Question: Part A Part B Problem 10.34A a-e Greish Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants have provided

Part A

Part B

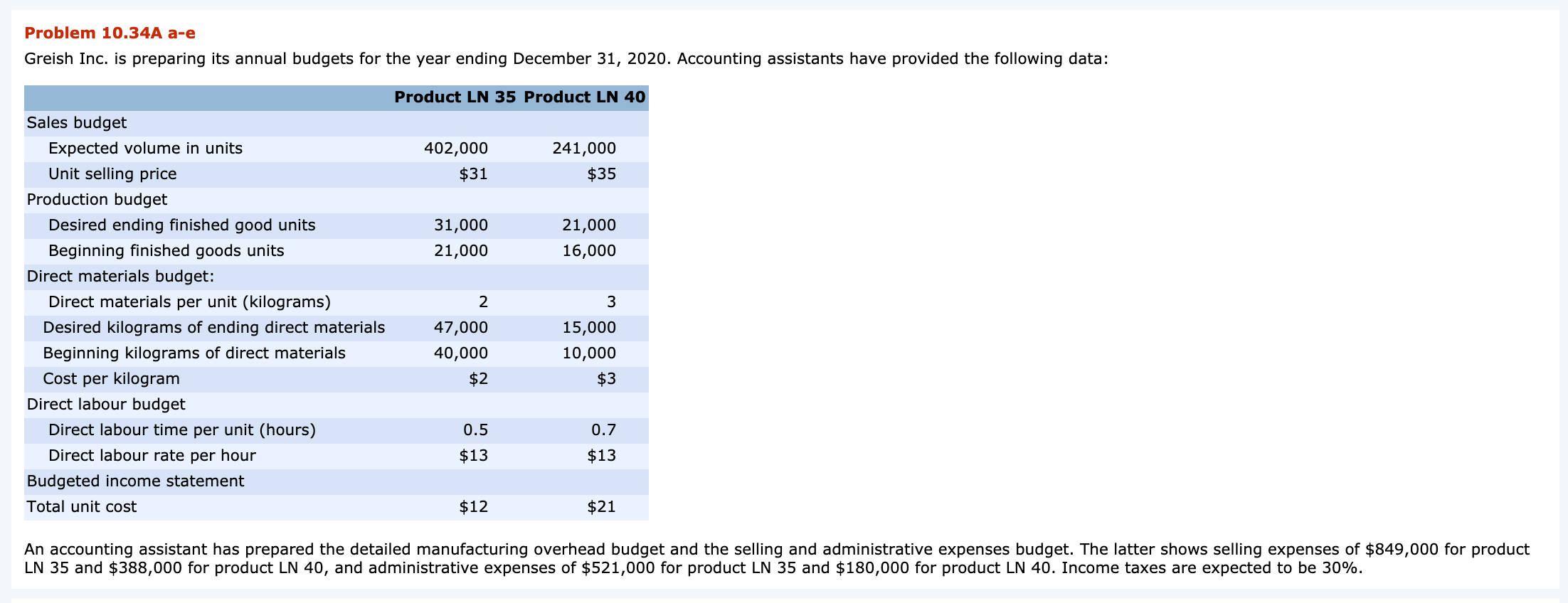

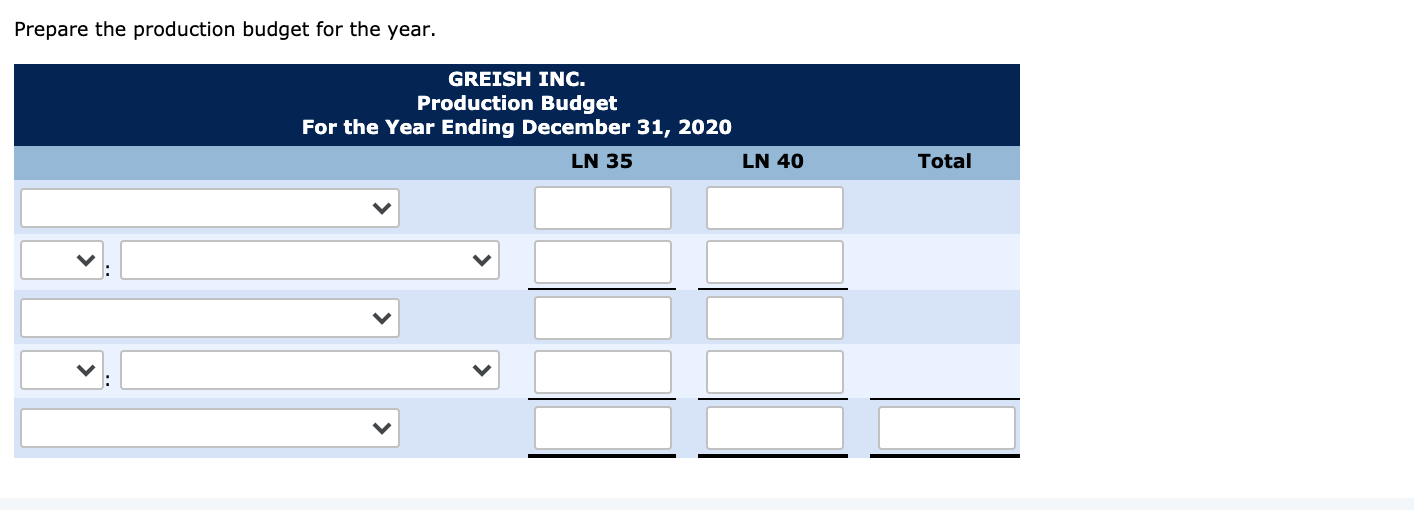

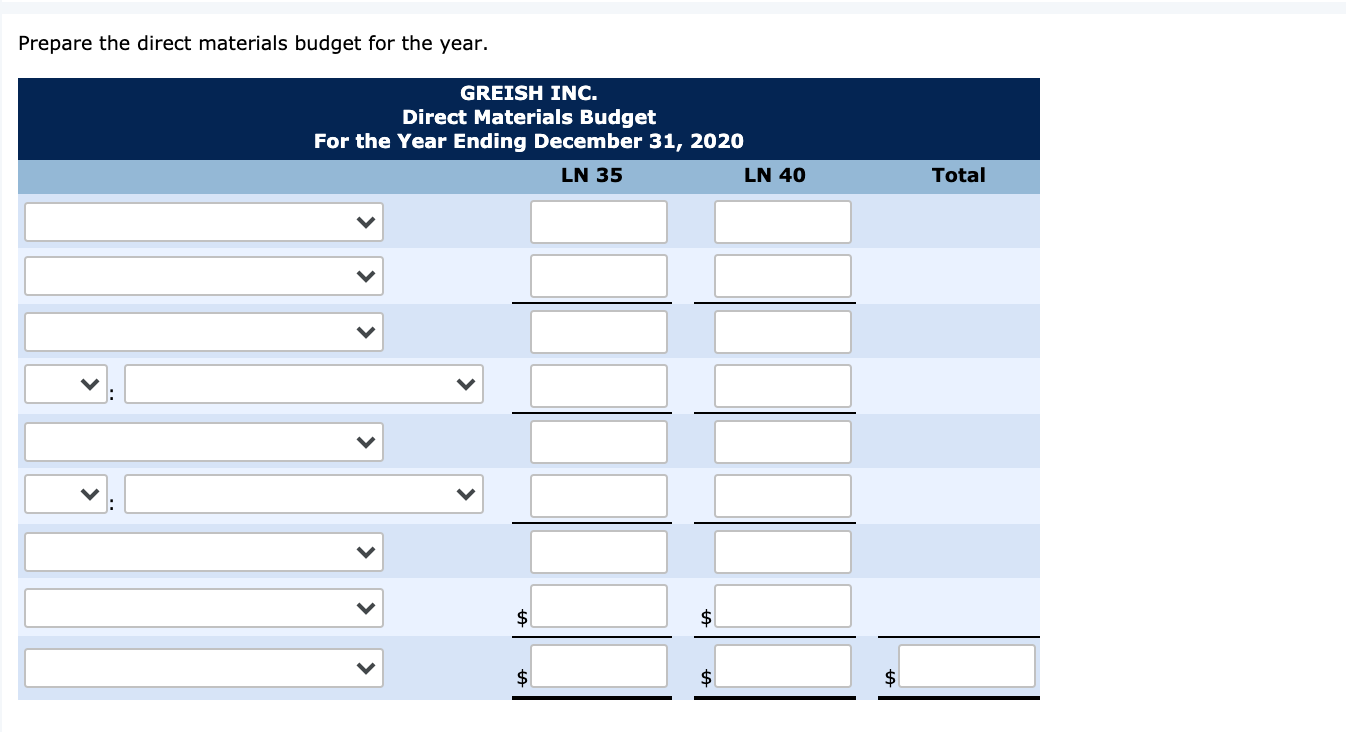

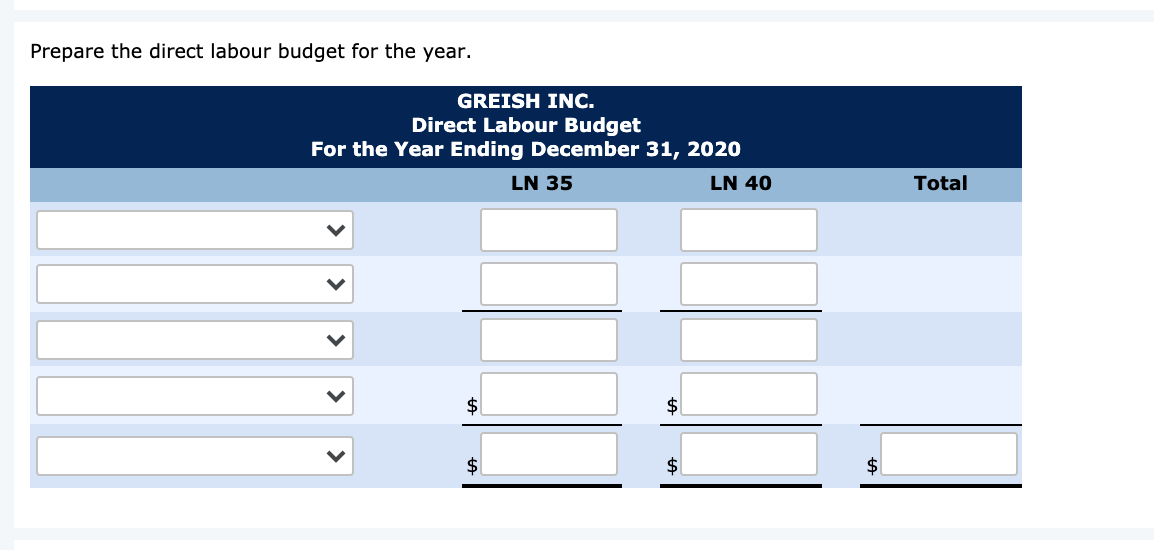

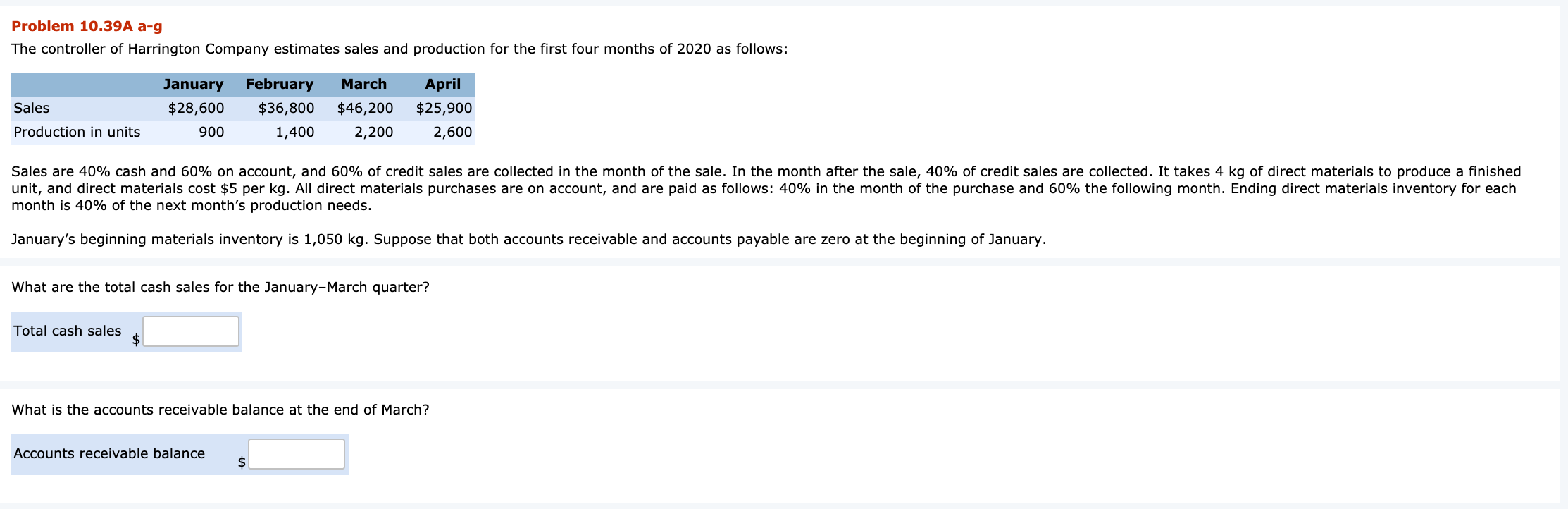

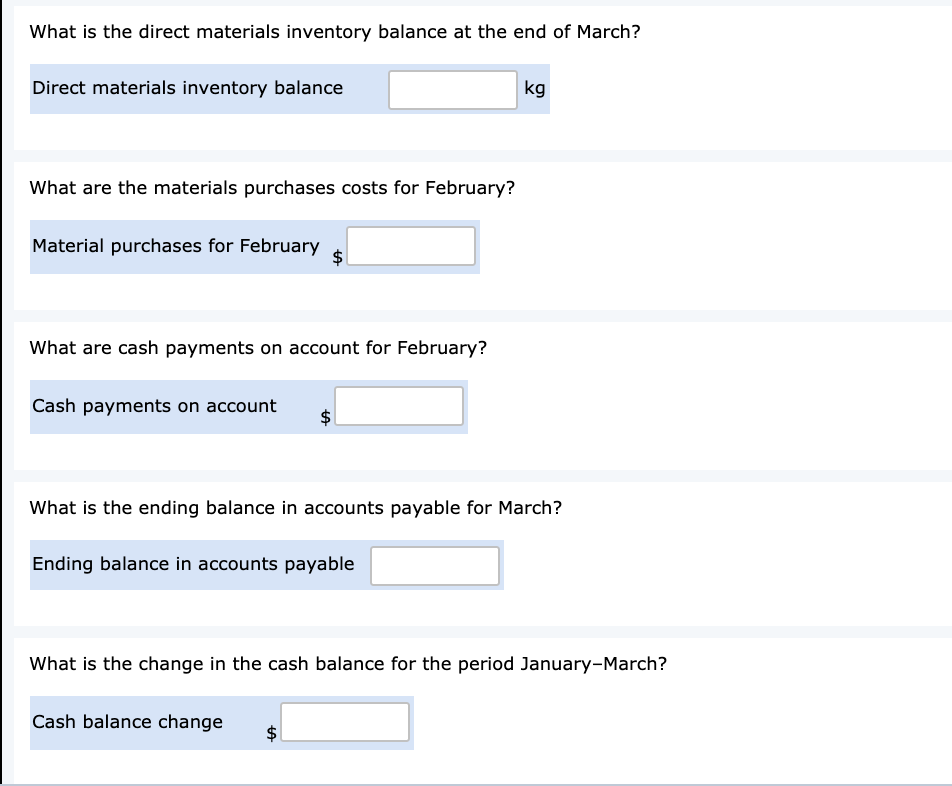

Problem 10.34A a-e Greish Inc. is preparing its annual budgets for the year ending December 31, 2020. Accounting assistants have provided the following data: Product LN 35 Product LN 40 Sales budget Expected volume in units 402,000 241,000 Unit selling price $31 $35 Production budget Desired ending finished good units 31,000 21,000 Beginning finished goods units 21,000 16,000 Direct materials budget: Direct materials per unit (kilograms) 2 3 Desired kilograms of ending direct materials 47,000 15,000 Beginning kilograms of direct materials 40,000 10,000 Cost per kilogram $2 $3 Direct labour budget Direct labour time per unit (hours) 0.5 Direct labour rate per hour $13 $13 Budgeted income statement Total unit cost $12 $21 0.7 An accounting assistant has prepared the detailed manufacturing overhead budget and the selling and administrative expenses budget. The latter shows selling expenses of $849,000 for product LN 35 and $388,000 for product LN 40, and administrative expenses of $521,000 for product LN 35 and $180,000 for product LN 40. Income taxes are expected to be 30%. Prepare the sales budget for the year. GREISH INC. Sales Budget For the Year Ending December 31, 2020 LN 35 LN 40 Total Expected sales in units Unit selling price $ $ Total sales $ Prepare the production budget for the year. GREISH INC. Production Budget For the Year Ending December 31, 2020 LN 35 LN 40 Total Prepare the direct materials budget for the year. GREISH INC. Direct Materials Budget For the Year Ending December 31, 2020 LN 35 LN 40 Total $ $ $ $ $ Prepare the direct labour budget for the year. GREISH INC. Direct Labour Budget For the Year Ending December 31, 2020 LN 35 LN 40 Total $ $ $ $ $ Problem 10.39A a-g The controller of Harrington Company estimates sales and production for the first four months of 2020 as follows: March Sales January $28,600 900 February $36,800 1,400 $46,200 2,200 April $25,900 2,600 Production in units Sales are 40% cash and 60% on account, and 60% of credit sales are collected in the month of the sale. In the month after the sale, 40% of credit sales are collected. It takes 4 kg of direct materials to produce a finished unit, and direct materials cost $5 per kg. All direct materials purchases are on account, and are paid as follows: 40% in the month of the purchase and 60% the following month. Ending direct materials inventory for each month is 40% of the next month's production needs. January's beginning materials inventory is 1,050 kg. Suppose that both accounts receivable and accounts payable are zero at the beginning of January. What are the total cash sales for the January-March quarter? Total cash sales $ What is the accounts receivable balance at the end of March? Accounts receivable balance $ What is the direct materials inventory balance at the end of March? Direct materials inventory balance kg What are the materials purchases costs for February? Material purchases for February What are cash payments on account for February? Cash payments on account What is the ending balance in accounts payable for March? Ending balance in accounts payable What is the change in the cash balance for the period January-March? Cash balance change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts