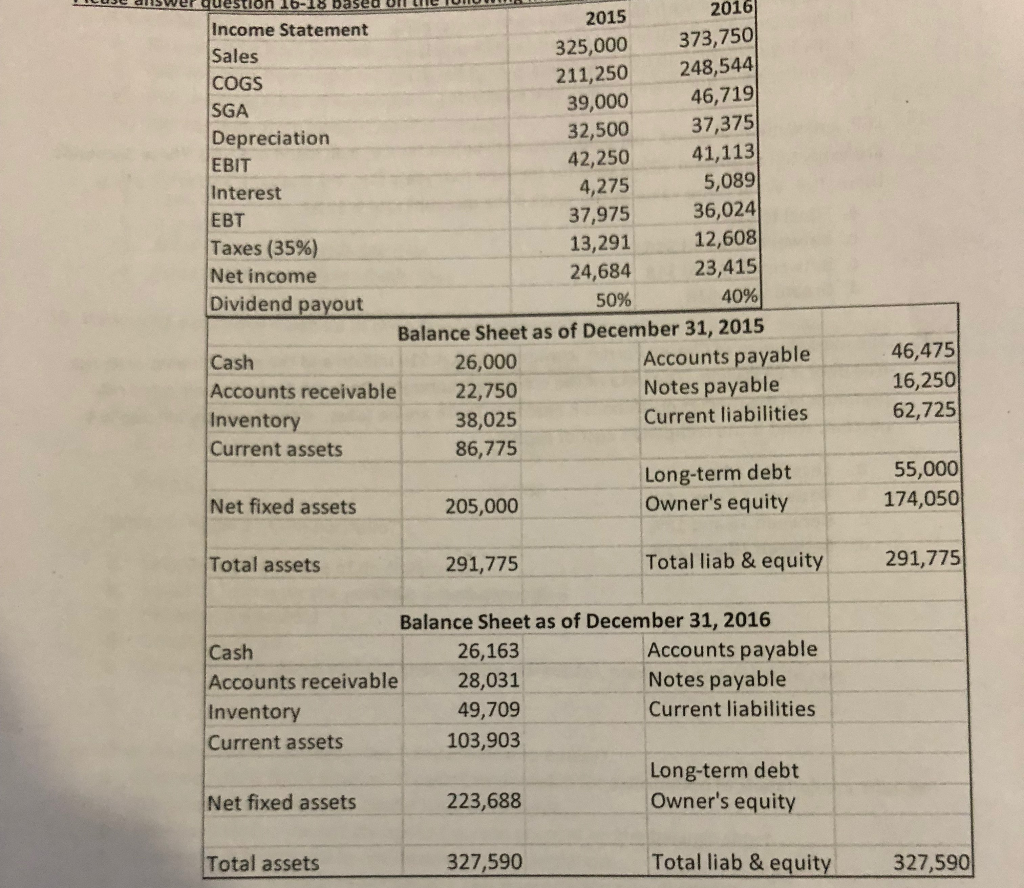

Question: Part A) Operating cash flow for 2016 is? a) less than $61,000 b) between $61,000-63,000 c) between $63,000-64,000 d) over $64,000 B) What is the

Part A)

Operating cash flow for 2016 is?

a) less than $61,000

b) between $61,000-63,000

c) between $63,000-64,000

d) over $64,000

B) What is the owners equity for 2016?

a)less than $185,000

b) between $185,000 and $190,000

c) between $190,000 and $195,000

d) greater than $195,000

C) ROE for William Widget Inc. in 2016 is?

a) less than 10%

b) 10-15%

c) 20-25%

d) over 25%

2016 2015 Income Statement Sales COGS SGA Depreciation EBIT Interest EBT Taxes (35%) Net income Dividend payout 325,000 373,750 211,250 248,544 46,719 37,375 42,250 41,113 5,089 39,000 32,500 4,275 37,975 36,024 3,291 12,608 24,684 23,415 50% Balance Sheet as of December 31, 2015 Cash Accounts receivable22,750 Inventory Current assets Accounts payable Notes payable Current liabilities62,725 46,475 16,250 26,000 38,025 86,775 205,000 291,775 Long-term debt Owner's equity 55,000 174,050 Net fixed assets Total assets Total liab&equity 291,775 Balance Sheet as of December 31, 2016 26,163 Accounts receivable 28,031 49,709 103,903 Accounts payable Notes payable Current liabilities Cash Inventory Current assets Long-term debt Owner's equity Net fixed assets 223,688 Total assets 327,590 Total liab & equity 327,590

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts