Question: Part A Part B Part C Could you please label your answer. Thanks so much for the help!!! Please make sure to round the answer

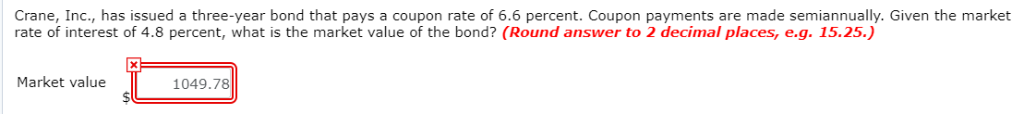

Part A

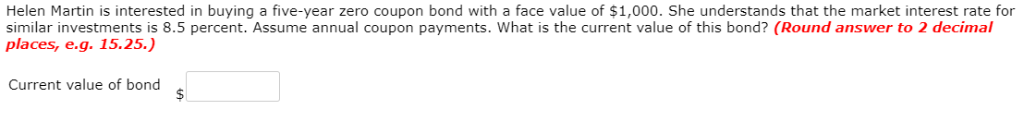

Part B

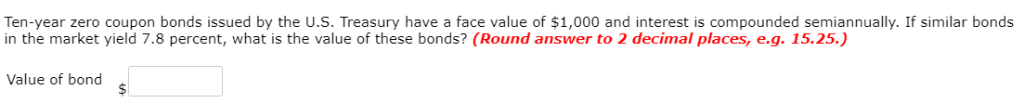

Part C

Could you please label your answer. Thanks so much for the help!!! Please make sure to round the answer properly

Crane, Inc., has issued a three-year bond that pays a coupon rate of 6.6 percent. Coupon payments are made semiannually. Given the market rate of interest of 4.8 percent, what is the market value of the bond? (Round answer to 2 decimal places, e.g. 15.25.) Market value 1049.78 Helen Martin is interested in buying a five-year zero coupon bond with a face value of $1,000. She understands that the market interest rate for similar investments is 8.5 percent. Assume annual coupon payments. What is the current value of this bond? (Round answer to 2 decimal places, e.g. 15.25.) Current value of bond Ten-year zero coupon bonds issued by the U.S. Treasury have a face value of $1,000 and interest is compounded semiannually. If similar bonds in the market yield 7.8 percent, what is the value of these bonds? (Round answer to 2 decimal places, e.g. 15.25.) Value of bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts