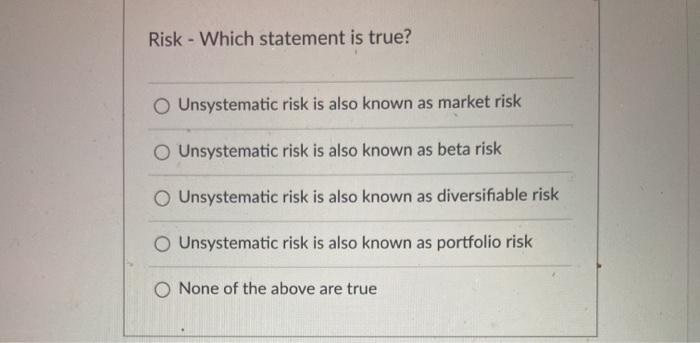

Question: part A part b part c part d Risk - Which statement is true? Unsystematic risk is also known as market risk Unsystematic risk is

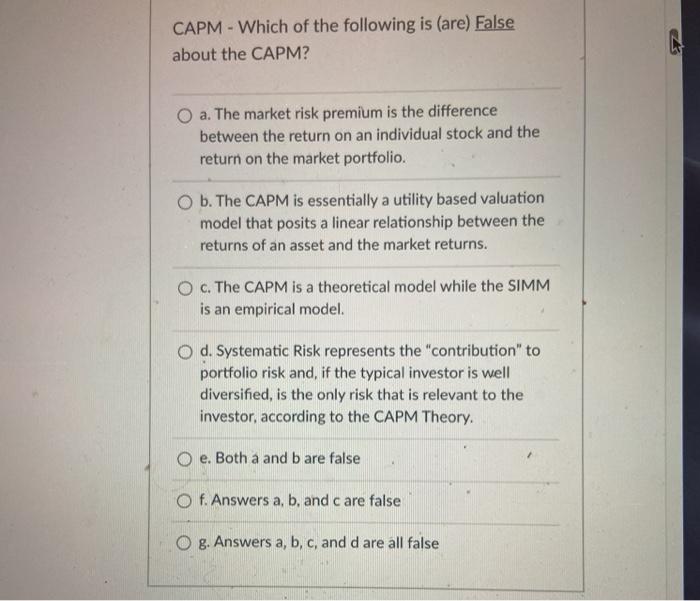

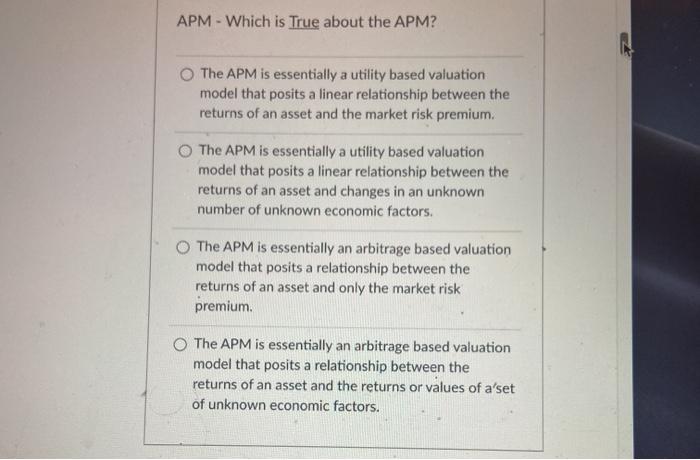

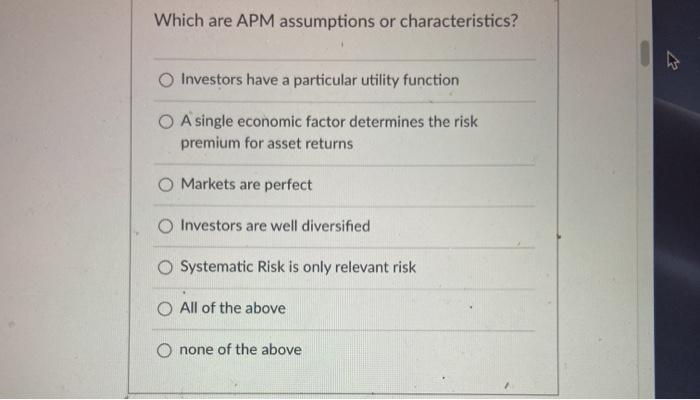

Risk - Which statement is true? Unsystematic risk is also known as market risk Unsystematic risk is also known as beta risk Unsystematic risk is also known as diversifiable risk O Unsystematic risk is also known as portfolio risk None of the above are true CAPM - Which of the following is (are) False about the CAPM? a. The market risk premium is the difference between the return on an individual stock and the return on the market portfolio. O b. The CAPM is essentially a utility based valuation model that posits a linear relationship between the returns of an asset and the market returns. O c. The CAPM is a theoretical model while the SIMM is an empirical model O d. Systematic Risk represents the "contribution" to portfolio risk and, if the typical investor is well diversified, is the only risk that is relevant to the investor, according to the CAPM Theory, O e. Both a and b are false O f. Answers a, b, and care false O g. Answers a, b, c, and d are all false APM - Which is True about the APM? The APM is essentially a utility based valuation model that posits a linear relationship between the returns of an asset and the market risk premium. The APM is essentially a utility based valuation model that posits a linear relationship between the returns of an asset and changes in an unknown number of unknown economic factors. The APM is essentially an arbitrage based valuation model that posits a relationship between the returns of an asset and only the market risk premium O The APM is essentially an arbitrage based valuation model that posits a relationship between the returns of an asset and the returns or values of a'set of unknown economic factors. Which are APM assumptions or characteristics? Investors have a particular utility function A single economic factor determines the risk premium for asset returns O Markets are perfect O Investors are well diversified O Systematic Risk is only relevant risk O All of the above none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts