Question: PART A PART B Part A During its first year of operations, the McCollum Corporation entered into the following transactions relating to shareholders' equity. The

PART A

PART B

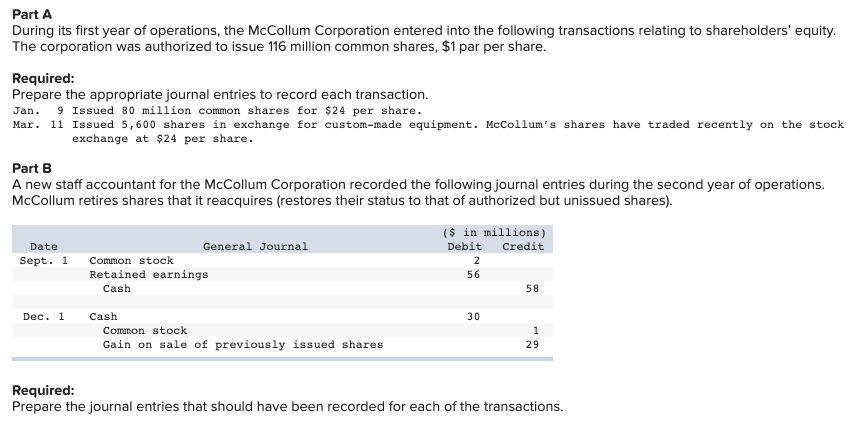

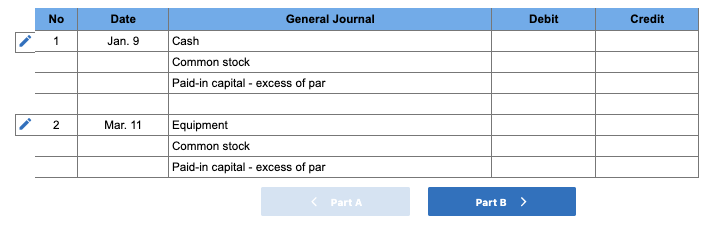

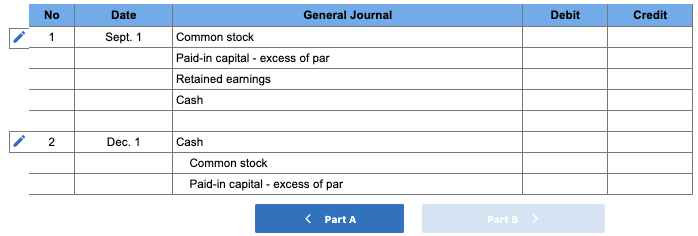

Part A During its first year of operations, the McCollum Corporation entered into the following transactions relating to shareholders' equity. The corporation was authorized to issue 116 million common shares, $1 par per share. Required: Prepare the appropriate journal entries to record each transaction. Jan. 9 Issued 80 million common shares for $24 per share. Mar. 11 Issued 5,600 shares in exchange for custom-made equipment. McCollum's shares have traded recently on the stock exchange at $24 per share. Part B A new staff accountant for the McCollum Corporation recorded the following journal entries during the second year of operations. McCollum retires shares that it reacquires (restores their status to that of authorized but unissued shares). ($ in millions) Debit Credit Date Sept. 1 2 General Journal Common stock Retained earnings Cash 56 58 Dec. 1 Cash Common stock Gain on sale of previously issued shares Required: Prepare the journal entries that should have been recorded for each of the transactions. No Date Debit Credit 1 Jan. 9 General Journal Cash Common stock Paid-in capital - excess of par 2 Mar. 11 Equipment Common stock Paid-in capital - excess of par

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts