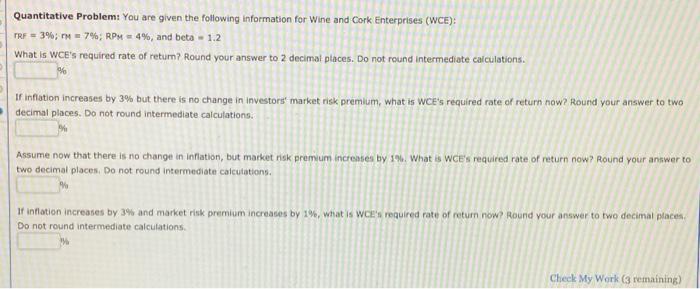

Question: Part A Part B Part A Part B Quantitative Problem: You are given the following information for Wine and Cork Enterprises (WCE): TRF = 3%;

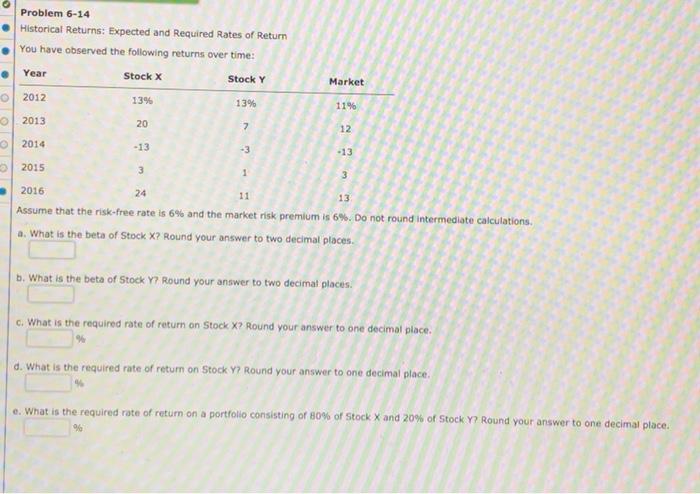

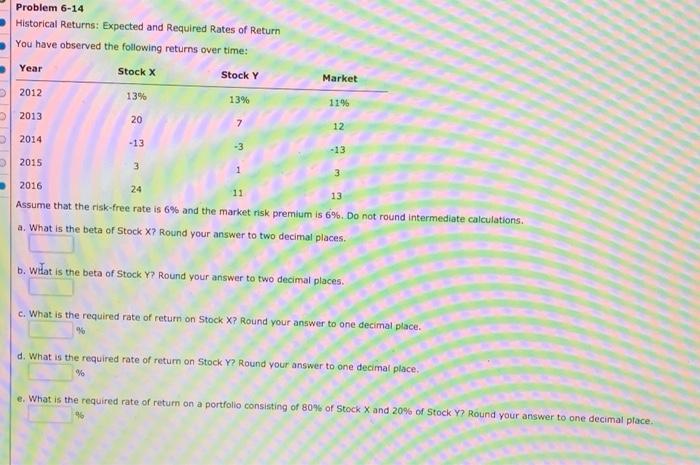

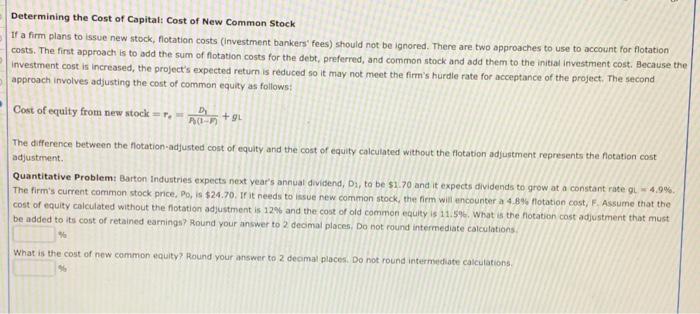

Quantitative Problem: You are given the following information for Wine and Cork Enterprises (WCE): TRF = 3%; H = 7%, RPH 4%, and beta - 1.2 What Is WCE's required rate of retum? Round your answer to 2 decimal places. Do not round Intermediate calculations. % If Inflation increases by 3% but there is no change in investors' market risk premium, what is WCE's required rate of return now? Round your answer to two decimal places. Do not round intermediate calculations. Assume now that there is no change in Inflation, but market risk premium increases by 196. What is ces required rate of return now? Round your answer to two decimal places. Do not round intermediate calculations If inflation increases by 3% and market riuk premium increases by 1%, what is WCE's required rate of cetum now? Round your answer to two decimal places Do not round intermediate calculations Check My Work (3 remaining) Problem 6-14 Historical Returns: Expected and Required Rates of Return You have observed the following returns over time: . Year Stock X Stock Y o 2012 13% 13% Market 11% 2013 20 7 12 -13 -3 2014 2015 -13 3 1 3 2016 24 11 13 Assume that the risk-free rate is 6% and the market risk premium is 6%. Do not round intermediate calculations. a. What is the beta of Stock X7 Round your answer to two decimal places. b. What is the beta of Stock Y? Round your answer to two decimal places. c. What is the required rate of return on Stock X? Round your answer to one decimal place d. What is the required rate of return on Stock Y? Round your answer to one decimal place. e. What is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y? Round your answer to one decimal place. % Problem 6-14 Historical Returns: Expected and Required Rates of Return You have observed the following returns over time: Year Stock X Stock Y Market 2012 13% 13% 119 2013 20 7 12 2014 -13 -3 -13 2015 3 1 3 2016 24 11 13 Assume that the risk-free rate is 6% and the market risk premium is 6%. Do not round intermediate calculations. a. What is the beta of Stock X? Round your answer to two decimal places. b. Wilat is the beta of Stock Y? Round your answer to two decimal places. c. What is the required rate of return on Stock X? Round your answer to one decimal place. d. What is the required rate of return on Stock Y? Round your answer to one decimal place. % e. What is the required rate of return on a portfolio consisting of 80% of Stock X and 20% of Stock Y? Round your answer to one decimal place. Determining the cost of Capital: Cost of New Common Stock If a firm plans to issue new stock, flotation costs (Investment bankers' fees) should not be ignored. There are two approaches to use to account for flotation costs. The first approach is to add the sum of flotation costs for the debt, preferred, and common stock and add them to the initial investment cost. Because the Investment cost is increased, the project's expected return is reduced so it may not meet the firm's hurdle rate for acceptance of the project. The second approach involves adjusting the cost of common equity as follows: Cost of equity from new stock =P D Ad+gu The difference between the Hotation-adjusted cost of equity and the cost of equity calculated without the flotation adjustment represents the notation cost adjustment Quantitative Problem: Barton Industries expects next year's annual dividend, Di, to be $1.70 and it expects dividends to grow at a constant rate u 4.9% The firm's current common stock price, Po, is $24.70. If it needs to issue new common stock, the firm will encounter a 4.8% Hotation cost, F. Assume that the cost of equity calculated without the rotation adjustment is 12% and the cost of old common equity is 11.5%. What is the flotation cost adjustment that must be added to its cost of retained earnings? Round your answer to 2 decimal places, Do not round intermediate calculations % What is the cost of new common equity? Round your answer to 2 decimal places. Do not round intermediate calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts