Question: Part A Part B part C thank you so much in advance Generally, when a firm considers beginning new projects, which of the following most

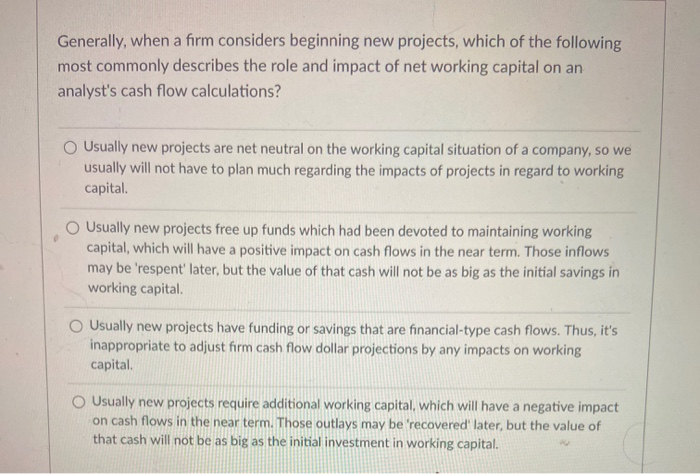

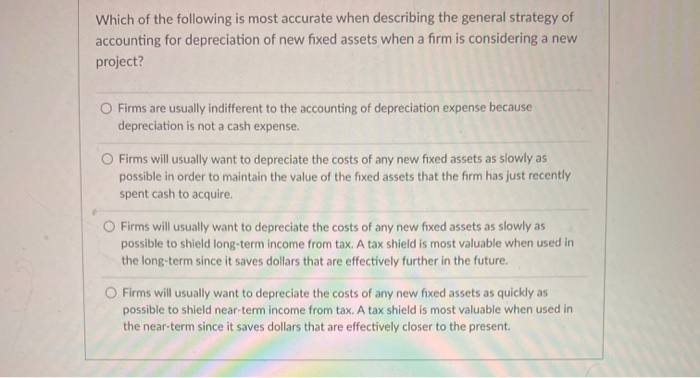

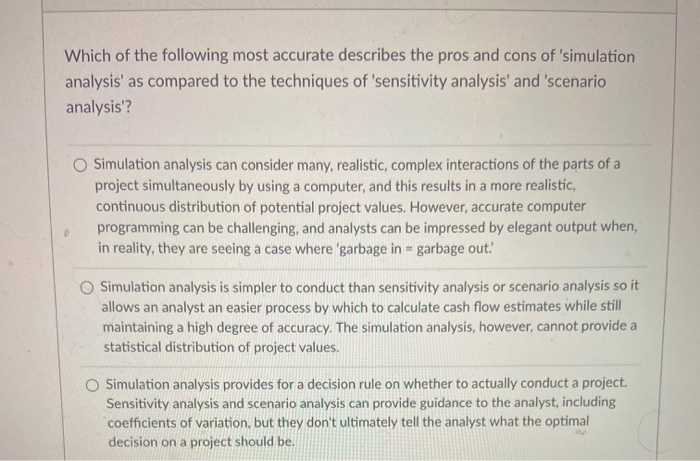

Generally, when a firm considers beginning new projects, which of the following most commonly describes the role and impact of net working capital on an analyst's cash flow calculations? Usually new projects are net neutral on the working capital situation of a company, so we usually will not have to plan much regarding the impacts of projects in regard to working capital. Usually new projects free up funds which had been devoted to maintaining working capital, which will have a positive impact on cash flows in the near term. Those inflows may be 'respent' later, but the value of that cash will not be as big as the initial savings in working capital Usually new projects have funding or savings that are financial-type cash flows. Thus, it's inappropriate to adjust firm cash flow dollar projections by any impacts on working capital Usually new projects require additional working capital, which will have a negative impact on cash flows in the near term. Those outlays may be 'recovered later, but the value of that cash will not be as big as the initial investment in working capital. Which of the following is most accurate when describing the general strategy of accounting for depreciation of new fixed assets when a firm is considering a new project? O Firms are usually indifferent to the accounting of depreciation expense because depreciation is not a cash expense. O Firms will usually want to depreciate the costs of any new fixed assets as slowly as possible in order to maintain the value of the fixed assets that the firm has just recently spent cash to acquire. O Firms will usually want to depreciate the costs of any new fixed assets as slowly as possible to shield long-term income from tax. A tax shield is most valuable when used in the long-term since it saves dollars that are effectively further in the future. O Firms will usually want to depreciate the costs of any new fixed assets as quickly as possible to shield near-term income from tax. A tax shield is most valuable when used in the near-term since it saves dollars that are effectively closer to the present Which of the following most accurate describes the pros and cons of 'simulation analysis' as compared to the techniques of 'sensitivity analysis' and 'scenario analysis'? Simulation analysis can consider many, realistic, complex interactions of the parts of a project simultaneously by using a computer, and this results in a more realistic, continuous distribution of potential project values. However, accurate computer programming can be challenging, and analysts can be impressed by elegant output when, in reality, they are seeing a case where 'garbage in = garbage out! Simulation analysis is simpler to conduct than sensitivity analysis or scenario analysis so it allows an analyst an easier process by which to calculate cash flow estimates while still maintaining a high degree of accuracy. The simulation analysis, however, cannot provide a statistical distribution of project values. Simulation analysis provides for a decision rule on whether to actually conduct a project. Sensitivity analysis and scenario analysis can provide guidance to the analyst, including coefficients of variation, but they don't ultimately tell the analyst what the optimal decision on a project should be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts