Question: part a part b part c part d part e Michael, Inc. is authorized to issue 50,000 shares of $50 par value, 8% cumulative, preferred

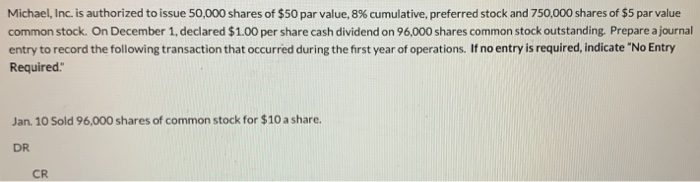

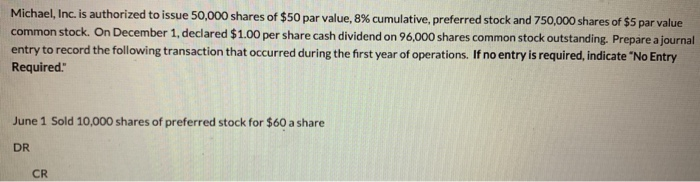

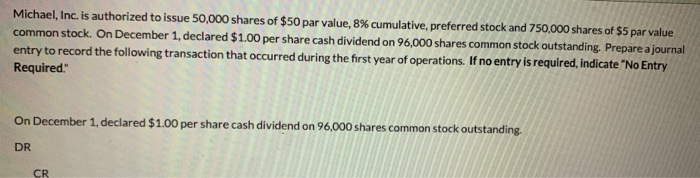

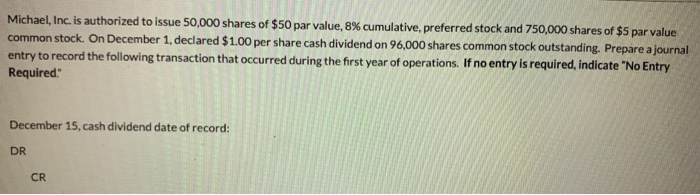

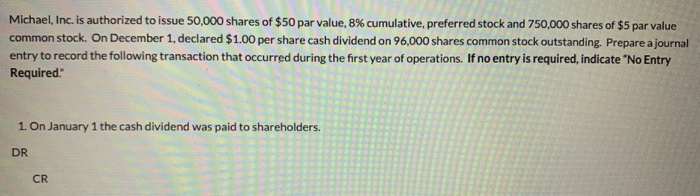

Michael, Inc. is authorized to issue 50,000 shares of $50 par value, 8% cumulative, preferred stock and 750,000 shares of $5 par value common stock. On December 1, declared $1.00 per share cash dividend on 96,000 shares common stock outstanding. Prepare a journal entry to record the following transaction that occurred during the first year of operations. If no entry is required, indicate "No Entry Required." Jan. 10 Sold 96,000 shares of common stock for $10 a share. DR CR Michael, Inc. is authorized to issue 50,000 shares of $50 par value, 8% cumulative, preferred stock and 750,000 shares of $5 par value common stock. On December 1, declared $1.00 per share cash dividend on 96,000 shares common stock outstanding. Prepare a journal entry to record the following transaction that occurred during the first year of operations. If no entry is required, indicate "No Entry Required June 1 Sold 10,000 shares of preferred stock for $60 a share DR CR Michael, Inc. is authorized to issue 50,000 shares of $50 par value, 8% cumulative, preferred stock and 750,000 shares of $5 par value common stock. On December 1, declared $1.00 per share cash dividend on 96,000 shares common stock outstanding. Prepare a journal entry to record the following transaction that occurred during the first year of operations. If no entry is required, indicate "No Entry Required. On December 1, declared $1.00 per share cash dividend on 96,000 shares common stock outstanding DR Michael, Inc. is authorized to issue 50,000 shares of $50 par value, 8% cumulative, preferred stock and 750,000 shares of $5 par value common stock. On December 1, declared $1.00 per share cash dividend on 96,000 shares common stock outstanding. Prepare a journal entry to record the following transaction that occurred during the first year of operations. If no entry is required, indicate "No Entry Required December 15, cash dividend date of record: DR CR Michael, Inc. is authorized to issue 50,000 shares of $50 par value, 8% cumulative, preferred stock and 750,000 shares of $5 par value common stock. On December 1, declared $1.00 per share cash dividend on 96,000 shares common stock outstanding. Prepare a journal entry to record the following transaction that occurred during the first year of operations. If no entry is required, indicate "No Entry Required 1. On January 1 the cash dividend was paid to shareholders. DR CR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts