Question: Part A : Part B: Auditors consider financial statement assertions to identify appropriate audit procedures. For items a through I match each assertion with the

Part A :

Part B:

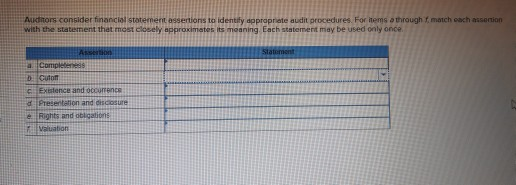

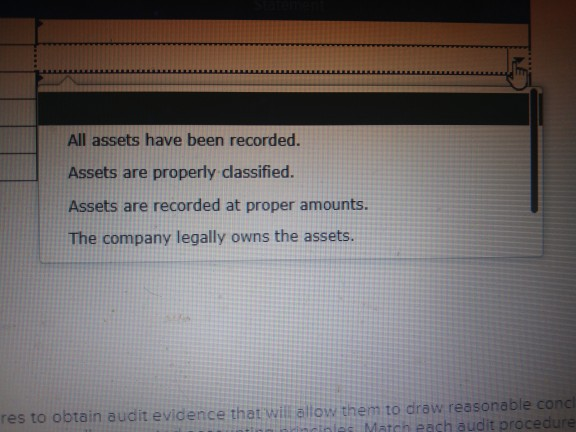

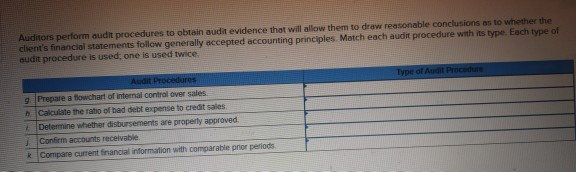

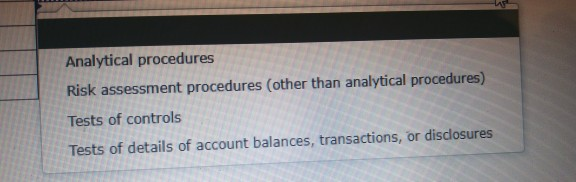

Auditors consider financial statement assertions to identify appropriate audit procedures. For items a through I match each assertion with the statement that most closely approximates its meaning Each statement may be used only once HET All assets have been recorded. Assets are properly classified. Assets are recorded at proper amounts. The company legally owns the assets. es to obtain audit evidence that will allow them to draw reasonable cong inn inniles Match pach audit procedure Auditors perform audit procedures to obtain audit evidence that will allow them to draw reasonable conclusions as to whether the clients financial statements follow generally accepted accounting principles Match each audit procedure with its type. Each type of audit procedure is used, one is used twice Audit Procedures Prepare a flowchart of internal control over sales Calculate the ratio of bad debit expense to credit sales Determine whether disbursements are properly approved Confirm accounts receivable Compare current financial information with comparable prior periods Analytical procedures Risk assessment procedures (other than analytical procedures) Tests of controls Tests of details of account balances, transactions, or disclosures

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts