Question: Part (a) part (b) Part (c) Part (d) Part (e) Part (f) Part (g) Accounting Cycle Review Facts: Stackhouse, Connelly, and Teagarden Enterprises (SCT Enterprises)

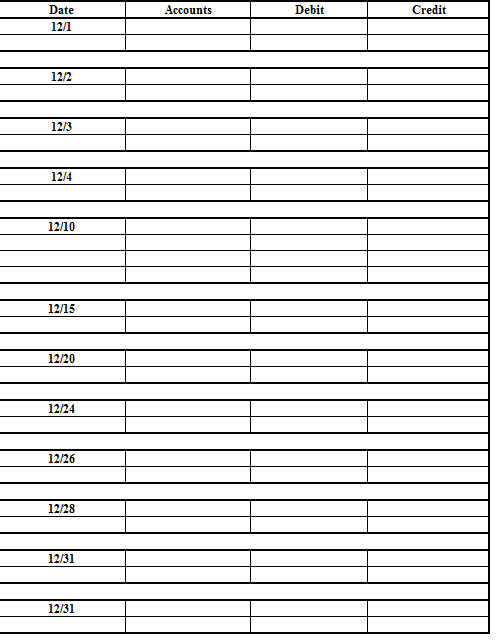

Part (a)

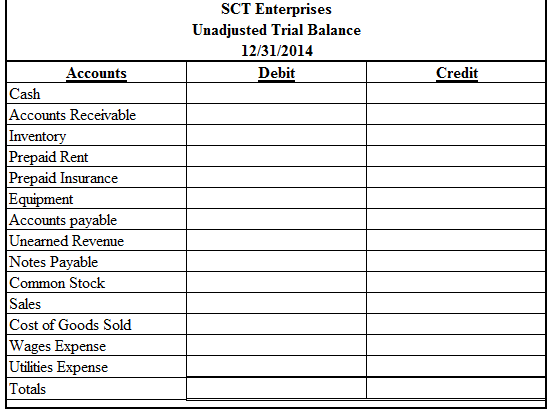

part (b)

Part (c)

Part (d)

Part (e)

Part (f)

Part (g)

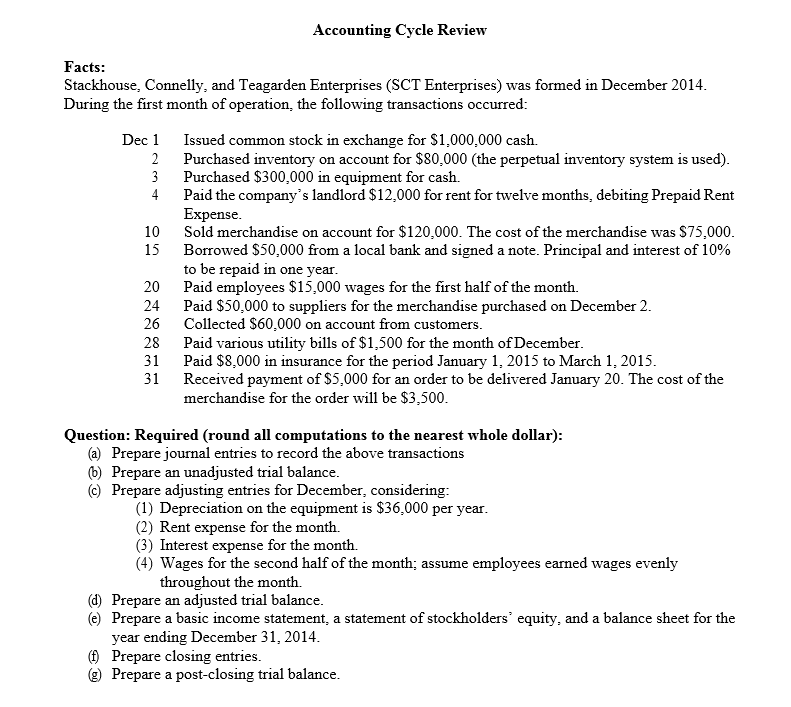

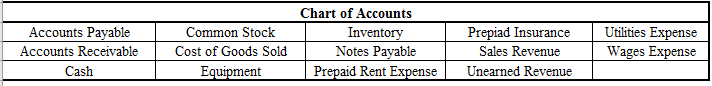

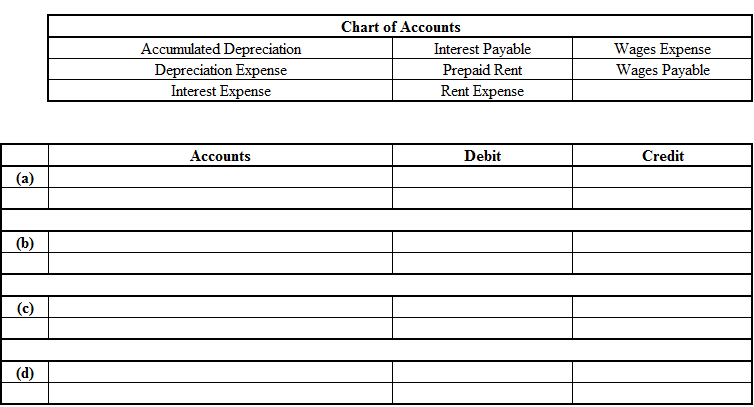

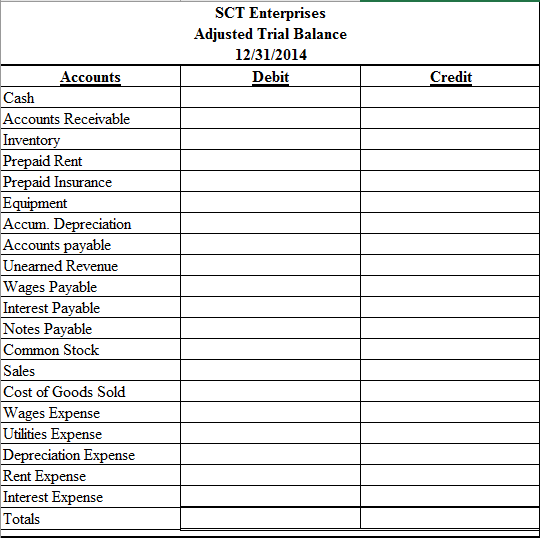

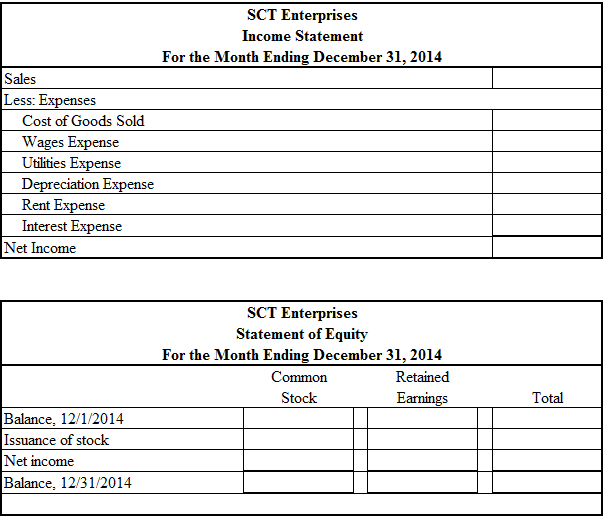

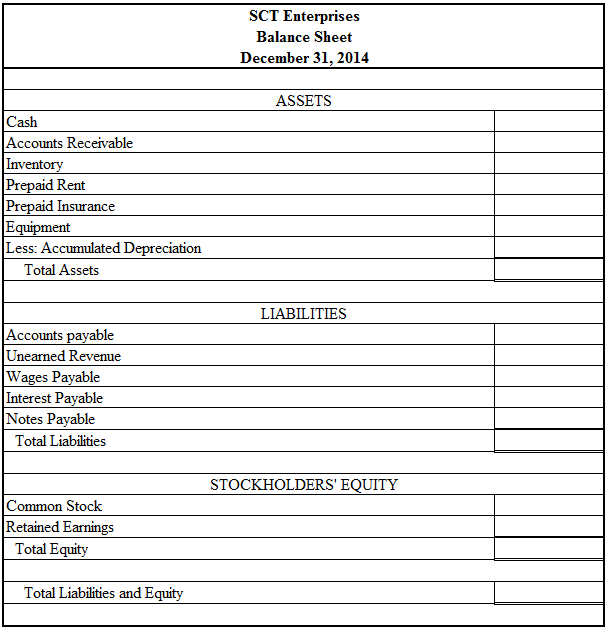

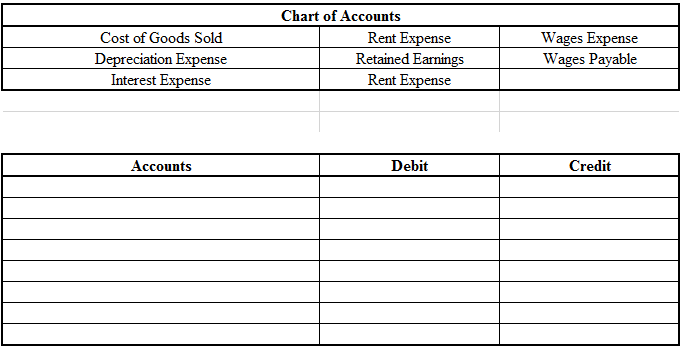

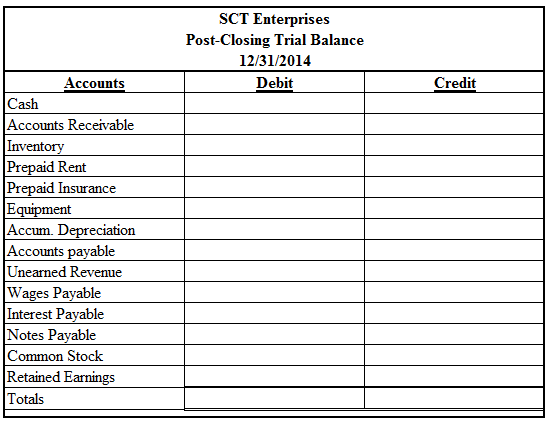

Accounting Cycle Review Facts: Stackhouse, Connelly, and Teagarden Enterprises (SCT Enterprises) was formed in December 2014 During the first month of operation, the following transactions occurred: Dec1 Issued common stock in exchange for S1,000,000 cash. 2 Purchased inventory on account for $80,000 (the perpetual inventory system is used) 3Purchased $300,000 in equipment for cash. 4Paid the company's landlord $12,000 for rent for twelve months, debiting Prepaid Rent xpense Sold merchandise on account for $120,000. The cost of the merchandise was $75,000 Borrowed $50,000 from a local bank and signed a note. Principal and interest of 10% to be repaid in one year 10 15 20 Paid employees $15,000 wages for the first half of the month. 24 Paid S50,000 to suppliers for the merchandise purchased on December 2 26 Collected S60,000 on account from cust 28 Paid various utility bills of $1,500 for the month of December 31 Paid $8,000 in insurance for the period January 1, 2015 to March 1, 2015 31 Received payment of S5,000 for an order to be delivered January 20. The cost of the merchandise for the order will be $3,500 Question: Required (round all computations to the nearest whole dollar) (a) Prepare journal entries to record the above transactions Prepare an unadjusted trial balance (c) Prepare adjusting entries for December, considering (1) Depreciation on the equipment is $36,000 per year (2) Rent expense for the month. (3) Interest expense for the month. (4) Wages for the second half of the month; assume employees earned wages evenly throughout the month. (d) Prepare an adjusted trial balance (e) Prepare a basic income statement, a statement of stockholders' equity, and a balance sheet for the year ending December 31, 2014 () Prepare closng entries. (g) Prepare a post-closing trial balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts